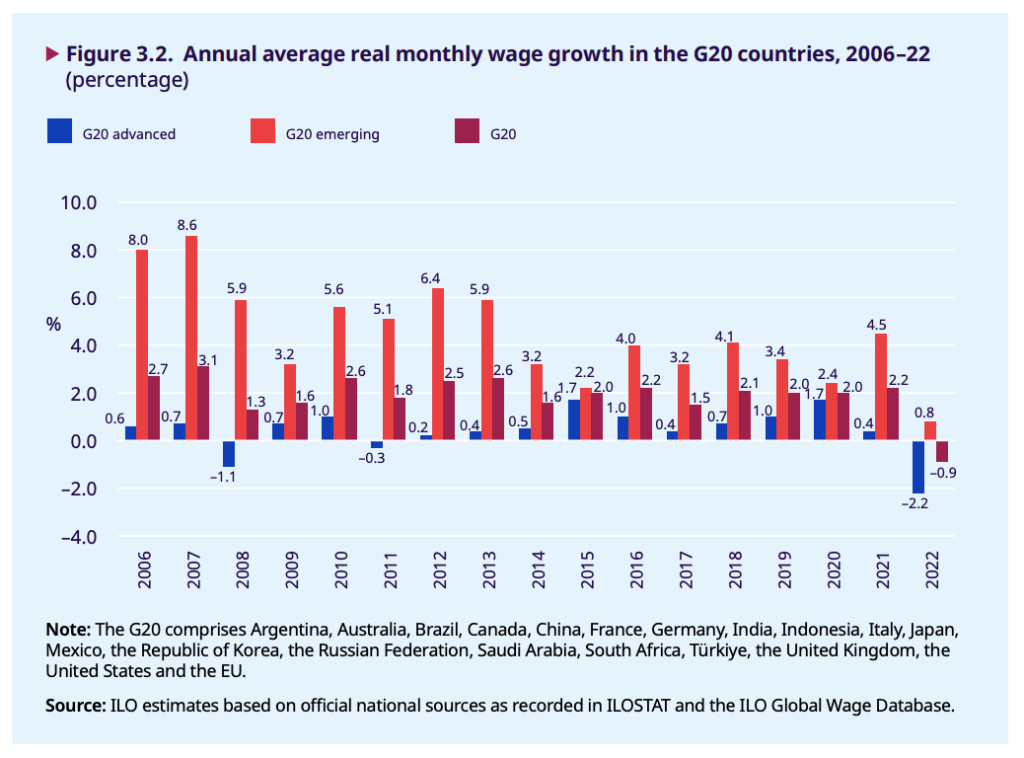

Workers around the world have had enough: thanks to surging inflation, minimal— if any— wage growth, skyrocketing borrowing costs, and a general distaste for the current trajectory of their respective economies, employees are walking out on their jobs in protest of rapidly-deteriorating standards of living.

Despite some signs suggesting inflation reached its peak and central banks’ monetary policies are cooling what was an overheated economy, markets are growing weary of labour market unrest. Certainly, on one hand, mass layoffs are becoming prominent across America’s tech sector as companies no longer need the abundance of employees hired during the pandemic-fuelled consumer demand boom, but on the other hand, an increasing number of workers are throwing in the towel as inflation rapidly erodes at their income.

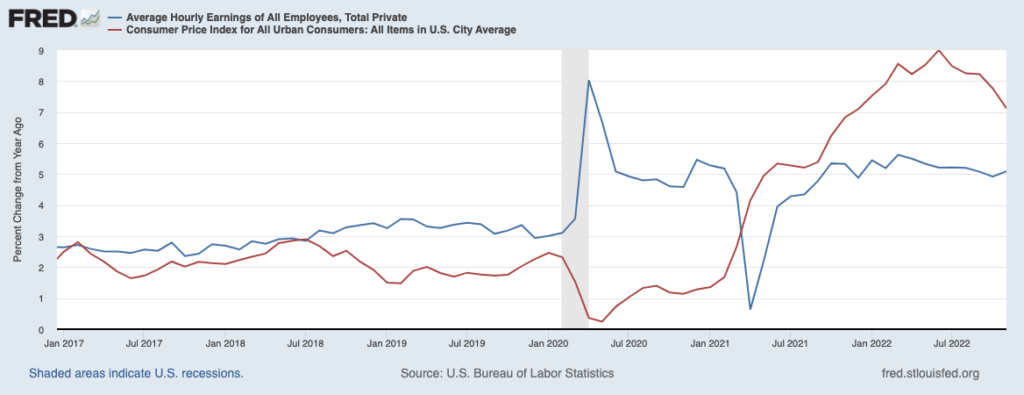

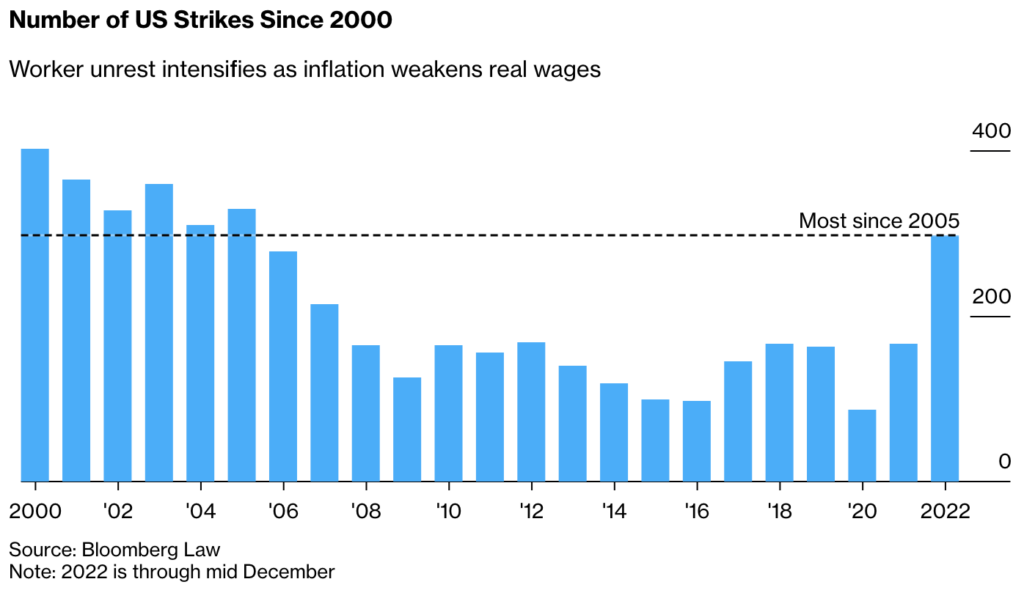

Key OECD economies undergoing record-breaking inflation are becoming increasingly riddled with worker unrest. In November, over 900,000 industrial workers part of Germany’s IG Metall union walked out before employers agreed to raise wages 8.5%. In the US, worker strikes are reaching the highest since 2005, as paltry real wages are weakened by the sharpest— and highest— increase in consumer prices in over 40 years. US President Joe Biden even took matters into his own hands, narrowly avoiding a rail strike in December by frantically signing a tentative deal with a 24% pay increase.

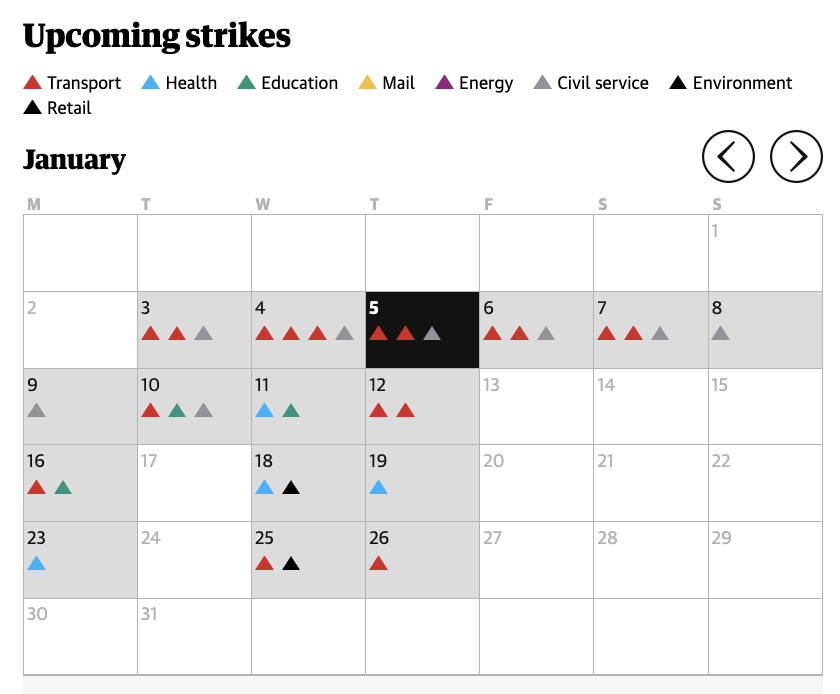

The UK, meanwhile, is grappling with an even more precarious labour situation. The country eclipsed into a tidal wave of strikes just before the holidays, as essential workers including rail staff, nurses, and ambulance drivers walked out in protest of poor wages. In fact, December saw the largest monthly drop in working days thanks to strike action since the late 1980s Margaret Thatcher era.

In response, the UK government is expected to announce new laws next week allowing essential sector employers to dismiss striking workers and sue unions if employees don’t provide a minimum level of service. The legislation was initially carved out by Prime Minister Rishi Sunak back in December, and will cover essential sectors including railways, education, the National Health Service, nuclear, and the fire brigade.

The thing about the anti-strike legislation is that they can’t guarantee service levels right now, because of chronic underfunding, so any new service levels are pointless. What are they going to do? Sack every nurse, rail worker, teacher, etc? How does that help?

— Dan 🏴🇪🇺🚴♂️ (@eggynewydd) January 5, 2023

“This is the definitive battle of 2023 — it’s labor versus the paymasters,” commented Nikko Asset Management chief global market strategist John Vail, as cited by Bloomberg. “If wage hikes go through, it’ll be stagflationary and a headwind for markets, both bonds and stocks.”

Information for this briefing was found via Bloomberg and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.