Tinley Beverage Co (CSE: TNY) filed third quarter financials Friday after the close of market, reporting revenues of $21,664 for the three month period ended September 30, 2019. The quarter marks the first full quarter of production since commissioning of its phase 2 bottling line. There’s little doubt that long time investors had expected higher earnings for the period – unrest among social media platforms verifies that in itself. What’s missing however, is an understanding of how Tinley Beverage recognizes revenues relative to that of its peers.

Before we go any further, let us be clear. Tinley Beverage Co is a client of The Deep Dive. If you’re the type that tends to invalidate an argument based on this, that’s fair – however, we feel it’s necessary to be out in the open on this, as we always are. Take our understanding of the financials as you will. Now back to our analysis.

Initial revenue is now coming in after the firm exceeded capacity at its pilot facility. While a drought was previously experienced by the firm as a result of continuously changing California regulations on labeling as well as operational scaling, the phase two production line is now in full production, ensuring revenue build through oncoming quarters.

Understanding Revenue Generation

Tinley Beverage recognizes revenue slightly different from its peers as a result of the nature of its business. The firm has taken an ultra-conservative approach more common among manufacturers and distributors than that of its peers in the cannabis space. Rather than recognizing revenue when product is shipped from their facility, Tinley Beverage recognizes revenue when it has been paid by its customers.

What this means, directly, is that product has shipped from its facilities that it has yet to be paid for, largely due to payment terms. Revenue does not typically show up for one to two quarters as a result of the nature of payments within the beverage industry, where generous payment terms, such as net 90, are offered as an incentive to bring in additional retailers. The implication for Tinley in the current state is that revenue will begin to show up in subsequent quarters now that it has experienced its first full quarter of production.

This is not to say that Tinley will not be paid – such items are non-retfundable within the state of California. Meaning it’s simply a matter of time until product is paid for by retailers, allowing inventory to translate to revenue.

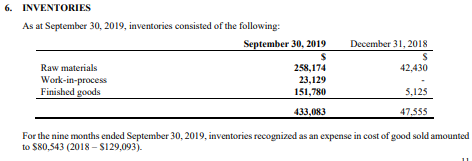

This is evident in its growing inventory line, which now sits at $433,083. Of that, $151,780 is finished goods, the majority of which is unlikely to be currently sitting at Tinley’s facilities. Rather, it’s been shipped to retailers – a portion of which has already likely been consumed by consumers as well. However, that inventory will not translate to sales until Tinley’s client pays up for the product.

Further evidence of this lies in the growing amount of raw materials, which was the largest amount of inventory overall at $258,174. Simply, there would be no need for the firm to up its raw materials if there was no demand. Rather, this is required for production to replenish inventories at dispensaries as its product continues to see sales increases. Tinley Beverage says as much within its filed MD&A, when the firm states the following.

Also, during the period, considerable inventories were shipped to over 50 retail locations throughout California. These inventories, despite being at stores, would not be reflected in the Company’s revenue because the Company only recognizes revenue when it is paid, not when products ship to either distributors or retailers. These products on shelves, including product that the stores may have sold to customers, therefore show as finished goods in this quarter’s inventories until such time as the Company receives payment – even if the Company has received reports of these products having been sold by the retailers.

Subsequent to the end of the quarter, the Company produced and shipped additional inventories to replenish its distributors and stores. The Company is taking steps with its distributors and retail store customers to reduce the days needed to collect payment, which currently can exceed 90 days. Reducing days to receive payment would enable recognition of revenue closer to the quarter in which the product is delivered.

To add further to the issue of revenue – we know for certain that $200,000 worth of product was shipped in May and June of this year following the restart of production. This revenue, once collected, will show up on the interim financials as Tinley continues to propel forward with its growth in distribution and revenue generation. This revenue is directly a result of strong demand out of the gate from retailers. With over fifty stores now stocking Tinley product, the firm has exceeded initial expectations that most new beverage retailers have.

Unfounded Cash Concerns

Stepping away from revenues, the second item Tinley detractors appear to point to is the cash position and consumption of the firm during the quarter. The three month period saw Tinley’s overall cash decrease from $6.7 million to $2.5 million, which has been a fair concern for investors when looking at things from a high level. Lets dig into that a bit more.

The breakdown was as follows from the cash flow statement:

- Cash flows (used in) operating activities: ($1,519,140)

- Cash flows (used in) financing activities: ($218,078)

- Cash flows (used in) investing activities: ($2,888,691)

With respect to the manner in which cash was spent during the quarter, let’s be clear on a few items here. The Long Beach, California phase three facility is now largely paid for, save for typical lease payments. That means much of the investing activities are non-recurring in future quarters. Lease costs will also come down once phase three hits production, as Tinley has previously acknowledged that phase two will be packed up upon phase three’s completion, which will later be moved to a new jurisdiction.

Let’s start from the top. Of the cash flows used in operating activities, $325,595 was put towards paying down accounts payables. Meanwhile, Note 16 for its general and administrative expenses indicates a large portion of the costing was attributable to employees and rent. Financing activities meanwhile were from lease payments. Finally, investing activities include a $1.98 million charge to capital assets, and $900,000 that was placed into short term investments to earn interest – something that would not have been done should the firm have cash flow concerns.

The firm also stated within the financials, under the “going concern” portion that “the Company believes that it has sufficient cash flows to fund its continuing operations for the 12-months period ending September 30, 2020.” Investors should thus have piece of mind that Tinley is not currently facing a financial crunch as it continues to seek growth. This is further bolstered by the fact that the firm just raised an additional $1.35 million via inbound investor interest.

Finally, it should be sufficiently noted that the third quarter of 2019 marked the first full quarter wherein Tinley’s phase II bottling line has been commissioned and in production, with an estimated annual bottling capacity of 3,000,000 bottles. For those still not fully convinced on the matter of revenues, this means that given the current delay in payment and the manner of revenue recognition, Tinley should begin to see a revenue ramp occurring as we head into the fourth quarter of the fiscal year.

That ramp is expected to continue, with the firms Long Beach, California facility and its 12 million bottle per annum capacity expected to receive final licensing in the fourth quarter of 2019. Furthermore, three potential co-packing arrangements are anticipated to increase that capacity, as well as revenue, via the demand for additional canning lines as well.

Tinley Beverage last traded at $0.36 on the Canadian Securities Exchange.

FULL DISCLOSURE: Tinley Beverage is a client of Canacom Group, the parent company of The Deep Dive. The author has been compensated to cover Tinley Beverage on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.