It appears that the US economy has been subject to what appears to be significantly flawed predictions. Throughout the duration of the coronavirus pandemic, it was projected that the US economy would collapse to the likes of the Great Depression, with astronomical unemployment numbers, hyperinflation, food shortages etc. However, according to a recent report released by the US Bureau of Labour Statistics (BLS), a strange potential has emerged which could finally put the continuing economic pessimism aside.

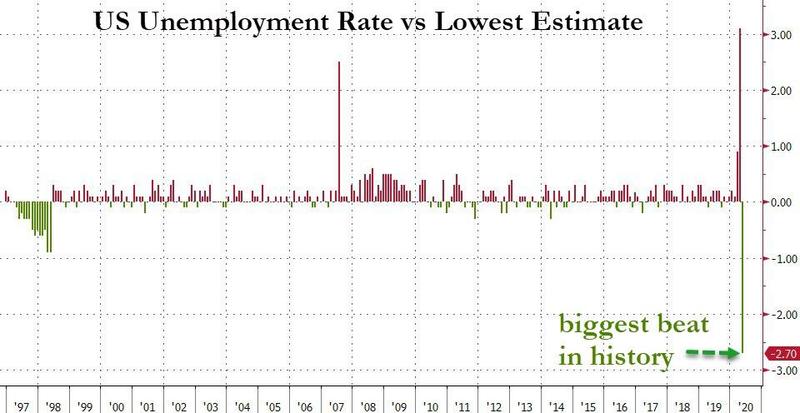

The status quo prediction of the unemployment rate skyrocketing to 19.1% and nonfarm payrolls dropping by a staggering 7.5 million has been met with a contradicting data analysis. According to the BLS report, the unemployment rate has now dropped to 13.3%, all meanwhile nonfarm payrolls have actually increased by 2.5 million. And even more shocking? The supposed 2.5 million jobs emerged before lockdowns were lifted, all while unemployment claims continued to surge past the survey period in May.

So what is really going on? SouthBay Research offers a potentially rational explanation for the reasoning behind the contradictory data. According to the advisory firm, there have been some ongoing flaws in with the jobless claims numbers: as per their calculations, there have actually been a total of 27 million non-seasonal jobless claims filed, as opposed to the BLS calculations of only 18 million private payroll jobs lost. SouthBay Research attributes the discrepancy between the calculations as function of 3.7 million fraudulent claims (the Washington State fiasco), a seasonal adjustment of 4 million, and a run rate of 2 million – all of which have been overlooked by the BLS.

As such, SouthBay proposes three headache-easing scenarios of what could be going on in the economy: either the partial re-opening in some US states got employers jumping for joy that they went on a hiring spree between April 13 – May 12 and increased the job market by 9 million; the calculations behind the jobless claims data are significantly flawed, with fraudulent claims being closer to 30% rather than the reported 10%; or, someone at the Bureau of Labour Statistics needs to retake some stats classes because the data analysis is wrong.

Nonetheless, this puzzling mess paints a V-shaped economic recovery in a positive light, something that is certainly going to get a Tweet and a thumbs up from the US President.

Information for this briefing was found via Bloomberg, and SouthBay Research. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.