How much in incentives does it take for Canada to draw major automakers to build manufacturing facilities in the country? Lately, about $13.7 billion, based on what the nation has reportedly provided Volkswagen AG in grants and subsidies to build their new North American battery plant.

And that’s just from the Feds. The government source that provided the data on Thursday indicated that funds could also be provided by the Ontario government, which was later confirmed on Friday. The Ontario government is expected to provide a further $500 million in up-front capital costs. The cash giveaway was said to largely match what was being offered by the United States under its Inflation Reduction Act.

The subsidies and grants are said to be distributed over a ten year period.

“The payback is five years. That’s a very good investment. Talk to any banker, he would say ‘if you get your money in five years, for a plan that’s going to be there for 100 years, that’s a pretty good deal for Canadians,'” commented Canadian industry minister Francois-Philippe Champagne on Thursday.

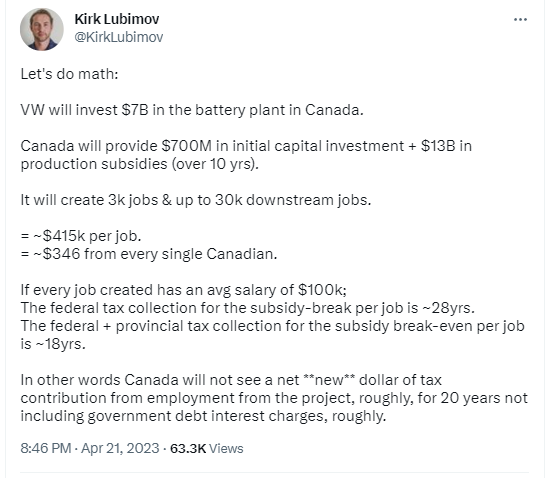

Funding from the Feds is said to consist of an initial capital investment of $700 million, with the remaining $13 billion provided by the Federal government to be issued as ongoing production subsidies. The contract is said to include a clause that the subsidy will be issued so long as the Inflation Reduction Act in the US remains in place.

Automotive Parts Manufacturers Association president Flavio Volpe meanwhile commented that he estimates the funding will provide between $100 and $200 billion in economic activity over the next ten years.

The plant is expected to employ 3,000 workers, with Champagne on Thursday also working to further justify the major subsidies by highlighting it will also result in trickle-down job creation. Trickle down job creation is estimated at 30,000.

Notably, these numbers are at issue with estimated provided in March, which suggested the plant would employ 2,500 people directly. At the time Volpe also estimated that up to 7,500 indirect jobs would be created by the plant.

By the numbers

While these figures are good and well, are they actually attainable?

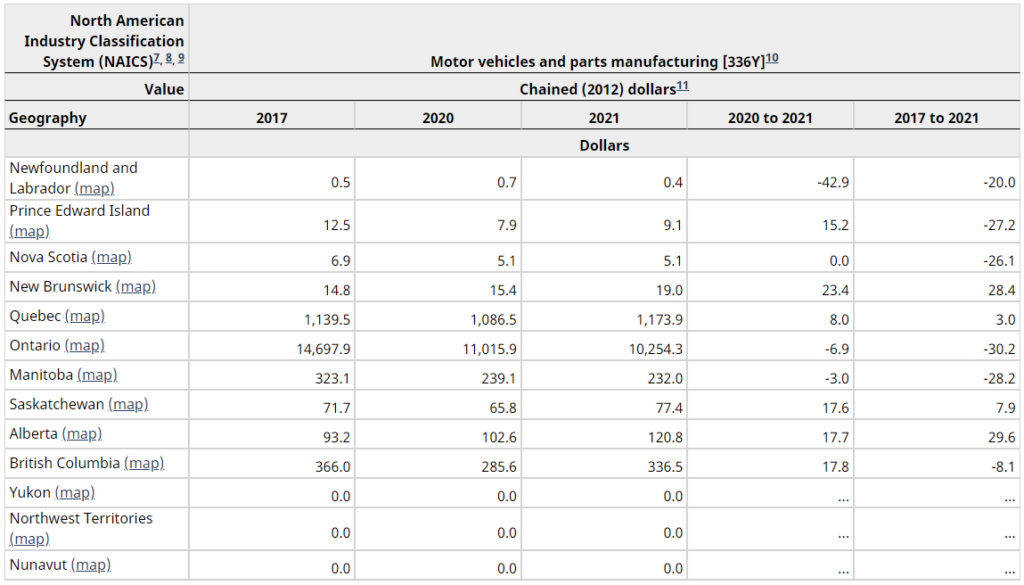

To put things into perspective, as per Statistics Canada, the motor vehicle and parts manufacturing sector in 2021 had a GDP of just $10.3 billion – or roughly 75% of the total figure that just the Federal government has committed to provide to Volkswagen, before any commitments from Ontario are factored in. In fact, in 2021, the sector across all of Canada garnered just $12.2 billion in GDP.

The sector in 2019 (to exclude any impact of the pandemic) generated $14.3 billion in GDP for Ontario, and $16.5 billion for the entire nation. Yes, these figures may not include trickle-down impacts on other sectors, but at the very least it puts into context just how large the commitment is relative to the industry.

“Let’s be really clear about what’s happening today. Other parts of the world, including our neighbours to the south, were willing to put up an awful lot of money to get this project there. Everyone wanted this, so yes, we put up a lot of money. Money that’s going to come back in economic investments very quickly,” commented Prime Minister Justin Trudeau on Friday.

Others are not so sure on the economic value.

The plant itself is slated to have a manufacturing capacity of 90 gigawatt hours, which translates to enough battery power for approximately one million vehicles annually. It’s expected that the plant will cost an estimated $7.0 billion to build (meaning Canadian governments are paying about 17% of development costs), with the facility to be located in St. Thomas, Ontario.

Production from the plant is slated to occur in 2027.

Information for this briefing was found via StatCan, Reuters, Glove and Mail, Financial Post, Twitter, and the sources mentioned or linked. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.