It’s been a pretty busy month for Vintage Wine Estates (NASDAQ: VWE), a SPAC that was initially listed to go after the large U.S cannabis sector but pivoted to wine after a few months of searching. Following the go-public, two analysts upgraded their 12-month price target and then another analyst initiated coverage on the stock this week, bringing the 12-month consensus price target to $16.33, or a 38% upside.

Canaccord, the most recent firm to cover Vintage Wine, has the street high at a $17 price target while D. A Davidson has the lowest target at $16. In Canaccord’s initiation report, they say that premium wine is the next secular trend and “that will lead to material margin expansion and free cash flow generation.”

Canaccord expects the premium wine segment, which is any bottle above $10, to see a 6% compound annual growth rate for at least the next two years, bringing the total addressable market of the premium wine segment to $15.6 billion. They believe that 2020/COVID-19 has been seen the consumer shift towards a more premium brand “as more customers shift their alcohol dollars toward wine consumption at home.” Premium bottles are 99% of Vintage Wine’s case volume during 2020.

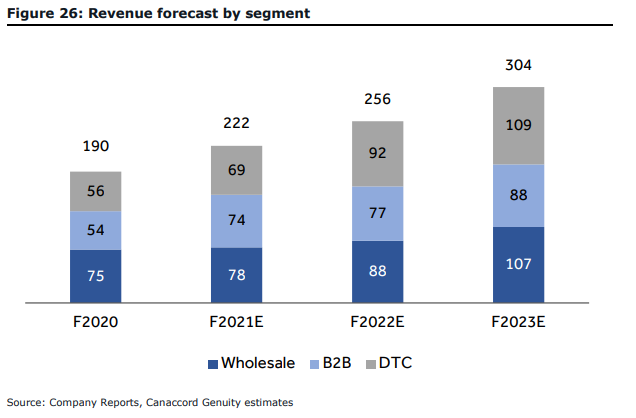

Due to this tailwind, Canaccord expects Vintage Wine’s revenue to grow from $190 million in 2020 to $304 million in 2023, with all three categories seeing significant year-over-year growth. One of the main reasons for the growth comes from Vintage’s “best-in-class e-commerce platforms,” which will help the consumer segment. For the business-to-business segment, they believe Vintage to be the ideal partner “for retailers looking to develop private label wine brands.”

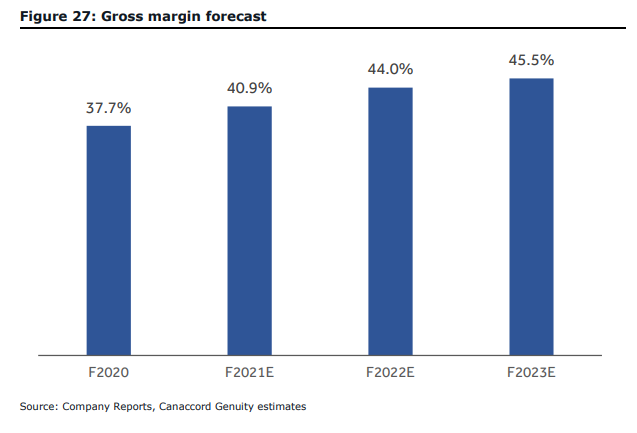

Due to all revenue segments growing, Canaccord believes that there will be organic margin growth. They expect gross margin to rise from 37.7% in 2020 to 45.5% in 2023. This is because direct to consumer will represent a larger part of the revenue, which offers significantly higher gross margins at roughly 60%, compared to the wholesale or business to business segments which offer 40% and 30%, respectively.

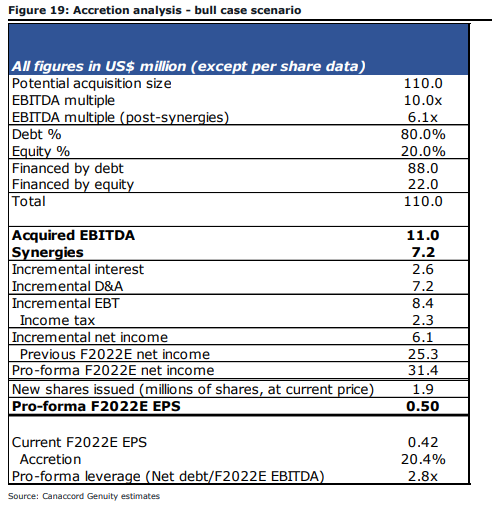

Below you can see the bull case scenario, wherein management doubles its pace of acquisitions now that it has completed its de-SPACing and has roughly $280 million. Of that $280 million, they expect $110 million to go towards M&A.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.