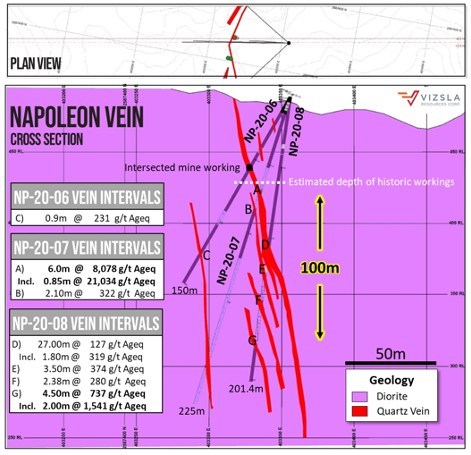

Vizsla Resources Corp (TSXV: VZLA) this morning released further assay results for the Napolean Vein Corridor at its Panuco silver-gold project located in Mexico. Highlights from the latest round of drilling include 1,541 g/t silver equivalent over 2.0 metres, as well as 261 g/t silver equivalent over 22.6 metres from two separate holes.

A total of sixteen holes have been completed to date within the current drill program on the Napolean vein, with the company releasing results from three holes this morning.

The first hole released by the company this morning, hole NP-20-08, was drilled to a depth of over 177 metres, and found mineralization at multiple depths. Highlights from this hole include 1,540.8 g/t silver equivalent over 2.0 metres at a depth of 175 metres, within 737.3 g/t silver equivalent over 4.5 metres at 173.50 metres depth. Mineralization in this hole also included 127.3 g/t silver equivalent over 27.0 metres at 103.50 metres of depth and 108.6 g/t silver equivalent over 8.5 metres at 143 metres of depth.

Hole NP-20-09 found mineralization of 1,227.9 g/t silver equivalent over 1.0 metre, which was within a wider intersect of 260.7 g/t silver equivalent over 22.6 metres at a depth of 68.0 metres.

The final hole released, NP-20-10, saw 314.1 g/t silver equivalent over 1.7 metres, within a wider intersect of 179.1 g/t silver over 3.4 metres at 72.55 metres of depth.

The current region being drilled is said to be located “almost entirely” on concessions that have been optioned by the company that Vizsla currently has the rights to purchase 100% of. Included on the concessions is a 500 tonne per day mill, a tailings facility, permits, roads, and power, which the company can acquire all for $23 million. In the interim Vizsla intends to continue with exploration on the property.

Vizsla Resources last traded at $2.61 on the TSX Venture.

Information for this briefing was found via Sedar, and Vizsla Resources. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

Can WallStreetBets Push Silver Higher? – The Daily Dive feat John-Mark Staude

Returning to the Daily Dive is frequent guest John-Mark Staude, whom is CEO of Riverside...