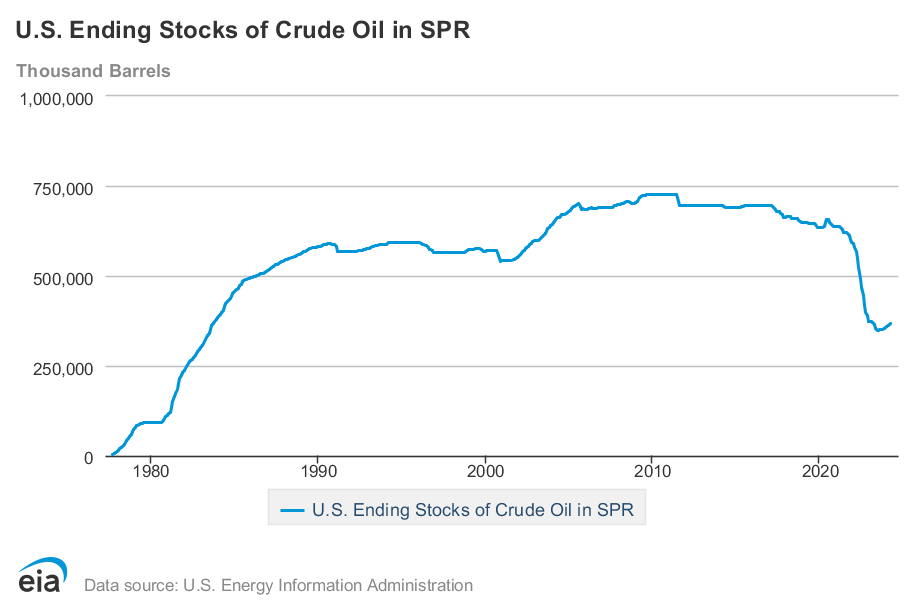

The Biden administration recently announced that it has resorted to purchasing 4.65 million barrels of crude oil for the United States’ Strategic Petroleum Reserve (SPR). This move highlights a startling irony: the world’s largest oil producer is now compelled to buy back oil to replenish its emergency stockpile.

The Energy Department’s incremental efforts to restock the SPR come after the reserve hit a 40-year low. This depletion followed the administration’s unprecedented release of 180 million barrels last year to curb skyrocketing gasoline prices, triggered by Russia’s invasion of Ukraine. While the intent was to provide immediate relief at the pump, the long-term consequence has left the country scrambling to refill its reserves.

Taking advantage of a modest 10% dip in crude oil prices since early April, the administration is making these purchases at an average price of $77 per barrel.

Deputy Energy Secretary David Turk has attempted to put a positive spin on this strategy. “We will keep buying back,” Turk said in an interview. “We will keep going into next year and try to buy back as much as we are capable of buying back.”

However, this approach raises significant questions. How did the U.S., a leading oil-producing nation, find itself in a position where it must purchase oil to secure its energy future? Critics argue that the administration’s handling of the SPR reflects short-term thinking and a reactive approach to energy policy, rather than a coherent, long-term strategy.

The contracts announced Monday, awarded to Exxon Mobil and Macquarie, will see oil delivered to the Bayou Choctaw storage site between October 1 and December 31. These purchases bring the total amount of oil bought to refill the reserves at 43.25 million barrels. Yet, the SPR currently holds only 375 million barrels, a stark contrast to the nearly 600 million barrels it held at the start of 2022.

Critics contend that the administration’s actions have left the nation vulnerable. Moreover, the urgency of these purchases underscores the precariousness of the nation’s energy security. The SPR was designed to be a buffer against unforeseen disruptions, yet its current state reflects a reactive rather than proactive approach to energy management.

This scenario also raises broader concerns about the U.S.’s energy independence. As the world’s top oil producer, having to purchase oil to secure the nation’s emergency reserves signals a strategic failure.

In December 2023, the U.S. led the world in oil production, producing 13,264,000 barrels per day, followed by Russia with 10,126,000 barrels, and Saudi Arabia with 8,950,000 barrels. Canada and Iraq also contributed significantly, producing 4,990,000 and 4,375,000 barrels per day, respectively. This marked the sixth consecutive year that the U.S. has been the top oil producer globally, a feat largely attributed to the surge in shale oil fracking since 2010.

Moreover, U.S. oil production hit a historic peak in October 2023, further solidifying its dominant position in the global oil market.

Information for this story was found via Bloomberg and the sources mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.