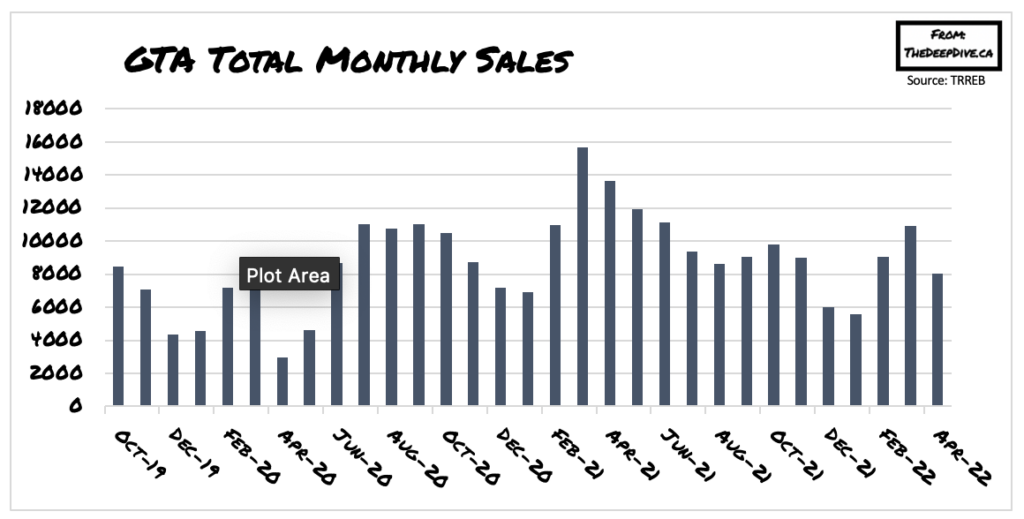

Canada’s hottest real estate market may not be so hot anymore, as higher borrowing costs, coupled with historically-high home prices deter both buyers and sellers.

Latest data from the Toronto Real Estate Board showed that a total of 8,008 properties traded hands in the Greater Toronto Area last month, marking a staggering 27% decline from March, and a 41.2% drop from the 1`3,613 units sold in April 2021. “Based on the trends observed in the April housing market, it certainly appears that the Bank of Canada is achieving its goal of slowing consumer spending as it fights high inflation,” said TRREB President Kevin Crigger.

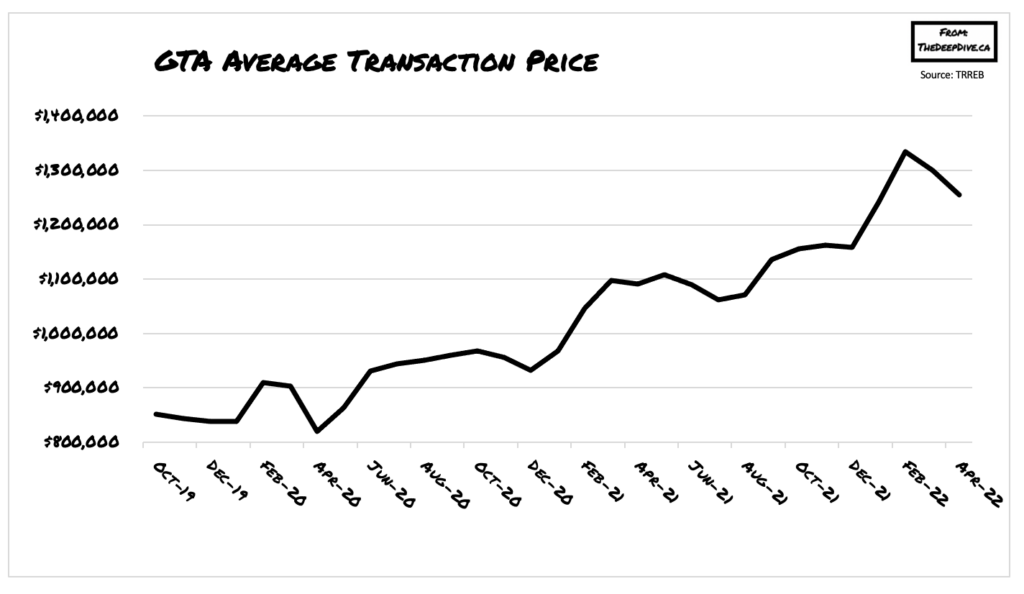

All types of properties saw double-digit declines in April, particularly those in the suburbs. The broader slump in Toronto’s real estate market also prompted potential property sellers to halt activities, as new listings fell 11.7% compared to April of last year. The slump in real estate activity led to a 3.5% month-over-month decrease in the average selling price, which sat at $1,254,436 in April.

“Despite slower sales, market conditions remained tight enough to support higher selling prices compared to last year. However, in line with TRREB’s forecast, there is evidence of buyers responding to increased choice in the marketplace, with the average and benchmark prices dipping month-over-month,” explained TRREB Chief Market Analyst Jason Mercer.

Information for this briefing was found via TRREB. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.