As the US economy continues to be battered down by the coronavirus pandemic, the Federal Reserve has been strenuously working on propping up any and all markets to keep them from collapsing under the weight of prior financial recklessness.

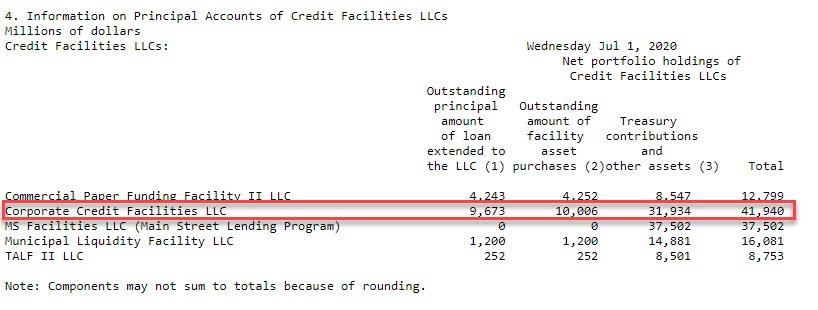

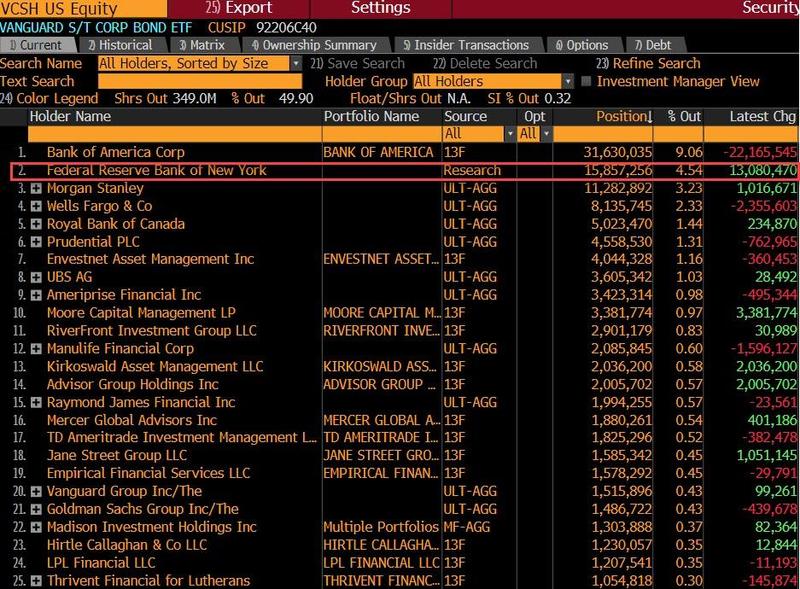

According to a recent compiling by Bloomberg, the Federal Reserve has been going rampant with buying corporate bond ETFs. To date, the Fed’s balance sheet is comprised of at least 16 different corporate ETFs, which amount to an approximate market value of $9.7 billion, or about $300 million in corporate bonds per day. However, given that the Fed keeps the details of the ETFs under wraps on its H.4.1 weekly filings, there could certainly be many more that we are unaware of.

Nonetheless, upon further inspection it appears that the Fed is one of the top five holders of some of the largest bond ETFs, and is the fifth biggest holder of junk bond ETFS. With propping up that many clearly collapsing corporations, it is no wonder the Fed wants to keep its generosity – or should we say – the taxpayers generosity, undisclosed!

But have no fear, it appears as if the Fed may now begin to curtail its buying frenzy – or so it seems. According to the latest H.4.1 statement, the Federal Reserve’s balance sheet has been on the decline for the third consecutive week since the onset of the pandemic, even though there has not been a reduction in quantitative easing or any slowdown in spending. It appears that the shortened balance sheet is rather due to a decrease in liquidity swaps, which contracted by $49.5 billion to $225.4 billion.

The Fed’s liquidity swaps, which serve as a tool for easing the demand surge for US currency, have not been this low since April. Thus, this potentially suggests that global financial markets may soon be returning to near pre-pandemic levels, and circulation of the world’s reserve currency may be falling.

Information for this briefing was found via the US Federal Reserve and Bloomberg. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.