Twitter Inc (NYSE: TWTR) on July 22 reported their second quarter earnings, beating analysts’ estimates. The company reported revenues of $1.19 billion, growing 74.2% year over year. Gross profits also grew by 95.6% year over year to $773.5 million. The company had gross margins of 65% and an operating margin of 6.9%. Net income came in at $66 million, reflecting $0.08 in earnings per share.

Analysts all raised their 12-month price targets, bringing the consensus up to $71.82, from $62.17 from last month. The street high target sits at $90 while the lowest comes in at $30. Twitter has 40 analysts covering the stock, of which 4 have strong buy ratings, 7 have buys, 25 have holds and 4 have sell ratings.

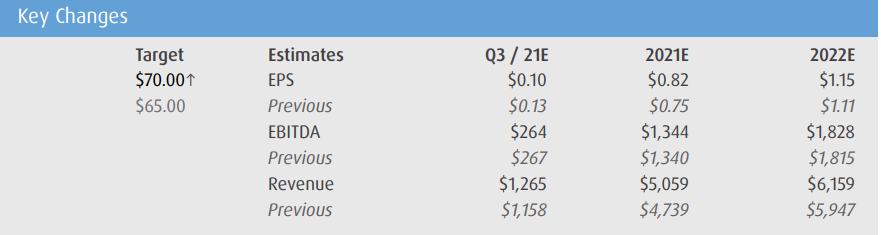

BMO Capital Markets on July 29 raised their price target to $70 from $65 and reiterated their market perform rating on the stock. They comment, “very few stocks engender so many questions on the potential of consistent execution as TWTR,” which is a very good question. They believe that both bulls and bears have compelling arguments going into the third quarter. They say that bears are looking at weaker third quarter revenue guidance due to the Olympics and current industrywide digital ad trends, as well as softer U.S mDAU’s. Meanwhile bulls are looking at the opportunity in direct response ads, more monetization, and share buybacks.

Below you can see BMO’s updated third quarter, 2021, and 2022 estimates. They have also lowered their mDAU’s by 1 million.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.