News which suggests that inflation may remain higher for longer seems to come in daily. Just in the last few days, fresh data showing that used car prices have u-turned and are starting to rise sharply again, as well as a revised analysis of the Personal Consumption Expenditures (PCE) Price Index by the Federal Reserve Bank of New York signals that inflationary pressures remain quite resilient.

In the end, the U.S. Federal Reserve could be forced to maintain a tighter monetary policy stance for a longer period than most market investors hope.

On March 7, Mannheim Consulting reported that wholesale seasonally adjusted used car prices rose 4.3% sequentially in February. This represents the largest percentage increase in the month of February since 2009.

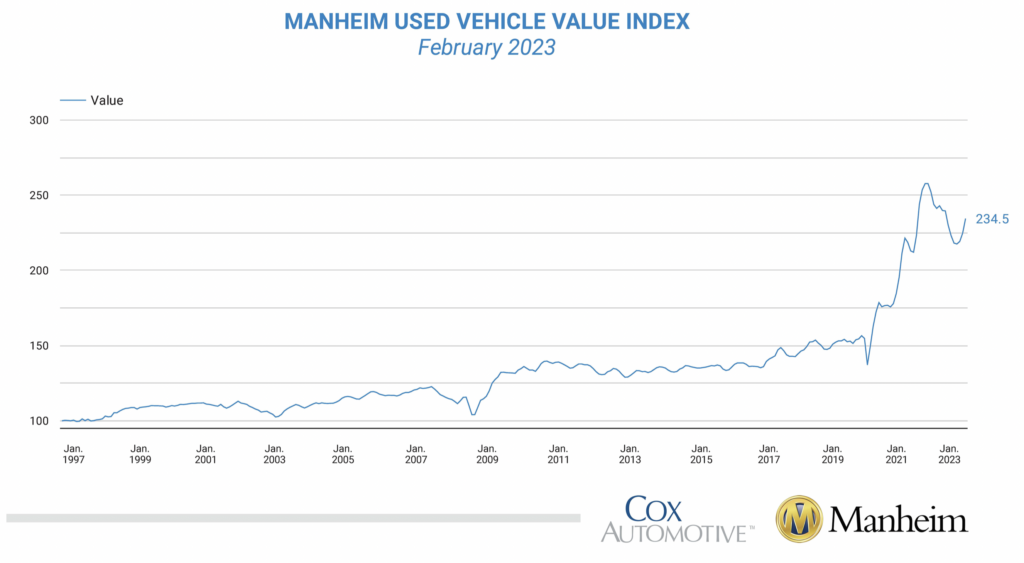

Mannheim’s Used Vehicle Value Index showed sharp gains throughout 2021 as auto consumers turned toward used vehicles primarily because supply chain issues made finding a new car to buy quite challenging. Mannheim’s index peaked in January 2022 and declined for ten successive months through November 2022. This downtrend was of course aided by rising costs to finance a used car purchase.

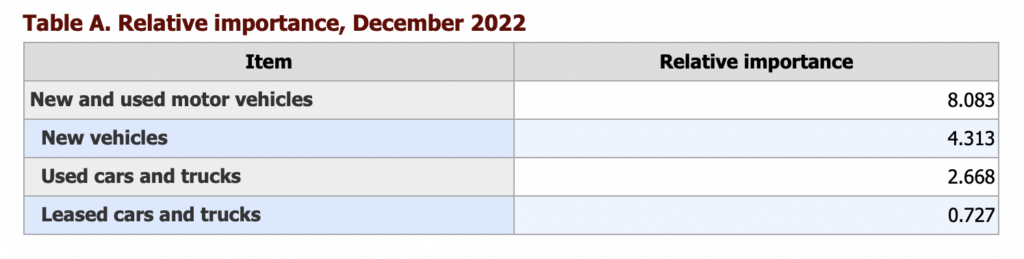

However, with the increase in February 2023 wholesale prices, used car prices have risen an aggregate 7.8% over the last three months. In the Fed’s battle against inflation, this move is not trivial; used car prices comprise about 2.7% of the CPI.

On March 9, the New York Fed released an analysis of the status of one of the Federal Reserve’s favorite inflation reports, the PCE price index. The New York Fed determined that after inputting the most recent (January 2023) data into its Multivariate Core Trend (MCT) in-house model, it now believes that inflationary pressures should be considered much more persistent than it had previously thought. The MCT is a dynamic factor model based on monthly data for the 17 major sectors of the PCE index.

Phrased differently, the aggressive rate hikes the Fed has implemented so far seem not to have significantly reduced the overall price pressures in the economy. The MCT has risen over the last two months because the pricing of both core goods and core services, excluding housing components, is rising at too robust a pace.

Both the used car pricing data point and the New York Fed analysis seem to reinforce the comments made by Fed Chairman Powell in his Congressional testimony this week. The Fed’s fight to quell inflation will require more action and more time than many investors expect.

Information for this briefing was found via Edgar and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.