In a development consistent with the current unpredictable market environment, the price of perhaps the world’s most hated commodity, thermal coal (or the coal used in power plants to generate “dirty” electricity), continues to soar across the globe. European and Asian utilities are finding it increasingly difficult to source the material. It goes without saying that building adequate stockpiles of coal to provide a margin of safety does not seem to be a possibility at this juncture.

For example, on October 1, the German utility Steag announced that its 747-megawatt (MW) Bergkamen coal-fired generating plant in the west-central region of the country simply ran out of coal. The company attributed both robust worldwide demand for coal and the difficulty of securing barge space to transport it as reasons for depleting its coal supply.

Bergkamen has no railroad links, so the coal cannot be brought in by rail. A 747 MW coal-fired power plant generates sufficient electricity to power nearly 500,000 homes. About a quarter of Germany’s electricity is produced by coal.

Natural gas and power prices are near all-time highs in Europe (amazingly in the shoulder month of October, not in a peak cooling or heating period in the summer or winter), so many utilities have switched some of their fuel mix to coal from natural gas due to surging gas prices. Bloomberg reports that some European utilities have reached out to Russian coal suppliers for incremental coal, but the Russian companies have largely rebuffed those requests saying that Russian coal exports are constrained.

Another and perhaps even more worrying example: Reuters reported on October 5 that more than half of India’s coal-fired plants will run out of supplies by the end of the week. As of September 29, sixteen of the country’s 135 coal-fired plants had no coal. Half of India’s plants had only a three-day supply; another 30% had sufficient coal for a week. Coal-fired electricity represents about 70% of India’s total electricity consumption.

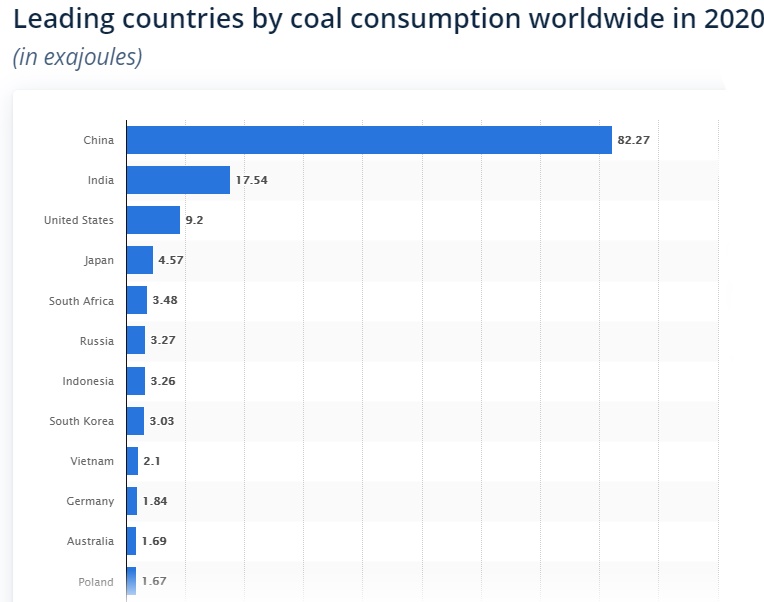

Rising power demand as India emerged from the second COVID-19 wave accounts for much of this problem. The country’s electricity tariff system also contributes to this vexing issue as distribution utilities have a tough time passing on rising costs to customers. India’s heavy reliance on coal could keep pressuring global coal prices higher. It is the world’s second largest (only to China) importer, consumer, and producer of coal.

A third piece of anecdotal evidence: thermal coal is likewise in short supply in China. So much so that, almost unbelievably, the China Electricity Council announced on September 26 that it will expand coal procurement at “any price to ensure heating and power generation in the winter.” About 90% of China’s coal is mined locally; but it is difficult to raise local output significantly.

China in the past has purchased substantial amounts of coal from Australia. However, a long-running political dispute between the countries has brought exports from Australia to only minimal levels. (China bristled at some of Australia’s statements regarding the potential origins of COVID-19 and has effectively banned the import of many Australian products.)

If investors want to participate in the skewed coal supply-demand dynamics in Europe and Asia, one way could be through CONSOL Energy Inc. (NYSE: CEIX). CONSOL produces both thermal and metallurgical (steel making) coal in the U.S.’s Northern Appalachian Basin. Making use of an export terminal it owns in Baltimore, Maryland, CONSOL exports both types of coal to foreign markets.

CONSOL Energy Inc. last traded at US$33.95 on the NYSE.

Information for this briefing was found via Bloomberg and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.