Presidential son Donald Trump Jr. strode onto the NYSE floor on Tuesday, rang the opening bell, and launched into a chant of “USA! USA!” during the public debut of GrabAGun Digital Holdings (NYSE: PEW). He branded the IPO as a triumph over “all the ‘woke’ nonsense we’ve been watching for the last decade.”

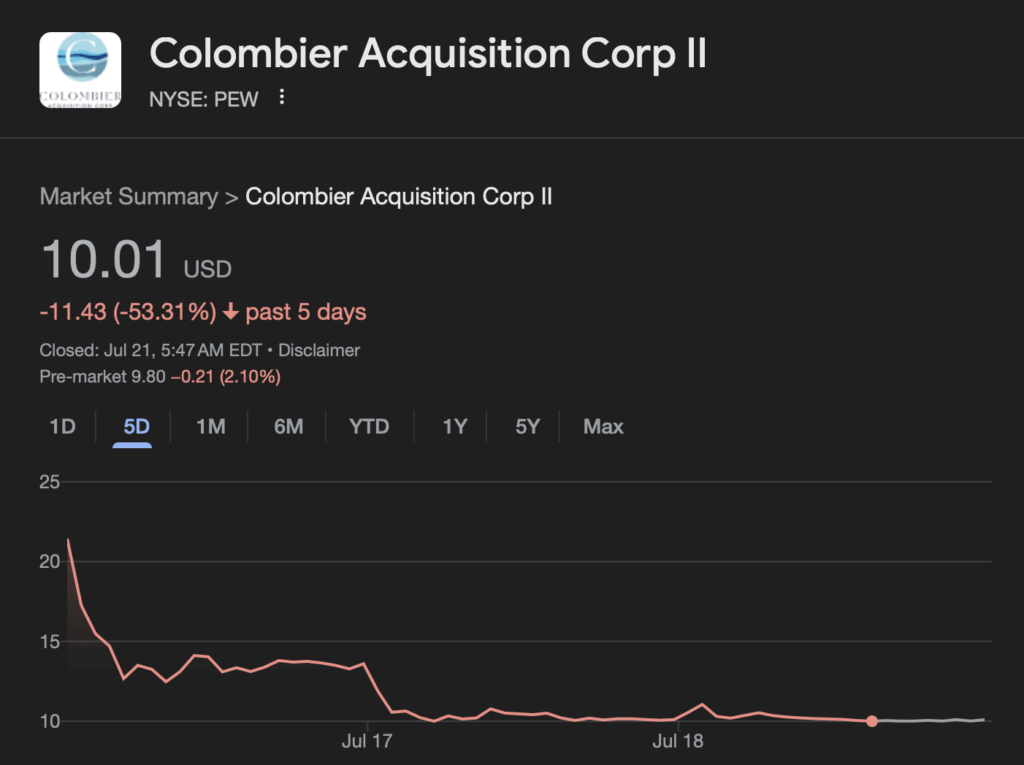

Two trading sessions later, the stock had spiraled down 53% from its $21.40 open to about $10.01, wiping roughly $1.8 million off the value of the 300,000-share stake Trump Jr. pockets for his board seat.

GrabAGun’s listing came via a $179-million merger with Colombier Acquisition Corp. II, the SPAC vehicle founded by 1789 Capital partner Omeed Malik. The deal left the retailer with a $119 million cash cushion for “working capital and other purposes to accelerate future growth,” the firms said.

For Trump Jr., the online firearms seller fits a growing portfolio of “anti-woke” ventures aimed at conservatives who distrust mainstream commerce. He consults for Patriot social-media platform PublicSquare, advises right-leaning VC outfits, and appears at rallies plugging “parallel economy” brands.

“What we’re doing with GrabAGun would have been unthinkable four years ago,” he posted on X, underscoring his pitch that MAGA loyalty can outmuscle Wall Street skepticism.

The Palm Beach-based retailer reported roughly $93 million in revenue and just over $4 million in net profit in both 2023 and 2024—healthy for a niche e-commerce platform but hardly explosive for a company now valued near $300 million. GrabAGun boasts 20,000 SKUs ranging from hunting rifles to 9 mm ammo and markets buy-now-pay-later plans it brands as “Shoot Now, Pay Later,” targeting millennial and Gen Z buyers.

Investor enthusiasm proved fleeting. Academic reviews of 400-plus SPACs since 2019 show median market-adjusted returns turn negative within three months—-14.5% on average—and sink by 25% lower after one year.

The NYSE debut attracted zero redemptions—rare for modern SPAC deals—but secondary-market buyers quickly priced in regulatory overhangs and consumer backlash risks. Citi and other banks have begun re-evaluating firearms policies, signaling that capital access could tighten just as GrabAGun seeks expansion funds.

The eldest Trump son has leveraged partisan media and hunting imagery—most notoriously a 2012 safari photo clutching a severed elephant tail—to cultivate a brand of unapologetic gun culture. Critics say that notoriety lures retail investors but adds headline risk.

Either way, Trump Jr.’s ventures share a pattern: high-octane launches followed by the sober mathematics of public markets. GrabAGun is now the test case for whether MAGA enthusiasm can offset the systemic drag that has turned most post-merger SPACs into value traps.

Information for this briefing was found via Futurism and the sources mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.