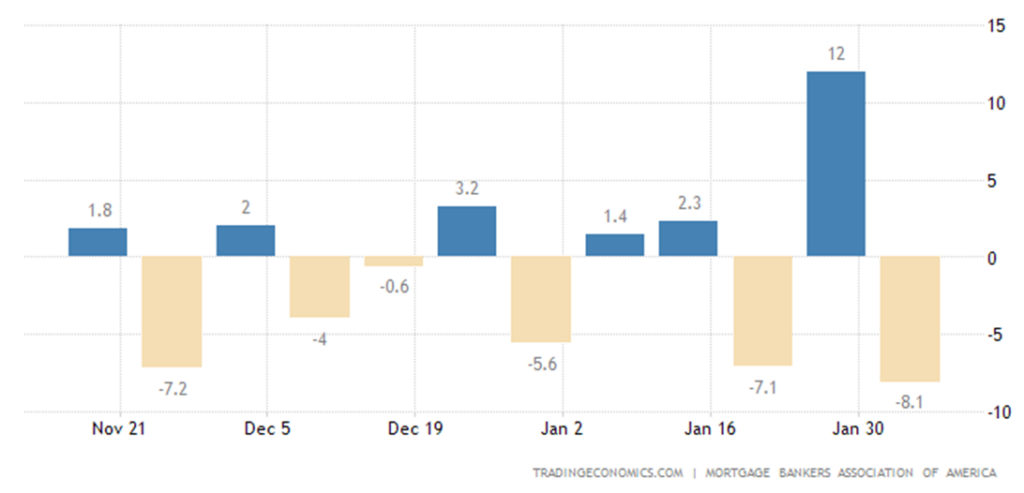

It seems rising mortgage rates are starting to take a toll on demand. Mortgage applications in the US were reported to drop 8.1% in the week ended February 4, 2022–“the biggest decline in almost a year.”

According to the report by the Mortgage Bankers Association of America, mortgage applications to buy a home dropped by 10%. This is 12% lower than its counterpart a year ago. On the other hand, mortgage refinancing demand also dropped by 7%, lower by 52% compared to the same period in the previous year.

The report also noted that the average fixed 30-year mortgage rate increased to 3.83% from 3.78%, “hitting the highest level since January 2020.”

“Mortgage rates followed the U.S. 10-year yield and other sovereign bonds as the Federal Reserve and other key global central banks responded to growing inflationary pressures and signaled that they will start to remove accommodative policies,” said the association’s AVP of economic and industry forecasting Joel Kan.

Mortgage rates relatively move with the 10-year treasury yield. As of Monday, the treasury rate is at 1.92%, with an average growth rate of 0.93%. This is 61.34% higher than its value a year ago of 1.19%.

30y mortgage rates in the US just hit 3.85%: that's 1pp higher vs Feb 2021.

— Alf (@MacroAlf) February 5, 2022

The new marginal buyer's real salary has shrunk, but let's say he wants to pay the same $2k/month.

He can now afford a $350k house versus $400k 1y ago.

>10% less.

Watch the housing market: it's huge. pic.twitter.com/gWnBfdnk8L

Information for this briefing was found via Mortgage Bankers Association of America and CNBC. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.