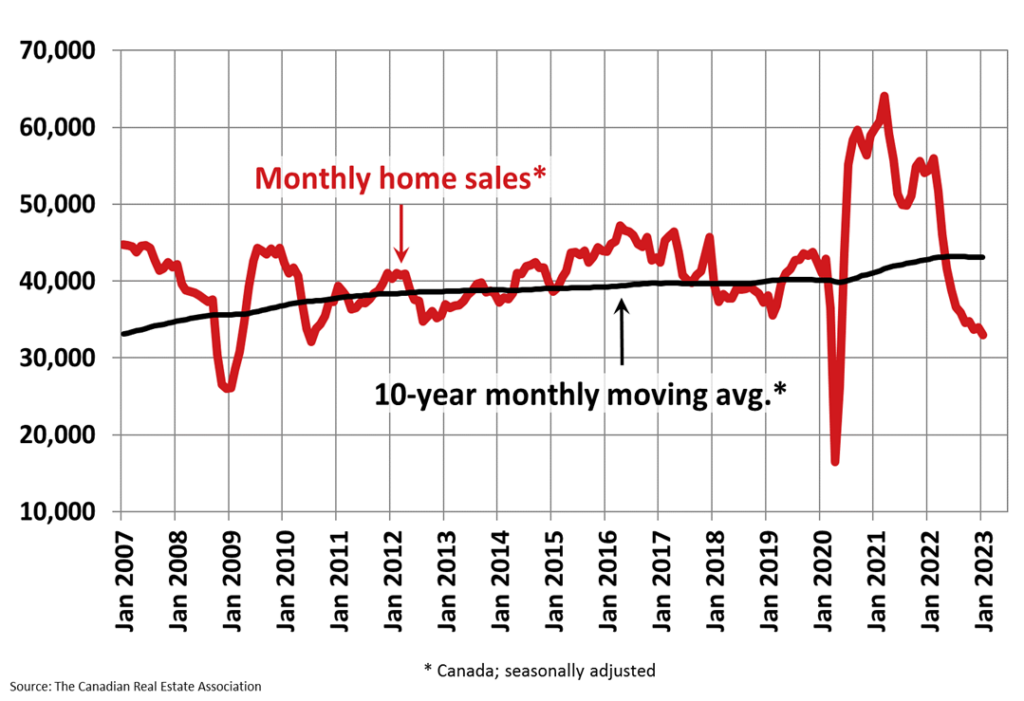

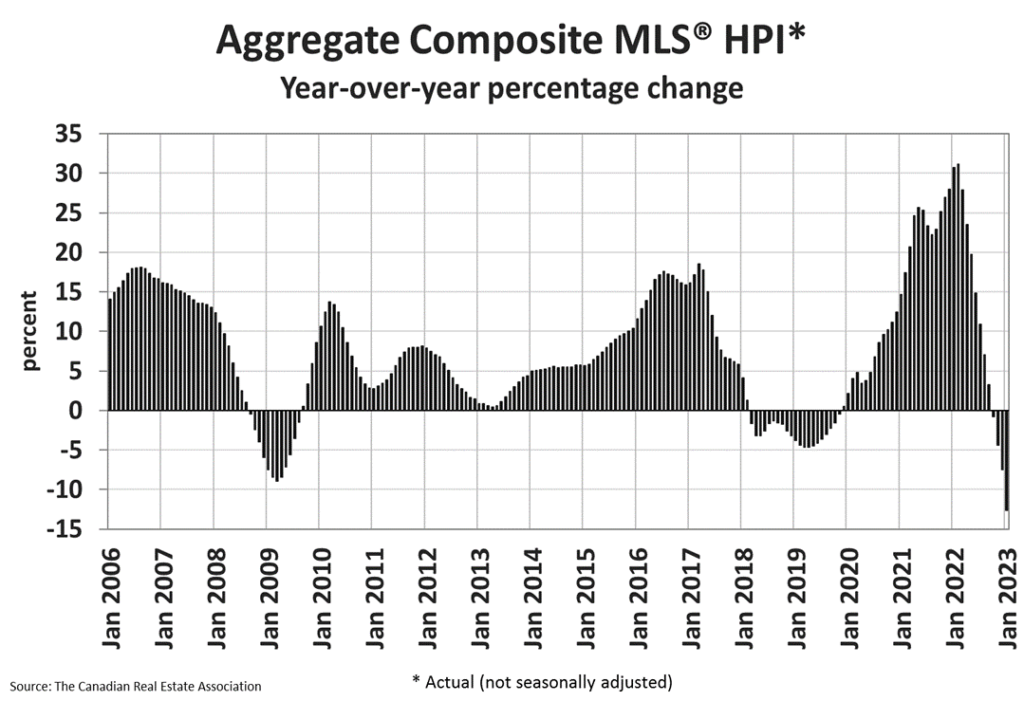

The Canadian housing market cooled dramatically in January, as high interest rates ripple through the economy and send potential homebuyers to the sidelines. National home sales fell 3% month-over-month in January and were down 37.1% from one year ago— the lowest in 14 years, according to the latest data from the Canada Real Estate Association (CREA).

New listings rose 3.3% on a monthly basis last month, largely led by gains in British Columbia. Still, the small increase wasn’t enough to offset the broader shortage, as national listings still sat at the lowest level for that month since 2000. National home prices were also down, falling 18.3% from one year ago to an average of $612,204.

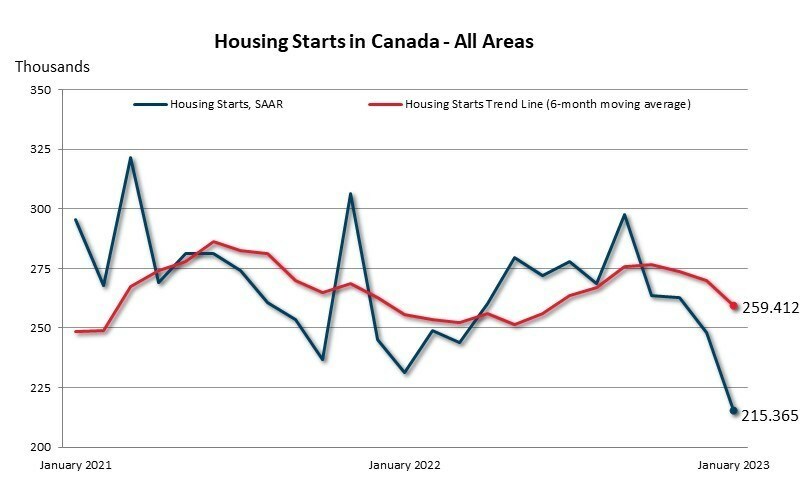

The pace of new home construction was also down last month, as housing starts fell 13% between December and January to 215,365 units, data published on Wednesday by the Canada Mortgage and Housing Corporation (CMHC) showed. Urban starts slumped 16% and multi-unit urban starts dropped 20%, while single detached home construction rose 3% to 45,224 units.

“Among Toronto, Montreal and Vancouver, Montreal was the only market with increases in total SAAR housing starts in January, up 36%. Toronto declined 52% while Vancouver declined 14%, which contributed to the overall monthly decline in SAAR housing starts for Canada,” added CMHC chief economist Aled ab Iorwerth.

The dip in home sales and new home construction comes as the federal government and provincial governments set ambitious goals to expand housing availability in Canada’s populated regions. Thanks to the Bank of Canada’s aggressive tightening cycle, though, higher interest rates are putting a chill on real estate activity across the country.

Information for this briefing was found via CREA, the CMHC, and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.