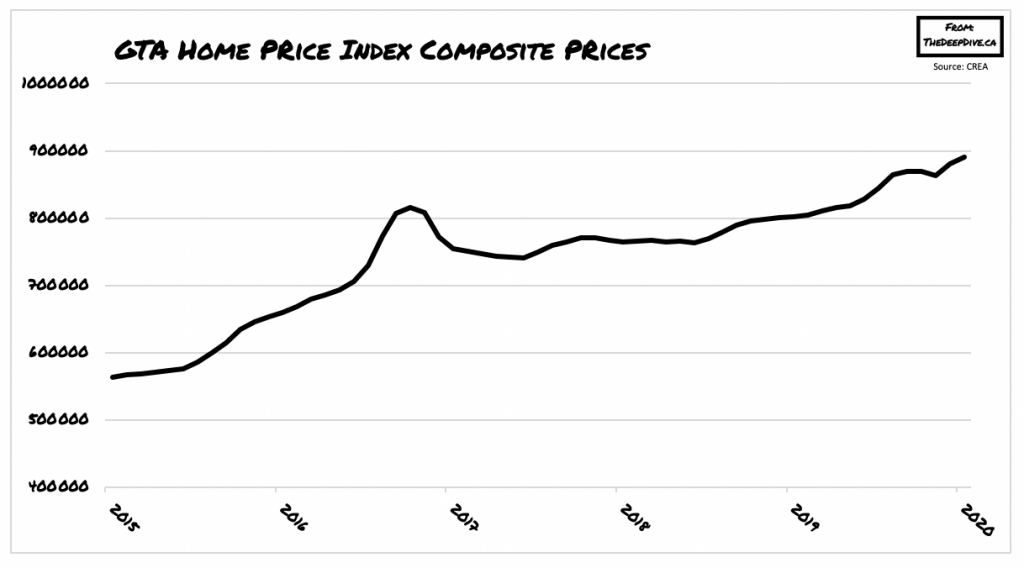

Toronto’s booming housing market is beginning to crumble amid the weight of pandemic economic implications, as the city’s condo sector sees a sudden surge of new listings.

According to data compiled by the Toronto Regional Estate Board and Urbanation Inc, the number of condo units for sale has sharply increased in September, as active listings in the downtown area rose by 215% compared to the same time a year prior. In the meantime, all other housing listings only rose by a mere 5.3% across the city. As a result, the trend will likely lead to lower condo prices in October, as supply has now significantly surpassed demand.

The Toronto region saw a total of 6,480 condos for sale during the month of September, which is an 881 unit increase from the month prior, and a whopping 3,077 unit rise compared to September 2019. As a result, benchmark prices fell by 1.8% since May, despite detached home values skyrocketing in the same duration. Moreover, the ratio of sales to new listings dropped by 24% last month – the lowest it has been since the 1990’s.

Although the average condo price is still currently above last year’s level, an increasing number of investors have been attempting to sell their units significantly below market values in order to exit the market as swiftly as possible.

The downtown Toronto housing market has also seen a declining trend in rents, which fell by 14.5% compared to the third quarter in 2019. There has been a slew of construction for new rental units, but it appears that the corresponding flow of new tenants has diminished to near-zero levels, as remaining tenants have been moving out in search of cheaper rental prices. In addition, rental units have been sitting for a longer period of time on the market, as the average in August increased to 26 days, compared to 14 days a year prior.

This emerging weakness in Toronto’s housing market suggests that the resiliency in real estate that defied the nationwide economic contraction is overdue for a correction. According to some real estate professionals, the vulnerability in Toronto’s real estate market is predominantly fixated in the downtown area.

An oversupply of housing began to form shortly after nationwide pandemic restrictions were imposed, which stopped immigration and forced many Canadians to work from home. As a result, those that were living in the downtown area soon sparked a migration exodus into suburban areas in search of more room and less infection risk.

Information for this briefing was found via TRREB and Urbanation Inc. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.