Verde Agritech (TSX: NPK) is expected to have a rough day in the market today after reporting fiscal 2022 results that failed to meet guidance figures in a substantial way. Revenue fell short of the most recent guidance by 26%, with the company blaming several factors on the shortfall.

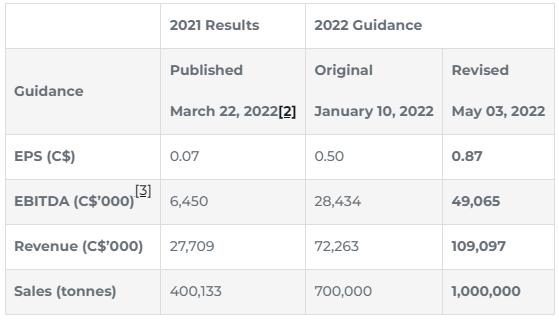

Revenue in 2022 amounted to $80.3 million for Verde, a Brazil-based potash producer, which equates to a 190% increase over the prior year. The problem, however, is that guidance issued in May 2022 called for the company to have revenue of $109.1 million for the full fiscal year, after having previously guided to a figure of $72.3 million.

The company, naturally, glossed over this failure to meet guidance in its earnings release, instead opting to state how great of a year it was.

“We are proud to now be Brazil’s largest potash producer by capacity, with an installed capacity of 3 million tonnes per year. However, our ambitions do not stop here. We are determined to continue growing and reach our goal of producing 50Mtpy as outlined in our PFS,” commented CEO Cristiano Veloso, CEO of Verde.

The guidance originally issued for 2022 was released prior to the onset of the Russia-Ukraine war. One impact of the war, as Verde highlights, is that it was expected to “cause significant shortage of potash fertilizers,” which lead to a dramatic 154% surge in the price of potash, leading to an increase in the firms guidance. Instead however the surging price lead to a glut of potash, and a 15% drop in potash consumption in Brazil.

“When the war in Ukraine broke out, there were concerns about a potential shortage of potash. In reality, however, the market was oversupplied. Throughout 2022, many farmers refrained from buying potash due to the unprecedented soaring prices, resulting in a 15% Brazilian potash imports and, consequently, a record inventory build-up,” commented Veloso.

Verde specifically is also said to have been impacted by cancelled orders during its peak season due to halting the sale of product due to groundwater issues impacting road construction.

In an attempt to throw anything at the wall that just might stick, the company also blamed elections in the country that “brought additional challenges to farmers’ purchasing decisions,” then went on a tangent related to Brazilian interest rates due to new government policies, before blaming adverse climate conditions that impacted the coffee sector for the second year in a row, leading to reduced fertilizer usage.

Despite these excuse, the company managed to report total sales of 628,000 tonnes of potash, a 57% increase over the prior year. Sales as a result improved from $27.7 million to $80.3 million, a 190% increase.

For the full fiscal year, Verde posted a net profit of $17.8 million, versus $3.5 million in 2021, while EPS grew from $0.07 to $0.34, a 386% increase. EBITDA meanwhile grew 271% to $23.9 million.

For 2023, Verde is being more conservative in its estimates, calling for sales of 800,000 to 1,200,000 tonnes of potash, and revenue between $78.1 and $115.3 million. EBITDA meanwhile is expected to be essentially flat or declining, with estimates calling for $9.3 to $24.6 million. Earnings per share meanwhile is slated to be between $0.04 and $0.29.

Verde Agritech last traded at $5.28 on the TSX.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.