Soaring mortgage rates are keeping United States households from buying their own houses and are pushing demand for rentals, thus driving rates higher.

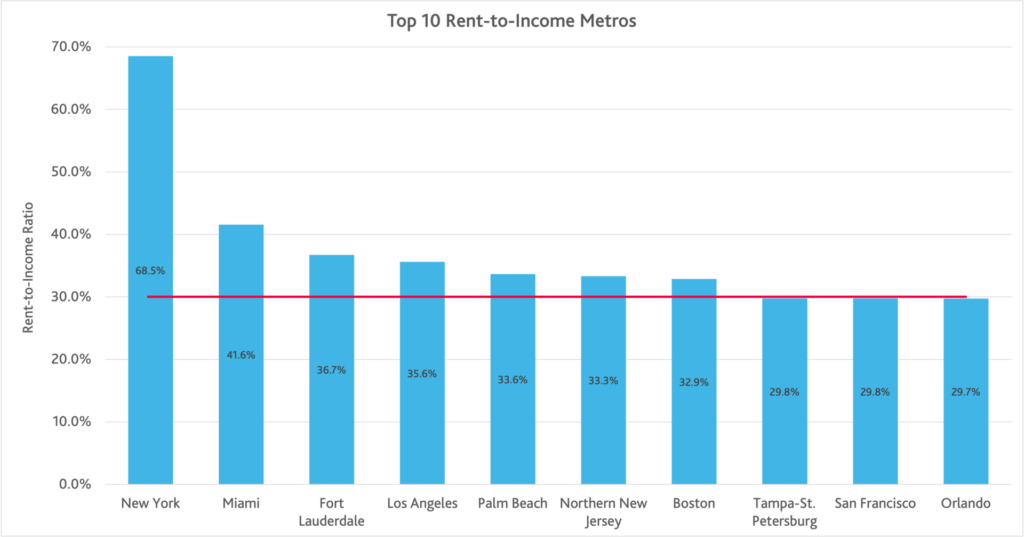

The national rent-to-income (RTI) ratio rose to 30%, the highest in over 20 years that Moody’s Analytics has been tracking data, and up 1.5% year on year, and 0.2% from the third quarter. By comparison, 20 years ago, the national average RTI was 23%, and 10 years ago it was 26%.

U.S. residents are now spending 30% of their income on rent, the highest in more than 20 years of Moody's tracking the data. "Rising mortgage rates caused many households to be priced out from homebuying and would-be buyers remained to remain renters," driving prices higher.

— Lisa Abramowicz (@lisaabramowicz1) January 19, 2023

Data from a recent Moody’s Analytics report saw a huge jump in households paying over 50% of their income in rent. It also found the fourth-quarter 2022 RTI to still be the highest in New York at 68.5% or almost three-fourths of the renter’s income, the figure is unchanged from the third quarter.

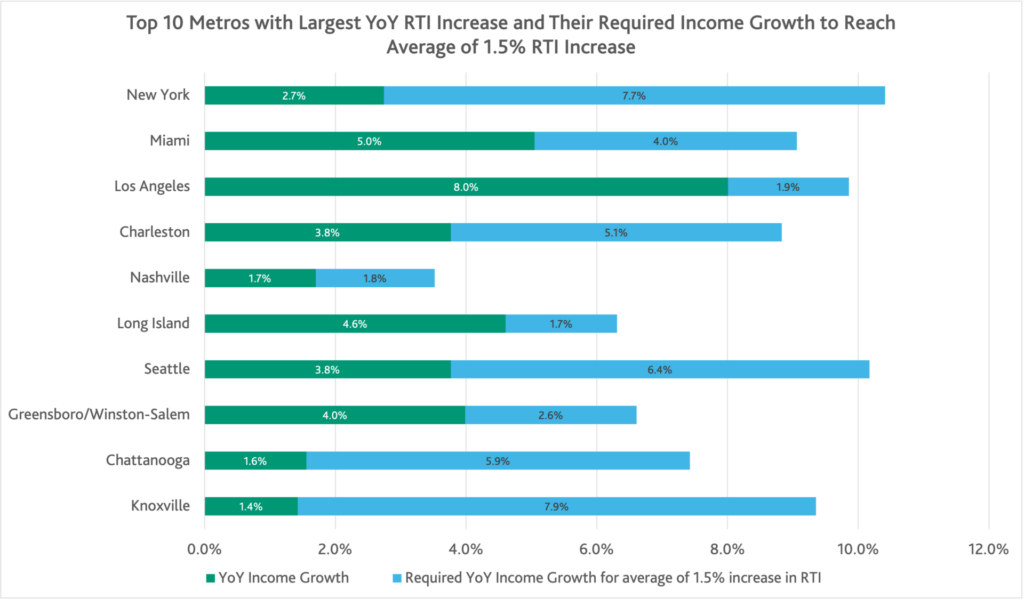

The report found that RTI in 19 metros declined in Q4 versus only two in Q3, while 60 metros still have it worse now than they did a year ago. Moody’s computed how much income growth is needed for the metros with the most deterioration in affordability to reach the national average increase in RTI of 1.5%.

While rental rates showed slight signs of cooling down late in the fourth quarter, the gap between income growth and the increase in rental rates remains wide. As renters burn more of their income on housing, they have less and less money to spend on other essentials, and much less to save for a down payment for a house.

Information for this briefing was found via Moody’s Analytics and Yahoo! Finance, and the sources and companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.