Last week, Trulieve Cannabis (CSE: TRUL) announced that they are acquiring two Pennsylvania companies, PurePen LLC and Solevo Wellness, which will make them a fully integrated Pennsylvania cannabis company while also expanding their footprint to five states. They agreed to acquire PurePenn for $46 million, $27 million in the way of Trulieve shares, and $19 million in cash, plus a potential $60 million in earn-out payments.

At the same time, Trulieve pays $20 million for Solevo, $10 million in cash, while the other $10 million is Trulieve shares plus a potential up to $15 million in earn-out payments. Apart from this, Trulieve decided to raise $115.5 million by selling 4.7 million shares at C$24.50. Canaccord’s Derek Dley had this to say about the acquisition in this morning’s analyst note, “in our view, this is a transformative acquisition for Trulieve, giving the company a presence in two of the three best medical markets in the US, and solidifying the company’s position as a leading MSO in the attractive US cannabis market.”

In the same note, Dley raises his 12-month price target to C$51 from C$45 and reiterates his firm’s Speculative Buy recommendation. For the purchase price, Dley believes that the total $66 million for the two assets, alongside a potential $75 million in earn-outs based on certain EBITDA-based milestones, “aligns both PurePenn and Solevo with Trulieve shareholders, as the companies remain heavily incentivized to pursue meaningful EBITDA growth.”

He says that it will make Trulieve a vertically integrated cannabis company in Pennsylvania with these two acquisitions, which “we view as one of the most attractive medical markets in the US. We view this announcement as a significant positive given the company’s impressive track record in Florida.” He mentions that Canaccord believes Pennsylvania is one of the three most attractive medical markets alongside Florida and Arizona. Current Pennsylvania operators have noted that the market remains in a supply crunch due to robust demand and growth in registered patients, especially since the Pennsylvania Department of Health added anxiety to the list of qualifying conditions. Dley also notes that Pennsylvania has roughly 350,000 patients, which is close to Florida’s patient count.

Canaccord says that on a post-earn-out basis, Trulieve paid roughly 5x their 2021 EBITDA assumptions for PurePenn and Solevo. This is favorable as Trulieve’s trading multiple for 2021 EBITDA was 10.2x before the announcement.

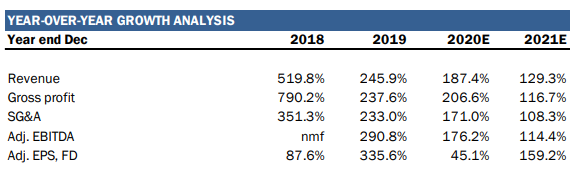

With the price target upgrade, Dley has upgraded his fiscal year 2021 estimates for Trulieve. He now expects revenue to be $612.78 million, compared to the previous estimate of $562.32 million, representing a 9% increase. Alongside that, he expects adjusted gross profit to be $393.18 million, 8% higher from the old estimate of $364.42 million. He also forecasts that adjusted EBITDA and EPS will be $267.21 million and $1.15 per share, respectively.

With Dley reiterating the $51 price target, he says, “given Trulieve’s healthy financial position, access to capital, and best-in-class profitability metrics, we believe the stock is attractive for investors looking for cannabis exposure to a high-quality operator with a proven ability to generate strong EBITDA and profitability.”

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.