As the Canadian-listed rare earth mining company with the largest stock market capitalization, Ucore Rare Metals Inc. (TSXV: UCU) would seem to be well positioned to benefit from an October 17 measure passed by China’s legislature. That law could lead to China’s banning the export of rare earth metals and advanced technology to the U.S. Specifically, it permits China to stop sales to a “country or region that abuses export-control measures and poses a threat to China’s national security or interests.”

Ten years ago, the imposition of such a ban triggered a frenzy in the rare earth industry in the West after China blocked rare earth exports to Japan, removing the supply of roughly 60%-80% of the world’s “magnet-feed” rare earth oxides to the key consumer of those materials. China’s action, which seemed to be a dramatically disproportionate response to Japan’s detention of a Chinese fishing trawler captain, caused a dramatic spike in the pricing of rare earth metals.

During this period, Molycorp, then the most prominent rare earth miner, went public via an IPO in July 2010 at US$14 per share. The stock subsequently soared, peaking at around US$79 in May 2011. However, after rare earth metals prices retraced, Molycorp suffered and ultimately filed for bankruptcy protection in mid-2015.

Ucore’s principal asset is the Bokan Mountain Heavy Rare Earth Elements Project located in southeast Alaska. Bokan contains 4.8 million tonnes of indicated mineral resources grading 0.601% total rare earth oxides via a 43-101 compliant resource estimate, along with 1.04 million inferred tonnes of 0.604% graded total rare earth oxides. About 40% of these resources contain the highest-grade heavy rare earth elements (REEs) in the U.S.

The 17 total rare earth elements are generally categorized as light or heavy elements. The heavy elements, such as dysprosium and terbium, are generally rarer and sell for significantly higher prices, as they are less common and much more costly to separate. In contrast, light REEs are produced in larger quantities because they occur naturally in greater quantities.

Financial Challenges

However, Ucore faces two significant financial challenges. First, Ucore is a pre-revenue company, and no substantial revenue is expected for at least a few years. In addition, the company is incurring substantial expenses in its development stage.

Operating cash flow deficits totaled about $2.5 million in the first half of 2020, and $3.0 million and $3.4 million in the full years 2019 and 2018, respectively. Ucore does have $2.9 million of cash on its balance sheet, but that is almost fully offset by about $2.7 million of combined convertible debentures and loans.

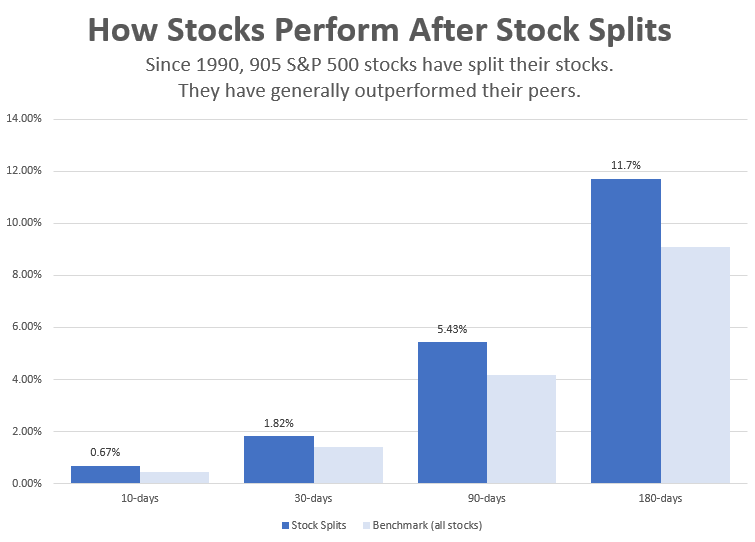

Second, Ucore announced a one-for-ten reverse stock split on October 20. This action, which will reduce shares outstanding to around 41 million from approximately 410 million, should become effective in late December. The downside of this initiative is that stocks frequently underperform after a reverse split. In particular, small-cap stocks, as reflected by Russell 3000 Index data, have performed poorly after a share consolidation. Given this trend, the performance of Ucore shares could be restrained given the upcoming corporate action.

It is of course possible that Ucore shares perform well over the next months. Investors may take a positive long-term view of North American rare earth miners given China’s threatened export ban. In that case, intermediate cash flow concerns and the potential trading implications of a reverse split may be judged to have only little importance.

Conclusion

Ucore’s Bokan Mountain project may in time become a key source of heavy REEs, which are utilized in cutting-edge technology products from electric vehicle batteries to defense systems. However, revenue and positive cash flow from mining Bokan are unlikely to be realized for some time. In addition, a scheduled reverse stock split could hinder performance of the shares over the near to intermediate term.

Ucore Rare Metals last traded at $0.085 on the TSX Venture Exchange.

Information for this briefing was found via Sedar and Ucore Rare Metals. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.