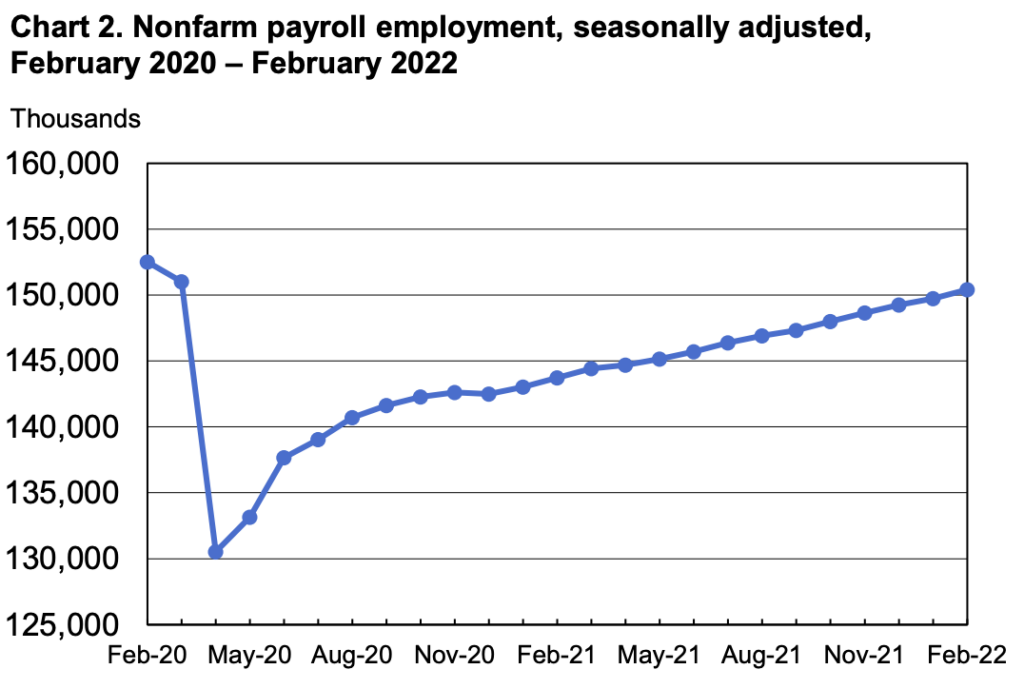

The US labour market continued to show signs of strengthening, as nonfarm payrolls substantially surpassed expectations in February. However, stagnating wage growth against a backdrop of surging inflation provides even stronger incentive for the Federal Reserve to begin raising interest rates this month.

According to latest data from the Bureau of Labour Statistics, nonfarm payrolls increased by 678,000 in February— the largest increase since July 2021, and exceeding forecasts calling for an advance of 423,000 jobs. Following upwardly revisions in December and January, The US economy has been steadily adding about 400,000 jobs to the labour market each month since May of last year, indicating a robust recovery towards the Fed’s goalpost of “maximum employment.”

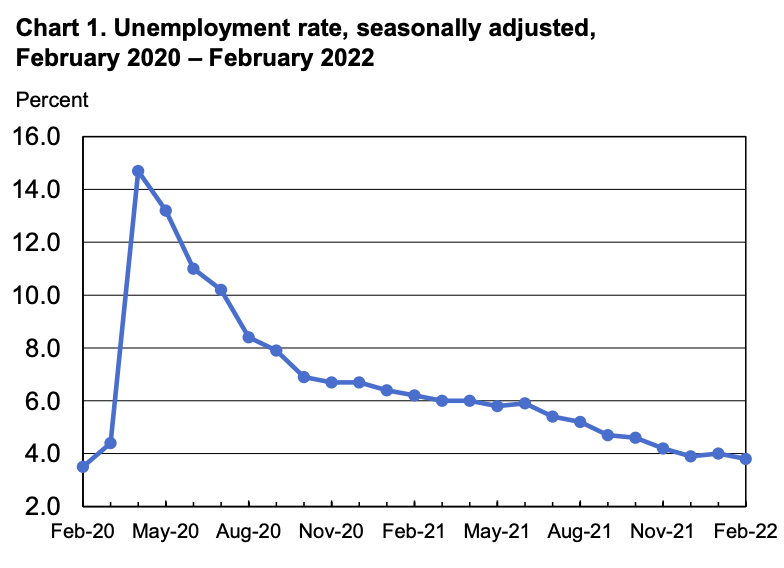

The unemployment rate fell to 3.8% last month, against expectations of 3.9% from economists polled by Bloomberg. However, average hourly earnings remained little changed between January and February, and were up only 5.1% compared to the same period one year ago. The dismal earnings data suggests that compensation is not keeping up with skyrocketing inflation, which stood at 7.5% in February— the highest in almost 40 years.

Despite lower-than-expected wage growth, a robust increase in hiring and lower unemployment rate further reinforced the Fed’s plan to increase borrowing costs in March. Fed Chair Jerome Powell assured lawmakers on Wednesday that he still favours a 25 basis-point hike, just as Russia’s invasion of Ukraine sent commodities including oil, natural gas, metals, and grains soaring.

WATCH: 'I'm inclined to propose and support a 25 basis point rate hike,' Federal Reserve Chair Jerome Powell Powell said in his testimony to the U.S. House of Representatives Financial Services Committee https://t.co/o542FS9Hdy pic.twitter.com/G9FqV88uLt

— Reuters Business (@ReutersBiz) March 3, 2022

Following the BLS report, the yield on US Treasurys fell lower, with the S&P 500 following in unison as concerns over the Russia-Ukraine conflict dimmed the employment figures.

Information for this briefing was found via the BLS and Bloomberg. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.