Thesis Gold (TSXV: TAU) has outlined a net present value of $2.37 billion alongside an internal rate of return of 54.4% on an after-tax basis for their Lawyers-Ranch project in British Columbia following the completion of a pre-feasibility study.

The study, based on US$2,900 an ounce gold and US$35 an ounce silver, outlines an open pit and underground operation that would see the proposed mine operate for 15.2 years, with annual production of 187,000 gold equivalent ounces a year. A high grade core is expected to be mined over the first three years, with production expected to average 266,000 ounces of gold a year over that time frame.

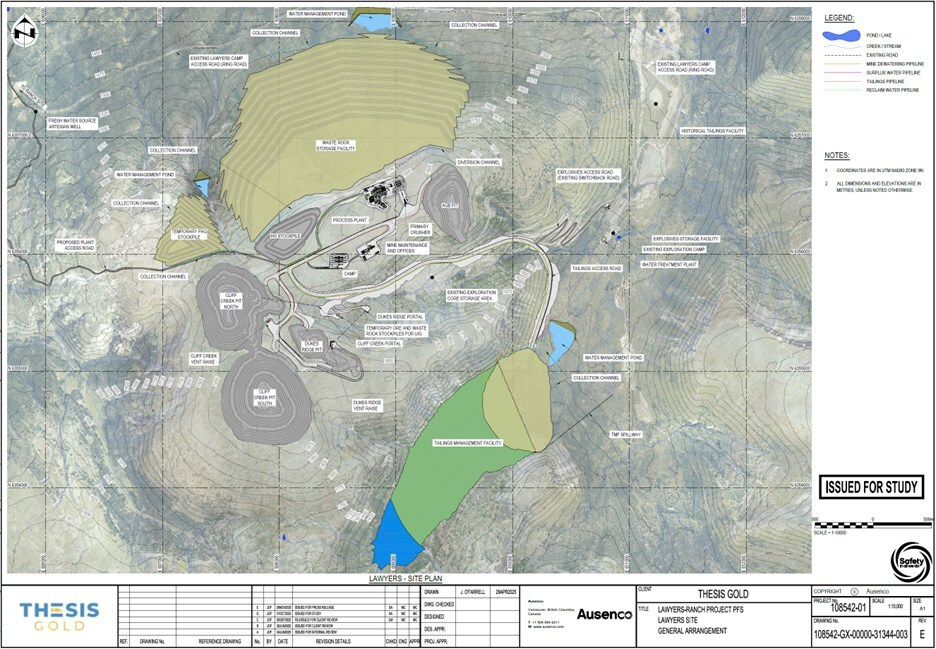

Initial production would come from an open pit mining operation at the Lawyers area of the project, with a crossover to underground mining using longhole stoping from the Dukes Ridge and Cliff Creek deposits, which is expected to run from years one through seven.

Head grades are expected to average 0.97 g/t gold and 28.1 g/t silver over the life of mine, with average recoveries of 92.8% for gold and 81.6% for silver.

Processing meanwhile is expected to use cyanide leaching for the lower sulphide material, while flotation is expected to be used for the higher sulphide material. The current flowsheet calls for the production of a saleable flotation concentrate, while the project is said to ‘maintain the ability’ for the production of dore as well.

As for costing, initial capital is estimated at $736.2 million, alongside sustaining capital of $789.4 million and closure costs of $71.8 million. Total capital outlay for the project is estimated at $1.5 billion over the life of mine. On a per ounce basis, all in sustaining costs are estimated at US$1,185 per gold equivalent ounce.

“With the prefeasibility results announced today, Thesis Gold is positioned as one of the strongest value-creation stories in the sector. An after-tax NPV of $2.37 billion, a 54.4% IRR, and a 1.1-year payback places Lawyers-Ranch firmly among the top tier of development-stage gold projects globally. The study strengthens the technical rigor of the project, increases total tonnes processed, and delivers a substantially improved payback period while preserving an exceptionally strong early-year production profile,” commented Ewan Webster, CEO of Thesis Gold.

Thesis Gold last traded at $1.90 on the TSX Venture.

Information for this story was found via the sources and companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.