The US will increase its strategic uranium stockpile, Energy Secretary Chris Wright said on Monday, in an effort to buffer nuclear fuel security and bolster confidence in long-term nuclear power as electricity demand rises.

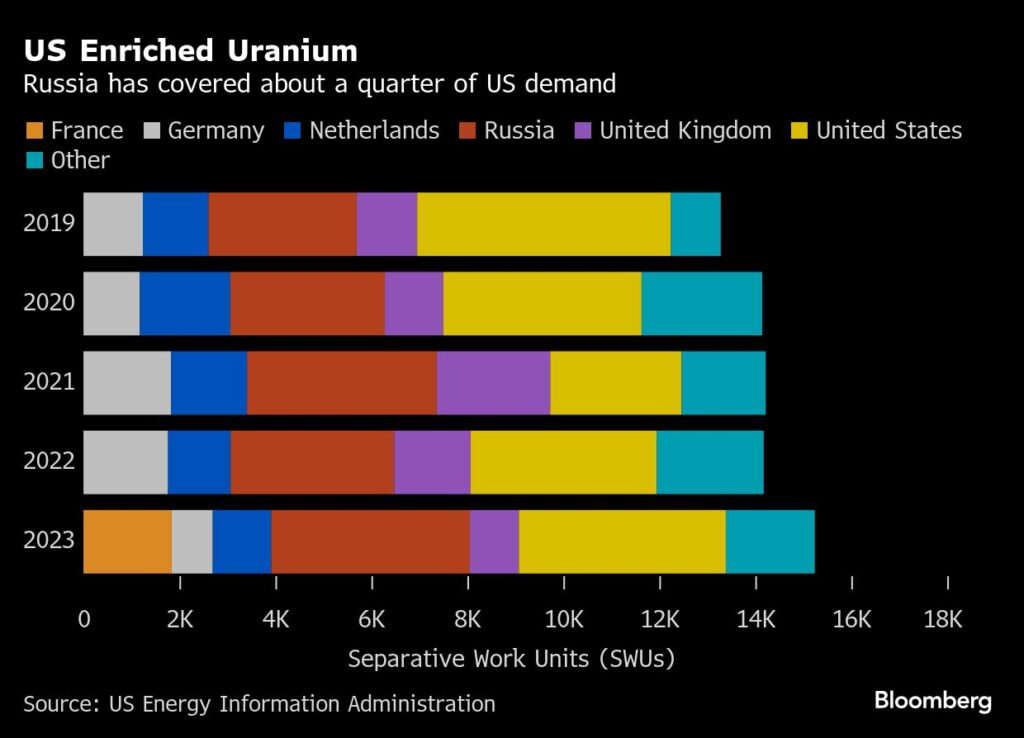

Russia currently covers about a quarter of US enriched-uranium demand, according to US Energy Information Administration data, and the US fleet of 94 reactors generates around 20% of US electricity. Wright warned that “turning the tap off too quickly” from Russian supply without alternatives or additional stockpiles could jeopardize about 5% of US electricity.

“We’re moving to a place—and we’re not there yet—to no longer use Russian enriched uranium,” Wright said at the IAEA General Conference. “We hope to see rapid growth in uranium consumption in the US from both large reactors and small modular reactors. The size of that right buffer would grow with time. We need a lot of domestic uranium and enrichment capacity.”

US utilities hold on average about 14 months of uranium, trailing peers. The European Union keeps roughly 2.5 years of fuel on hand, while China maintains stockpiles equivalent to 12 years of current generation, per IAEA data published last quarter.

The first Trump administration proposed a federal uranium reserve in 2020, requesting $150 million for direct purchases, but Congress funded roughly half. In 2022, the Department of Energy awarded contracts to buy hundreds of thousands of pounds for the reserve from miners including Energy Fuels and Uranium Energy.

The legal framework tightened in May 2024 when legislation required US utilities to shift away from Russian supplies by 2028. Six months later, Russia temporarily limited enriched-uranium exports to the US.

The US currently has two commercial enrichment facilities: Urenco’s plant in New Mexico (owned by a British-Dutch-German consortium) for conventional light-water reactor fuel, and Centrus Energy’s operation in Ohio, which recently began producing higher-assay material for advanced reactor designs. A White House executive order in May aimed to accelerate deployment of such advanced reactors, and the Energy Department expects the first models to enter testing by next year.

Public-private capital will be courted to speed the build-out, according to the energy secretary. Citing new entrants (including Peter Thiel–backed, enrichment-focused startup General Matter) Wright said: “That’s key for efficiency and innovation and pace. That’s how you drive progress.”

Energy Fuels jumped about 9%, Uranium Energy rose 6%, and Cameco gained 7% following Wright’s interview.

The government did not disclose a target size for the enlarged stockpile, with Wright saying the “right buffer” will scale with reactor additions.

Information for this story was found via Mining.com, Investing.com and the sources and companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.