As the coronavirus pandemic continues to rage on in the US, American voters are growing increasingly pessimistic about a quick economic rebound.

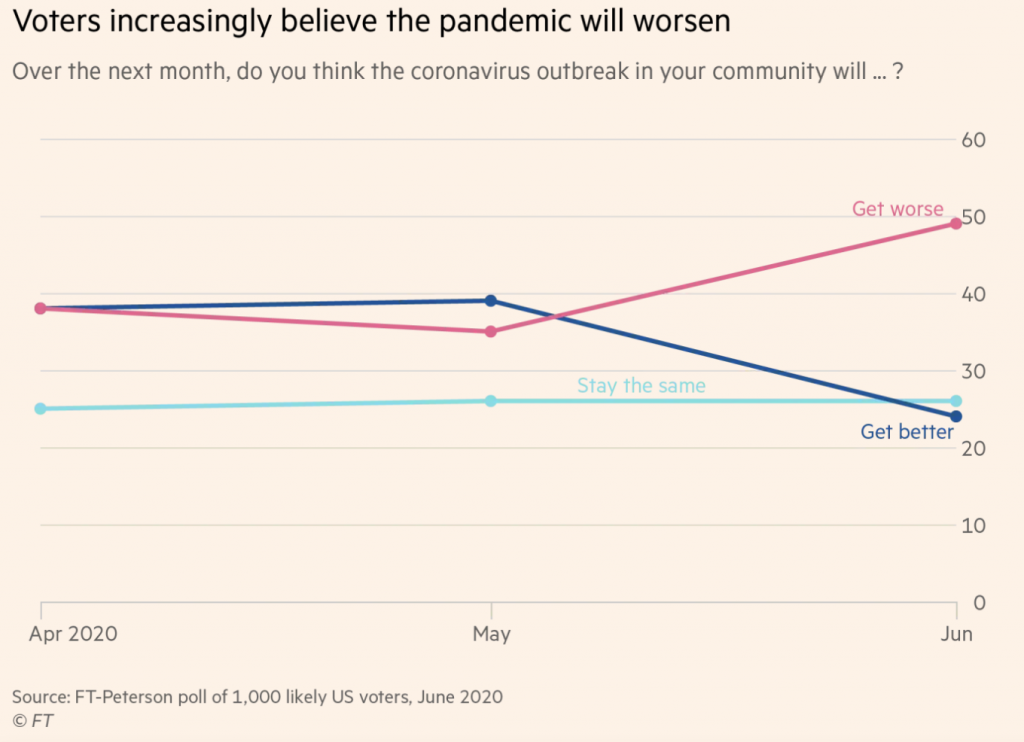

A recent poll conducted by the Peter G Peterson Foundation for the Financial Times surveyed a total of 1,000 eligible voters to gain their insight on several topics stemming from implications of the coronavirus pandemic. As infection rates across the US continue to increase at near-exponential levels, nearly 49% of likely voters feel that outbreaks in their communities are going to continue getting worse within the next month. The latest survey shows a sharp increase in a pessimistic outlook, given that last month only 35% said that they foresee the pandemic worsening.

The survey also found that about 37% of prospective voters believe the US economy would recover to pre-pandemic levels within a year; this corresponds to a 5% decline since the previous survey. Conversely, those foreseeing the economy recovery taking in excess of a year to fully recover increased from 58% to 63%.

With respect to the soaring infection rates across the US, especially in the southern states such as Texas, Arizona, Florida, and California, coupled with the increasingly grim outlook of a V-shaped economic recovery, the US president faces a significant challenge going into the election.

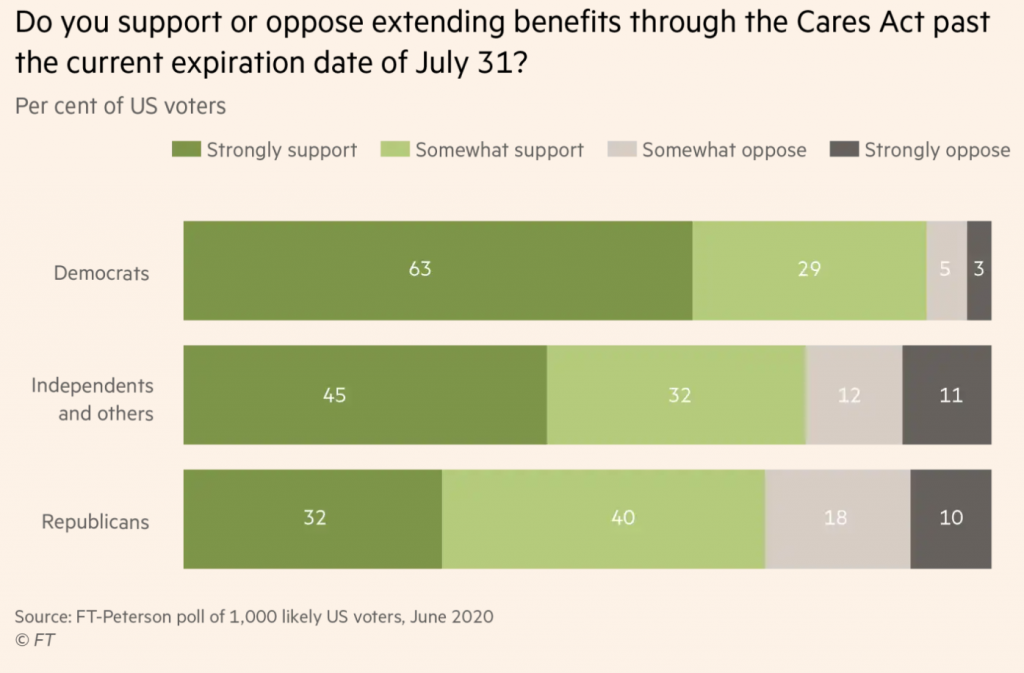

The FT-Peterson poll found that about 66% of voters were in favour of extending unemployment benefits past the slated end of July expiry date. However, an increasing number of Republicans oppose an extension of benefits, arguing that those unemployed are earning more whilst on benefits than they were when they worked.

Information for this briefing was found via Financial Times. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.