A Toronto mortgage broker faces fraud allegations following the failure of his long-established firm, with investors now attempting to recover more than C$100 million in syndicated mortgage funds.

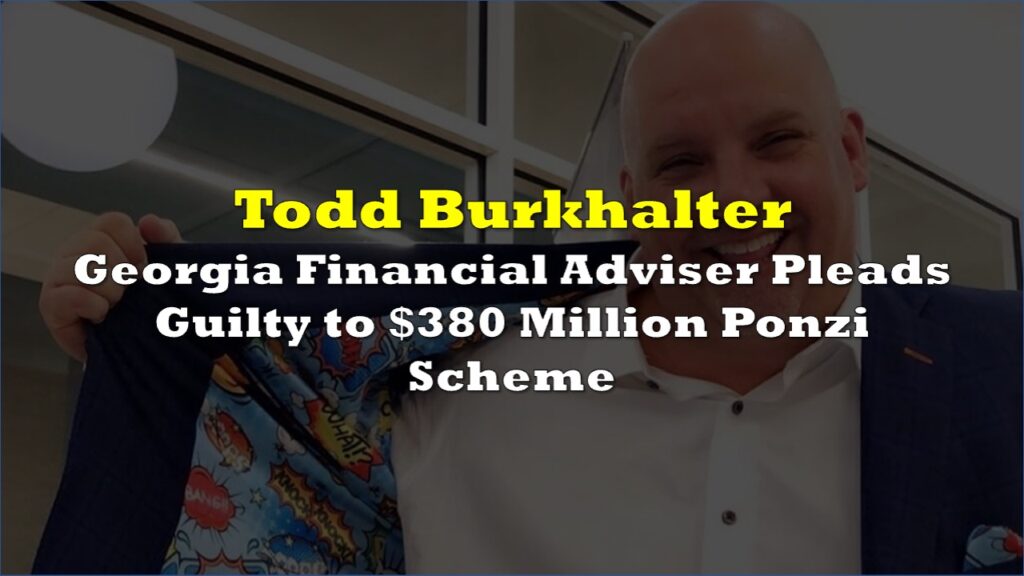

Sandy Sussman, who operated Sussman Mortgage Funding Inc., allegedly ran what investigators now characterize as a Ponzi-style scheme in Ontario’s cottage country real estate market. According to the court-appointed receiver’s findings, investor funds were not deployed into legitimate mortgage loans as represented.

Instead, returns paid to early participants were financed using capital from newer investors.

The Ontario Superior Court of Justice placed Sussman’s company into receivership in May 2025 at the request of the Financial Services Regulatory Authority of Ontario. B. Riley Farber Inc. was appointed as receiver to investigate and manage the firm’s assets.

Investigators found multiple irregularities in Sussman’s operations. The company halted interest distributions, defaulted on loan repayments, and, in some cases, released mortgage encumbrances without informing investors or returning their capital.

More than $73 million is now in arrears, according to court documents. The receiver has reported that the firm’s financial recordkeeping was severely flawed, creating major obstacles to tracing where investor money went and determining valid claims.

One group of investors — the Goldfarb family and their companies — had invested approximately $42 million through Sussman’s firm. Another investor group, the Greenspans, invested about $1.3 million.

For years, Sussman marketed syndicated mortgage investments in the Muskoka and Barrie regions north of Toronto — affluent vacation areas known as cottage country or the “Hamptons of the North.” He leveraged community connections to attract investors seeking higher returns than traditional bank deposits.

In syndicated mortgages, multiple private investors pool money to fund real estate loans instead of using traditional bank financing. While such investments can be legitimate, they carry significant risks, particularly when oversight is minimal.

Sussman’s business thrived during the decades-long boom in Canadian real estate, particularly in the luxury lakeside properties of cottage country. However, as borrowing costs rose sharply in 2022 and housing demand weakened, the scheme began to unravel.

The case draws plenty of comparisons to Bernie Madoff’s infamous Ponzi scheme and is the latest in a series of syndicated mortgage fraud cases that have plagued Ontario’s real estate investment sector.

In a Bull market everyone looks smart. In a Bear market, you find out who was lying.

— Steve Saretsky (@SteveSaretsky) September 30, 2025

Investors are scrambling to locate $100M as decades-old mortgage business collapses in alleged Ponzi Scheme.https://t.co/H7s6Maug1Y

The court has appointed the law firm Aird & Berlis LLP to represent investors collectively in the receivership proceedings. Sussman’s mortgage broker license expired on March 31, 2025.

The receiver is required to file regular reports with the court as the investigation continues.

Information for this story was found via Bloomberg, and the sources and companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

One Response

I have been telling the FSRA since 1990’s that Murray and Sandy Sussman were doing illegal practices but no one would listen. Now look what happened. He ruined us financially but not our spirit. Hope he gets jail time and lives a lonely, penniless life.