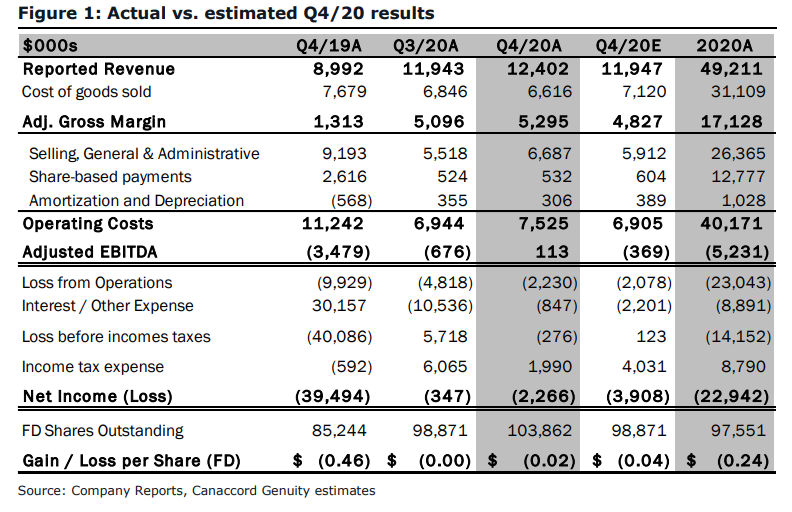

Last week, Vireo Health (CSE: VREO) released their fourth quarter and year-end 2020 financial results. The company recorded total GAAP revenue of $12.4 million and $49.2 million, a 38% and 64% increase for the fourth quarter and year-end respectively. Most notably, the company had reported its first quarter of breakeven adjusted EBITDA.

Vireo Health currently has three analysts covering the company with a weighted 12-month price target of C$3.69. One analyst has a strong buy rating, while the others have buy ratings. The street high comes from M Partners with a C$5.25 price target.

Canaccord Genuity reiterated their C$4 price target and speculative buy rating on the company. Matt Bottomley, their analyst, headlines, “Q4/20 review: An in-line print while near-term growth drivers remain somewhat muted.”

Vireo’s quarterly numbers came in slightly below Canaccord’s estimates. The main reason for the slight miss was due to Vireo’s underperformance in their key states of Minnesota and New York. Bottomley writes that the restrictive nature of the medical markets in these states contributed to the low quarter-over-quarter growth. He adds, “we believe VREO still has an attractive long-term growth profile; however, given the somewhat restrictive nature of its core markets, we believe near-term QoQ growth will remain limited.”

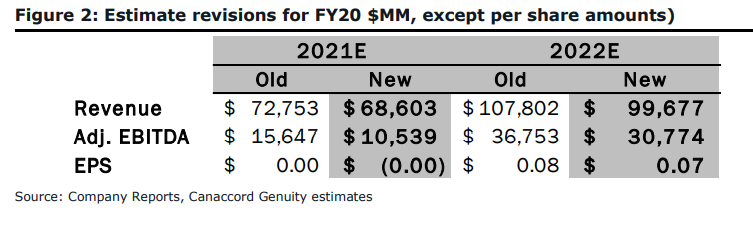

Bottomley has lowered their near-term forecasts as they are forecasting a slower revenue acceleration in Minnesota and New York. Below you can see their new estimates.

M Partners meanwhile raised their 12-month price target on Vireo from C$3 to C$5.25 and reiterates their buy rating. Paul Piotrowski, M Partners’ analyst, headlines, “Q4 Results – Outlook Stronger Than Ever With NY Rec Imminent.”

Once more, Vireo’s quarterly numbers came in slightly below their estimates. M Partners forecasted $13.6 million and $5.7 million in revenue and gross profit respectively. Piotrowski writes, “VREO’s NY business is likely to generate upwards of $100M/year in sales and adds at least $270M in EV (or $2/share).”

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.