Vox Royalty (TSX: VOXR) has entered into an arrangement to acquire a portfolio of ten gold offtake and royalty assets from a subsidiary of Deterra Royalties in a deal that the company is defining as “transformational.”

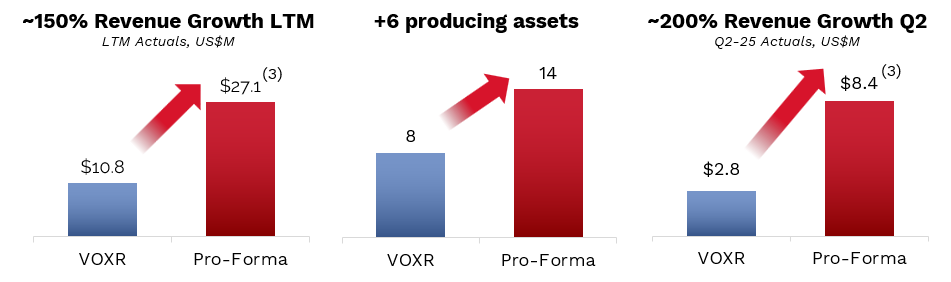

The arrangement will see Vox obtain royalties or offtake arrangements that cover twelve mines and projects across a total of eight jurisdictions. The deal is said to be immediately accretive on a revenue per share, cash flow per share, and net asset value per share basis.

The portfolio being acquired generated a total of $5.6 million in revenue for the quarter ended June 30, while trailing twelve month revenue sits at $16.3 million, resulting in expected revenue growth of 150% for Vox. The portfolio is said to provide access to over 300,000 ounces of gold per year, with fiscal year 2025, ended June 30, 2025, said to have resulted in 338,000 delivered ounces, with average margins of $63.10 an ounce.

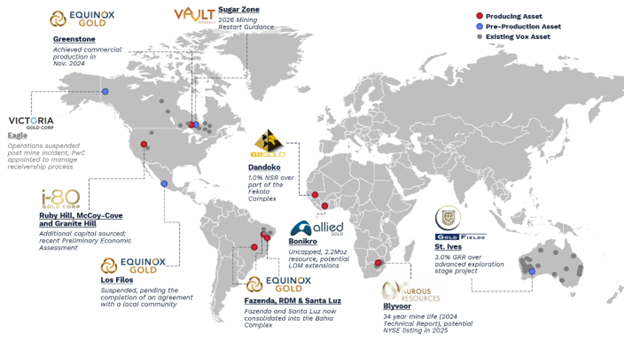

Assets involved in the transaction include Equinox’s Greenstone, Los Filos, Fazenda, RDM and Santa Luz mines, Allied Gold’s Bonikro mine, B2Gold’s Dandoko mine, and i-80 Gold’s Ruby Hill, Cove, and Granite Creek mine among other assets.

“We are excited to announce this highly accretive gold portfolio transaction that is expected to grow revenue per share by over 100%, expand our producing asset count to 14, and expand our large-cap operator exposure. The Portfolio revenue is entirely gold-related and based on Q2-2025 actuals, pro-forma revenue related to gold exceeded 80%, which is expected to accelerate our potential inclusion on the GDXJ index in 2026. This Transaction is consistent with our disciplined strategy of buying highly accretive legacy assets with exceptional long-term optionality,” commented Kyle Floyd, CEO of Vox Royalty.

Consideration under the offering amounts to $57.5 million in cash and $2.5 million in deferred milestones. The transaction is expected to be funded by an overnight marketed offering that is expected to raise gross proceeds of up to $55 million at $3.70 per share. Vox has also upsized their secured revolving credit facility with BMO by $40 million which is to be used to fund offtake purchases from the portfolio.

Vox Royalty last traded at $5.33 on the TSX.

Information for this story was found via the sources mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.