Vietnamese automaker VinFast (Nasdaq: VFS) finds itself facing mounting challenges as it struggles to materialize its ambitious plans amid burgeoning investments in the electric vehicle sector. Amidst concerns about its global expansion strategy and internal operations, the company’s much-anticipated North Carolina factory project has hit significant roadblocks, casting doubt on its ability to deliver on its promises.

Research agency Hunterbrook Media dug deep on the EV maker and its factory project in particular, noting that “little progress is visible” at the site and that “no construction workers were present” when its reporter visited last February.

What’s going on with Vinfast?

— OSINTtechnical (@Osinttechnical) April 22, 2024

Our wide-ranging investigation into the Vietnamese EV manufacturer relied on satellite imagery, AIS data, trade records, and on-the-ground reporting in multiple U.S. states and continents. pic.twitter.com/IiUFMYLofh

The groundbreaking ceremony last July was marked by fanfare and high hopes as VinFast announced plans to establish a manufacturing hub in North Carolina, backed by a $4 billion investment pledge and the promise of creating 7,500 jobs over five years.

“This VinFast factory will create thousands of good-paying jobs in our state,” said Roy Cooper, North Carolina’s governor, at the groundbreaking. Upon the initial unveiling of the factory plans in March 2022, President Joe Biden took to Twitter to commend VinFast’s choice to establish electric vehicle manufacturing operations in North Carolina, hailing it as “the latest example of my economic strategy at work.”

“No construction is being done”

However, more than two years later, progress at the site, spanning roughly 1,800 acres, has been sluggish, with little visible advancement beyond partial foundation work.

While VinFast’s North Carolina factory struggles to make headway, a stark contrast emerges just 300 miles southwest, where Hyundai is swiftly advancing with its $7.6 billion facility in Ellabell, Georgia, despite both projects being announced around the same time.

Source: Hunterbrook Media

In response to inquiries, a VinFast spokesperson maintained optimism, stating that progress continues on their proposed manufacturing site, with plans to “complete principal construction on the site before the end of 2025.”

However, recent statements from county officials suggest otherwise, with a spokesperson for Chatham County confirming that “no construction is being done.” Following scrutiny from the Raleigh News & Observer, which highlighted the lack of progress using drone imagery, VinFast submitted a new construction plan to Chatham County.

In stark contrast, Hyundai’s Ellabell facility, covering 2,900 acres, boasts steel beams and structures taking shape, with exterior wall panels already in place, according to reports from the Associated Press.

The North Carolina plant, initially touted to boost production by an additional 150,000 vehicles, faces challenges amid sluggish sales in the United States. Despite shipping over 3,000 cars to the US, only 265 have been sold, prompting VinFast to resort to a “death spiral of discounts” to stimulate demand, according to Jalopnik blogger Tom McParland.

Dismal demand

Alongside the North Carolina factory, the company announced a $2 billion plant in India and a $2.1 billion investment to establish a foothold in Indonesia. However, a comprehensive investigation by Hunterbrook Media, spanning various data sources and on-the-ground reporting across multiple continents, has revealed significant uncertainties surrounding the company’s prospects.

VinFast’s performance at its central manufacturing facility in Hai Phong fell short of expectations, with deliveries amounting to just 12% of its production capacity. Moreover, a substantial portion of these deliveries were directed to entities affiliated with VinFast’s CEO Pham Nhat Vuong, raising concerns about the company’s sales strategy and revenue sources.

VinFast has encountered significant challenges in selling vehicles outside of its home market in Vietnam. Despite shipping 3,118 electric vehicles to the United States in the previous year, only 265 VinFast vehicles were officially registered across the country in 2023, as indicated by an S&P report. A recent visit by Hunterbrook Media to the California port terminal, where VinFast’s cars are offloaded in the United States, revealed that hundreds of vehicles remained parked months after the last shipment arrived, with no new shipments recorded since then, according to AIS data.

Source: Hunterbrook Media

Moreover, VinFast’s expansion plans beyond the United States appear to be lagging behind schedule. While Canada was the sole country outside of Vietnam and the U.S. where VinFast reported sales in 2023, generating total revenue of $24.2 million, the company has faced delays in its European expansion efforts. Despite announcing plans to deliver 3,000 vehicles to Europe in 2023, VinFast has only made its first shipment to the continent this year, indicating a significant shortfall from its initial targets.

Furthermore, VinFast’s plans to establish showrooms both in the United States and Europe have fallen short of expectations. In California, where the company aimed to have 30 showrooms operational by the end of 2022, only 17 are currently open as of April. Similarly, in Europe, where VinFast planned to set up 50 retail outlets across Germany, France, and the Netherlands, progress has been slow, with 13 outlets operational thus far.

VinFast’s struggles are emblematic of broader industry challenges, including slowing demand in key markets and intensified competition. Established players like Tesla and legacy automakers like Ford are grappling with similar issues, while newcomers like Fisker Inc. and Rivian face their own hurdles.

VinFast’s rollercoaster journey in the financial markets also reflects its tumultuous trajectory. Initially buoyed by a high-profile listing on Nasdaq through a special purpose acquisition company, the company’s stock soared before plummeting by over 95%.

Despite these setbacks, VinFast remains resolute in its ambitions, doubling down on its expansion plans and aiming for exponential growth in the coming years.

The company has announced plans to distribute 100,000 vehicles globally in 2024, surpassing its 2023 sales figures twofold, and simultaneously intends to expand its presence to 50 countries. VinFast anticipates selling 750,000 cars annually by 2026, with the North Carolina factory playing a pivotal role in achieving this ambitious target.

Buy your own

VinFast’s journey is intricately tied to the vision and entrepreneurial spirit of its founder, Pham Nhat Vuong, who rose to prominence as Vietnam’s inaugural billionaire in 2013 through his successful ventures in real estate development. Under Vuong’s leadership, Vingroup, his conglomerate, has flourished across diverse sectors, extending its reach from education to healthcare, solidifying its status as a household name in Vietnam.

In 2017, Vingroup made a significant foray into the automotive industry, with Vuong spearheading an ambitious endeavor to establish VinFast. Over the ensuing years, the company, under Vuong’s stewardship, has committed over $11 billion to develop VinFast into a prominent player in the global automotive arena.

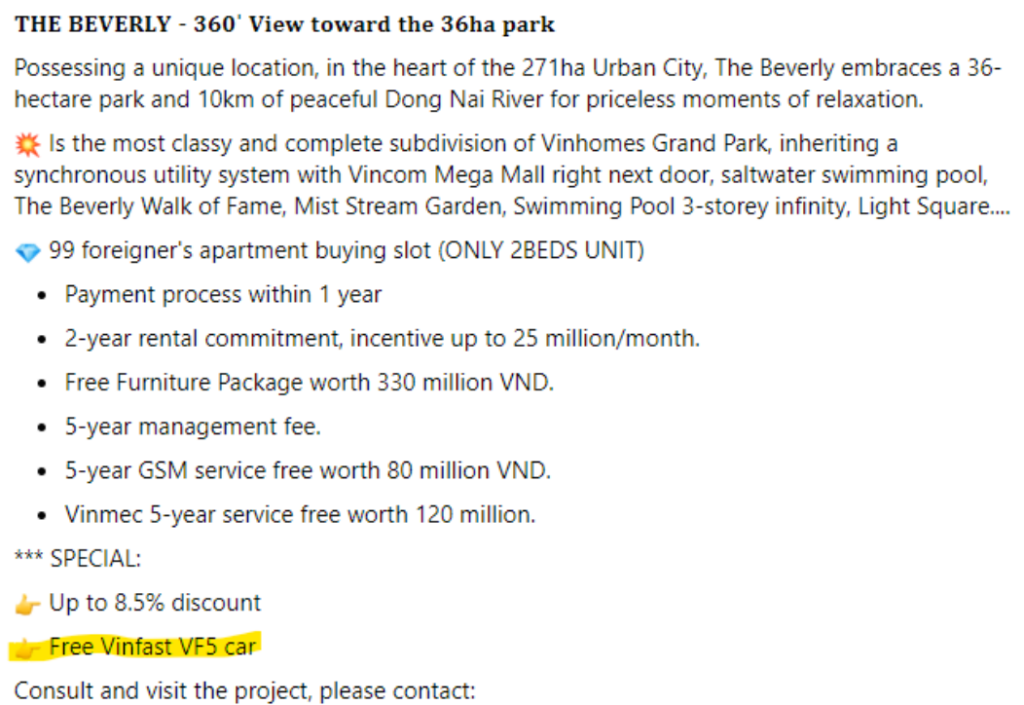

Notably, two of VinFast’s major clients, electric taxi firm Green and Smart Mobility (GSM), and real estate giant Vinhomes, are either owned or affiliated with Vuong or Vingroup. While GSM, predominantly owned by Vuong, played a pivotal role in driving VinFast’s sales last year, garnering scrutiny over their close association, Vinhomes’ contribution to VinFast’s revenue remained largely unnoticed until a recent investigation shed light on their significant role. EV sales to Vinhomes customers accounted for approximately 14% of VinFast’s 2023 revenue, as disclosed in a March SEC filing.

Vinhomes’ initiatives to incentivize its customers, such as offering complimentary VinFast cars to new homeowners and providing five years of free taxi services through GSM, further underscore the interconnectedness of VinFast’s ecosystem within the Vingroup network.

Source: Hunterbrook Media

Despite VinFast’s claims of robust revenue growth, largely propelled by a staggering 374% surge in total EV sales from the previous year, Hunterbrook Media’s analysis reveals that the sales increase to buyers outside of Vuong-affiliated entities was only 33%, indicating potential challenges in diversifying its customer base. In the first quarter of 2024, VinFast reported a decline in EV deliveries, with over half of the deliveries directed to other Vingroup companies.

Paying reporters

VinFast’s entry into the American automotive market has been marred by scathing reviews from prominent media outlets. Publications such as Motortrend, Road & Track, and Inside EVs criticized various aspects of VinFast’s vehicles, highlighting issues ranging from malfunctioning turn signals to unsettling suspension performance, as reported in a compilation by Jalopnik.

In an attempt to curry favor with the automotive press, VinFast resorted to unconventional tactics. Prior to the onslaught of negative reviews, the company offered journalists in the United States $100 prepaid debit cards for test-driving their vehicles. Additionally, VinFast extended invitations to journalists for expenses-paid trips to Vietnam, accompanied by substantial monetary compensation.

However, such gestures were met with skepticism, with auto podcaster Matt Farah dismissing the offer as dubious.

“Of course not, that sounds fucking shady,” he said.

According to industry expert Tu Le, VinFast’s hastened expansion efforts, particularly in the United States, represent a series of critical missteps.

“Trying to sell the first set of EVs they’d ever built from the Hai Phong factory before they could dial in the quality and reliability was a major mistake,” Le explained. “They’d invited a gaggle of journos to Vietnam to visit and test drive their vehicles. Most journos were not impressed. That should’ve been an indication that they should slow down and get things right.”

In response to initial criticism, VinFast claims to have implemented several improvements to its vehicles, resulting in marginally better reviews. The company asserted that “as a relatively new brand, we highly value market feedback and suggestions, and we are fully committed to delivering exceptional products and services.”

However, Vinfast’s control of its publicity is not without issues. In 2021, the company drew criticism for reporting a customer to the police over allegedly “untrue” comments made on YouTube, resulting in the removal of the video in question.

In December 2023, Sonnie Tran, a vocal critic of VinFast, was reportedly detained and subjected to a lengthy interrogation by Vietnamese law enforcement, during which his electronic devices were seized.

Further raising concerns, local outlets in Vietnam reported on an internal combustion vehicle bearing the VinFast logo catching fire outside a courthouse in Hanoi. Although these reports were swiftly removed from Vietnamese websites, footage of the incident circulated on social media platforms.

In February, a blogger posted a video on YouTube of a giant field in Thái Nguyên, filled with hundreds of idle blue Vinfast vehicles that appeared to belong to GSM.

— OSINTtechnical (@Osinttechnical) April 22, 2024

The video was quickly taken down, but we had a single good screenshot. pic.twitter.com/PXIJwVhKZo

In another alarming development, a Vietnamese blogger uploaded a video to YouTube showcasing a vast field in Thái Nguyên filled with hundreds of VinFast vehicles, purportedly belonging to GSM. The vehicles, covered in dust and surrounded by weeds, suggested neglect and raised questions about VinFast’s management of its fleet.

Following the removal of the video from YouTube, Hunterbrook Media, in collaboration with the Bellingcat geolocation community, conducted an investigation to locate the site featured in the video. Their findings revealed multiple sites where vehicles sold to GSM, including taxis, appeared to have been parked for extended periods. Satellite imagery corroborated the presence of GSM-owned VinFast vehicles at these locations.

Multiple lawsuits

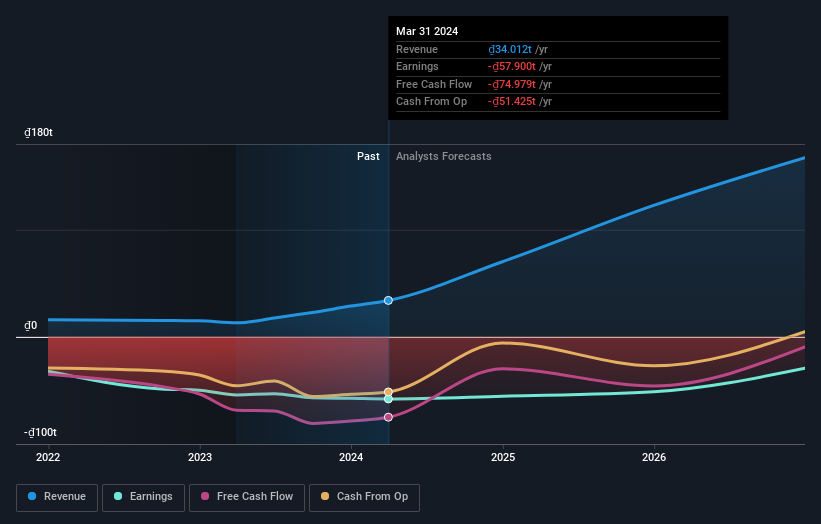

VinFast recently reported its quarterly earnings, and it wasn’t great news for shareholders. Revenues fell short of expectations by 29%, while losses were slightly higher than predicted. Looking ahead, analysts are forecasting a significant improvement in revenue for 2024, with a projected 106% increase compared to the previous year. However, they also expect losses to decrease only slightly.

Despite the revenue increase, the average price target for VinFast Auto’s stock dropped by 19%, indicating concerns about the higher expected losses.

At least four law firms have been calling on VinFast shareholders to initiate class action lawsuits against the carmaker, alleging securities fraud. The lawsuits claim that VinFast misled investors between August 15, 2023–the day VinFast debuted on Nasdaq through a blank check firm–and January 17, 2024, by overstating its financial health and growth prospects.

They argue that VinFast lacked the capital to execute its growth strategy and failed to meet its delivery targets for electric vehicles. The lawsuits highlight VinFast’s failure to meet its stated delivery targets, which resulted in a significant decline in its share price.

Information for this briefing was found via Hunterbrook Media and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.