President Donald Trump declared that a deal with China has been struck, writing on Truth Social that “OUR DEAL WITH CHINA IS DONE, SUBJECT TO FINAL APPROVAL WITH PRESIDENT XI AND ME.” The president promises upfront Chinese deliveries of rare-earth magnets and a 55% US tariff haul in exchange for easing visas on Chinese students.

Yet the announcement appears to merely revive—rather than advance—the fragile framework sketched in Geneva last month, leaving most of the record-high tariff architecture and export controls intact.

BREAKING: President Trump announces that a trade deal with China has been reached pic.twitter.com/owgeJaNGYl

— Exec Sum (@exec_sum) June 11, 2025

Commerce Secretary Howard Lutnick confirmed negotiators “reached a framework to implement the Geneva consensus,” meaning the headline concession is China’s pledge to resume exports of critical minerals it had already agreed to release in May.

US Trade Representative Jamieson Greer countered that Beijing “has failed to roll back restrictions on rare-earth magnets,” while Chinese officials accused Washington of stalling semiconductor sales and canceling student visas. In other words, each side is celebrating fixes to breaches they contested.

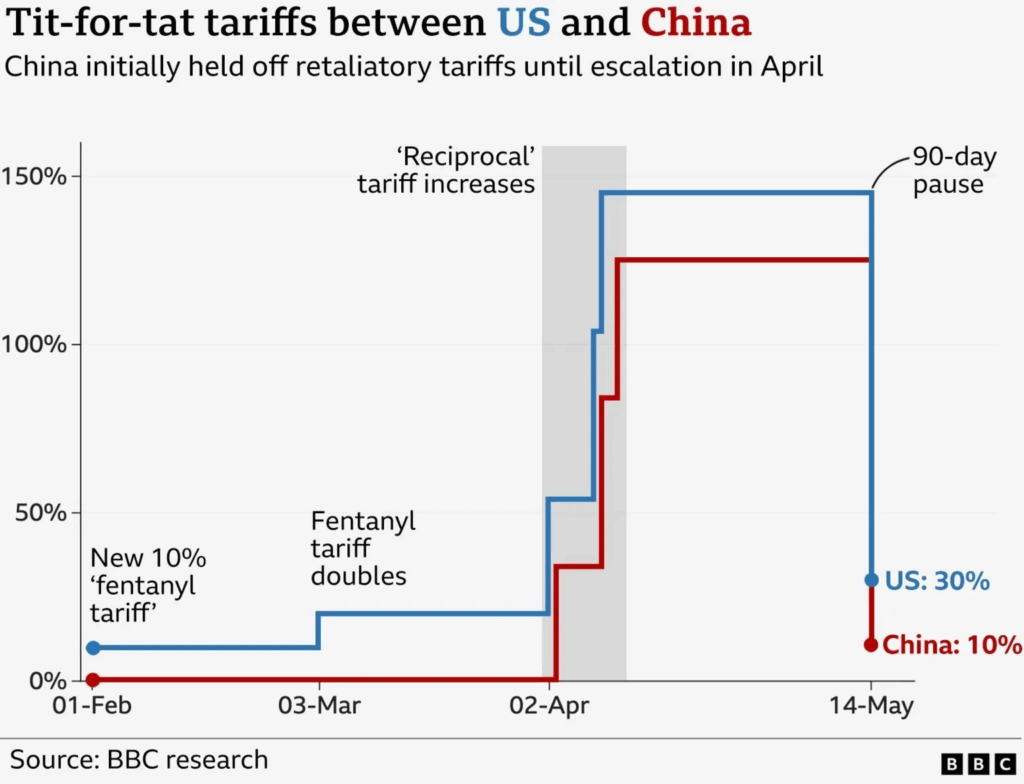

Trump’s claim that the US will pocket a 55% tariff windfall deserves scrutiny. Following the truce last month, US tariffs on Chinese goods dropped from a punitive 145% to 30%, while China reduced its duties on American imports from 125% to 10%. Why would China then agree to go from 30% up to 55%?

This column believes that Trump’s touted “55% tariff” is not a single, blanket duty but a theoretical stack of three separate levies—a draft 10% “reciprocal” tariff on all Chinese goods, the pre-existing 25% Section 301 duties (tech, machinery, furniture, toys, etc.), and a proposed 20% fentanyl-related surcharge—that would only apply simultaneously to a narrow subset of imports once multiple rule-makings and court challenges are resolved.

For most products, none of the paperwork is final and the real-world average tariff would remain below 55%.

Also, China would retain a 10% tariff on US goods—the same level set in the May 2025 truce.

The rare-earth component likewise underwhelms. China controls roughly 90% of global supply, and analysts note shipments to the US have “not been flowing…as they once had.” A promise to restore status-quo volumes, without binding quotas or enforcement triggers, offers little certainty for sectors spanning EV batteries to MRI machines.

Strategically, the agreement’s centerpiece—expanded US university slots for Chinese students—may prove the most durable deliverable, yet its economic weight pales beside unresolved disputes over intellectual property theft, market access, and a budding trade war.

Information for this briefing was found via BBC, CNN, and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.