On September 13, Trican Well Service (TSX: TCW) announced that it is expanding its equipment by upgrading the second set of existing pumps. Additionally, the company will be upgrading 48,000 hydraulic horsepower from conventional diesel engines to the Tier 4 DGB engines, bringing Trican’s total Tier 4 fleet to 84,000 HHP. The cost associated with these upgrades is expected to be $28 million, with $18 million being spent in 2021 and the remaining $10 million be spent in 2022.

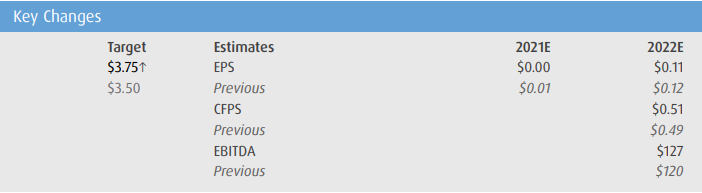

Two analysts raised their 12-month price target after the news release, bringing the average 12-month price target to $3.42, or a 31% upside. Trican currently has 10 analysts covering the stock, with 1 analyst having a strong buy rating, 6 having buy ratings and the other 3 have hold ratings. The street high sits at $3.75 from Stifel-GMP while the lowest comes in at $2.75.

BMO was one of the analysts to raise their 12-month price targets. They raised their price target to $3.75 from $3.50 and reiterated their outperform rating, saying Trican, “remains our top pick of the CDN pressure pumpers given its strong balance sheet, which is acting as a differentiator as producers continue to migrate towards higher ESG and equipment requirements.”

BMO notes that Tier 4 DGB engines are now becoming the standard for incremental upgrades across North America, as the engines can displace up to 85% of the diesel usage with natural gas, lowering emissions for their customers and giving them a better ESG rating. BMO expects that the large ESG push by producers will make Tier 4 or electric status the standard.

Below you can see BMO’s updated estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.