Earlier this month Canaccord initiated coverage on Verano Holdings (CSE: VRNO) with a C$35 price target and a speculative buy rating. Matt Bottomley summarizes the qualities of Verano with this line, “Verano is currently the leading cannabis brand by market share in its home state of Illinois. It has amassed a national footprint that now has more than 60 active dispensaries (pro forma) spanning 11 markets and wholesale penetration into a further ~350 locations throughout the US.”

Canaccord becomes the fourth analyst to initiate on Verano, the only analyst who has a higher 12-month price target is ATB Capital Markets with a C$42 price target. One analyst has a strong buy rating while the other three have buy ratings on the company.

Bottomley believes that Verano can hold a >15% market share in Illinois, which is expected to be a $3.5 billion market over the long term. They currently have eight dispensaries in the state but have the other two licenses to get to the 10 dispensary cap. Verano is also the number one wholesaler with their products in almost every single dispensary and is in the top three for market share by retail dollars.

Bottomley says that Verano holds one of only twelve vertically integrated licenses in New Jersey which they estimate will become a $2.5 billion market in the long term. Bottomley writes, “We believe license holders with operations up and running, such as Verano, are positioned to generate substantial top-line contributions upon the commencement of recreational sales in New Jersey (expected in H2/2021).”

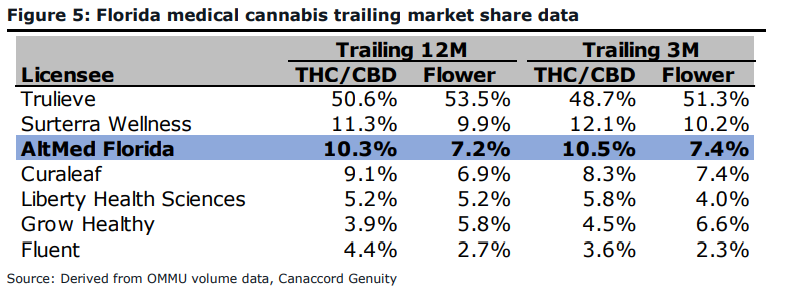

Onto Verano’s operations in Florida thanks to their reverse takeover of AltMed. Bottomley writes, “We believe Florida represents the most attractive medical cannabis market in the US today. We estimate that as of the end of 2020, the state was operating at a total sales run rate of close to ~US$1.3B,” with his long-term run rate pegged at >$5 billion if recreational cannabis becomes legal. AltMed has 31 retail stores, which makes it the fourth-largest company by store count but is battling it out with two other companies for the number two market share in the state.

He wraps up the state breakdown by writing, “we believe Verano is currently operating with one of the more attractive portfolios of assets in the US cannabis industry today.”

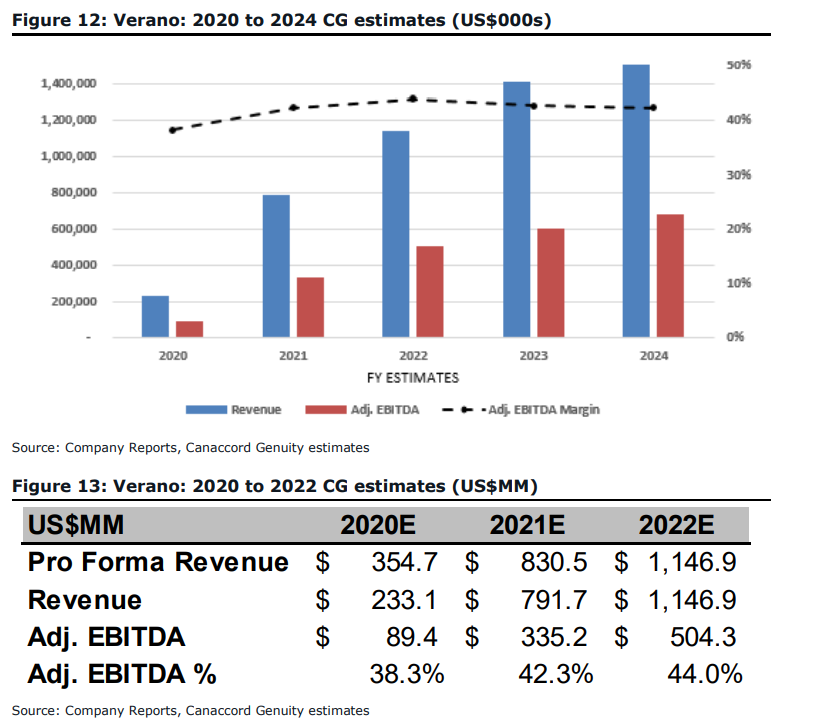

Below you can see Canaccord’s 2020 through 2022 estimates. Most notably is that Verano is trading below their peers at a 12x 2020 EV/EBITDA estimate, while the peer group trades at roughly 14x. Bottomley writes, “With a portfolio of assets that we believe can compete with the leaders in the space, we believe VRNO could see notable upside by re-rating closer to the leading MSO peer average.”

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.