Sports Illustrated was one of the larger chunks of the ordered, stable publishing galaxy that existed before the Facebook supernova exploded, and spun it all into a chaotic turmoil of space dust that’s still trying to settle. In the mess of people and models and platforms that are still trying to form themselves into planets and systems that fall into orbit around the Meta-cluster at the center of the galaxy, Sports Illustrated remained intact, held together mostly by readership, one of the strongest fundamental forces of this metaphorical galaxy.

That force is and was generated by the talent that produces its content. The other fundamental force at play here, capital, started pulling at it in different directions recently, altering its orbit and credibly threatening to bust it up into smaller pieces that may or may not end up developing atmospheres that can support life, but will assuredly be different in the near term.

The announcement last week that Sports Illustrated would be laying off its staff created a posting storm among sports and news writers who grew up with it. 2024 will be the publication’s 70th anniversary, if it makes it. We’re going to start our story in 2018, when it was bought from Time Inc. by TV conglomerate Meredith Inc. in a $2.8 billion deal backed by the Kochs. Meredith was more interested in Time’s video properties, so it started selling the print brands off for parts. Sports Illustrated was sold for $110 million to Authentic Brands Group, the type of modern IP company that could have only ever formed in the noxious atmosphere of late-stage capitalism.

Authentic Brands buys the rights to things that are great enough to have a permanent space in our collective consciousness, then works to embed those things deeper, and make them earn more money, thus increasing their value. Some of the authentic brands that are owned or managed by Authentic Brands include Muhammad Ali, AirWalk, Dr. J, Marilyn Monroe, Volcom… and of course Sports Illustrated.

Authentic Brands earns money from licensing brands that they own to partners who can make them earn. Often, that means licensing a mark to retailers of clothing, but it also means licensing the rights to Elvis’ image to a studio that wants to make a movie. The company licensed the Sports Illustrated brand to digital publishing upstart Arena Group Holdings Inc. (NYSEAMERICAN: AREN) for money, and Arena Group went about operating SI as the premier media property in its modern digital publishing enterprise.

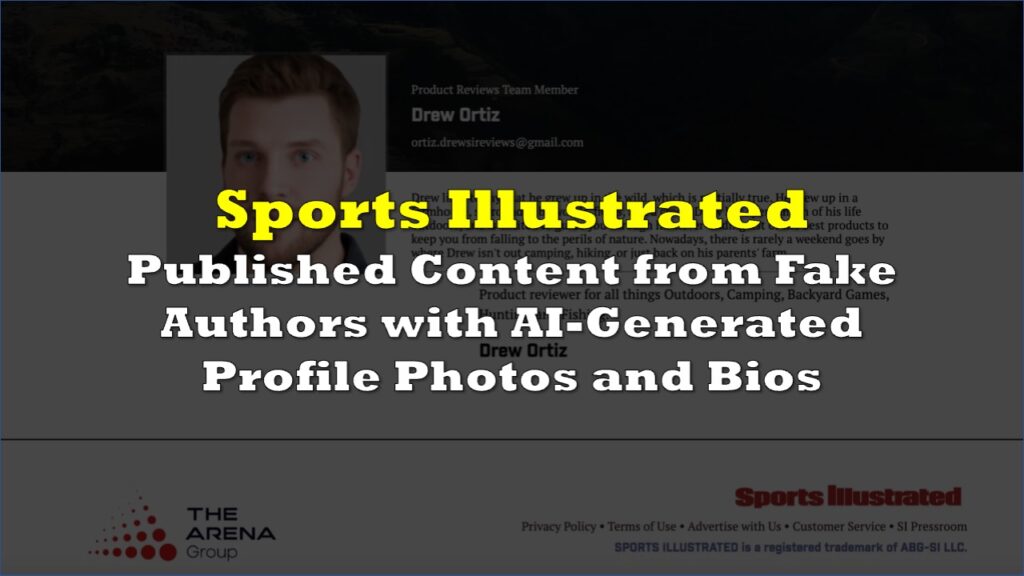

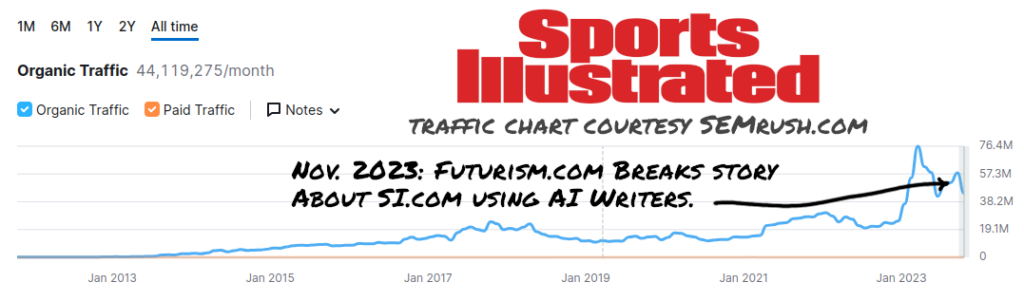

Arena Group operates a unique kind of publishing model that hasn’t yet found business success in content publishing, but it isn’t for lack of trying. The company has built a software stack of sorts that handles content management, SEO, analytics, syndication management… everything a modern digital publication needs.

Ultimately, Arena Group would surely like to license the rights to its software the way Authentic licenses the rights to its brands. It partners with publishers who want to use the system in exchange for a share of the revenue it generates, but that business isn’t yet popular. In most cases, Arena Group operates the publications through its own software and keeps the revenue. Sports Illustrated is its largest and most recognizable in-house brand.

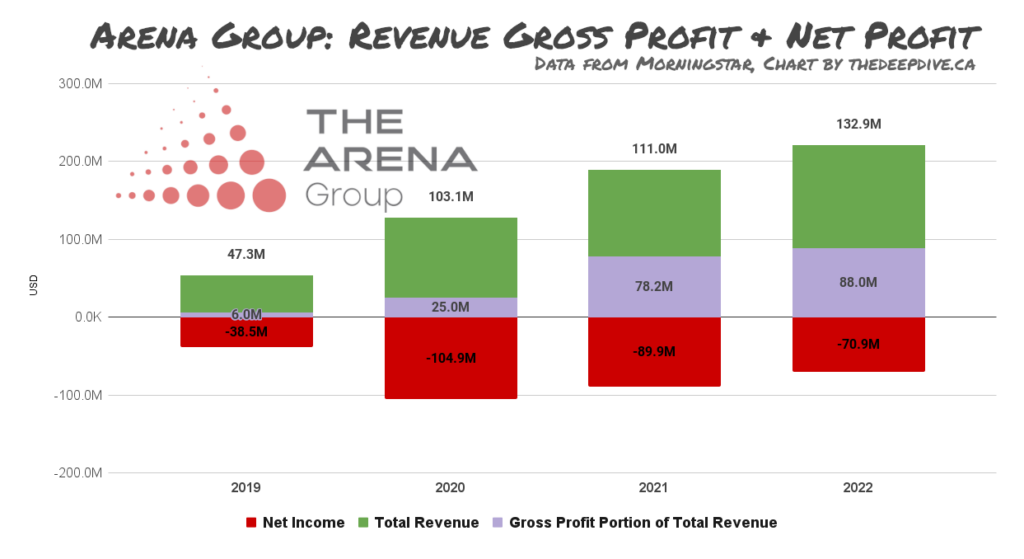

Arena’s business has managed to generate increasing revenue for the past three years, but it hasn’t yet been able to put it on the bottom line. It gets bogged down by the cost of acquisitions, the amortized cost of developing its software, and selling and marketing expenses that are routinely twice the size of its content creation expenses.

Running at a loss tends to erode a company’s balance sheet and cap table by causing it to issue debt and stock to keep the lights on. But the fact that the platform is clearly working on some level (growing revenue, growing readership) makes that beat-up stock attractive to capitalists who see value in the enterprize.

Matt Levine’s Bloomberg Money Stuff column from Jan 23rd has the best and funniest summary of this part of the saga, so we’ll keep our recap to the essentials:

In Summer 2023, with $110 million in debt and a $100 million market cap, Arena Group signed a letter of intent to merge with Simply Inventions LLC, a property of Manoj Bhargava, the founder of 5 Hour Energy.

The original idea was to merge Arena Group with some of Bhargava’s other media properties, invest $50 million in cash and buy $60 million worth of advertising over five years for some of their brands. The LOI was formalized in the form of a merger agreement in November of ’23. It hasn’t closed yet, because these things take time, but the binding deal would give Bhargava’s group a controlling interest in an Arena Group that had $50 million more in cash than it does now.

Less than a month later, Bhargava bought Arena’s $110 million in bonds off of its creditors, who also owned a controlling interest in Arena’s stock, which he also bought at a premium to market. He then made himself the company’s CEO, and appointed his people to Arena board seats previously held by representatives of the company’s former debtors.

So, by mid December, the man America knows best as The 5-Hour-Energy-Guy controlled The Arena Group’s C-suite, capital stock, balance sheet, board of directors, and was in a position to materially adjust the merger agreement he’d signed a month prior any way he liked, including in a way that cancelled the $50 million cash portion that was meant to re-capitalize it. (He hasn’t actually done this yet, but absolutely can).

At the end of September Arena had less than $8 million in cash on hand. From his new position as CEO and primary creditor of a digital media company that’s close to insolvency, Bhagava quit paying the company’s bills; most importantly the bill Authentic Brands sent for the licensing rights to Sports Illustrated.

On January 2nd, when Arena failed to pay its $3.7 million quarterly installment of the $15 million / year licensing fee, Authentic Brands sent a notice of default. The contract stipulates that Arena’s failure to pay gives Authentic Brands the right to terminate the deal, and demand a $45 million fee from Arena which, unless and until Bhargava re-capitalizes it, doesn’t have any money.

This all became news on January 19th, when Arena told the SI staff that they were all out of work. The 92 Arena Group employees who make Sports Illustrated are represented by The Writers’ Guild of New York, and have a freshly ratified collective bargaining agreement that gets them all severance, gets some of them 90 days notice, and may cease to matter if Sports Illustrated becomes a portfolio asset that publishes no content.

It’s a good old fashioned suit vs. suit standoff for the licensing rights to a publication’s title

Assuming the $26.2 million in royalties collected from Arena Group so far is the only rent Authentic Brands has collected from its Sports Illustrated purchase, then even if it gets its $45 million termination fee, it hasn’t yet broke even on its $110 million purchase price. It still owns the considerable photo archive, and all of the archived content, but it’s hard to imagine how the SI brand will be worth anything at all in a future where it isn’t generating regular, relevant sports content.

Authentic Brands’ website represents that it has a burgeoning video production arm, and extensive social media assets, but those look like they’re geared towards making and distributing ads that serve its product brand partners, not creating content that’s meant for general consumption. It isn’t in a position to run a news outlet like Sports Illustrated, and will need Arena Group or a company like it to keep the machine moving as it was.

Bhargava may be betting that he’ll be able to work out a better licensing fee under the threat of Sports Illustrated losing value without a publishing partner, but Authentic Brands CEO Jamie Salter isn’t having it:

“If a company doesn’t pay me, I breach,” the CEO of ABG said in an interview with The Washington Post on Friday, adding that Bhargava has sought to lower the licensing fee. “He’s trying to negotiate with me, and I told him to f— off. He tried to change the agreement. When you sign a deal with us, you live by the deal.”

Ben Strauss, Washington Post

It isn’t clear if either one of these empty suits has considered that any entity that publishes SI in the near term is going to need a staff like the one that just got their walking papers, or that someone’s going to have to answer to the subscribers if it goes away.

There’s still a print version of Sports Illustrated, for which Arena’s books have recorded $60 million worth of unearned subscription revenue, and another $19 million or so in unearned digital subscription revenue, that still needs to be delivered on. It isn’t clear what happens to that already-booked revenue if Arena Group loses the right to publish Sports Illustrated. Subscribers might be happy with something else, or they might want their money back. It won’t be good for the brand, but if Arena Group is ready to soldier forward without the rights to Sports Illustrated, then the damage done to the SI brand by angry subscribers isn’t their problem (but the money they took might be).

This isn’t just any sports content. Sports Illustrated won its spot in media consumers’ hearts because it’s good. It employed the best writers, the best photographers, and made the best content.

Crowdsourcing sports news content has been tried before. If it worked, Bleacher Report and SB Nation would be Sports Illustrated. Staffing a publication with a patchwork masthead of whoever is available has also been tried before. It ends up being early Deadspin, which wasn’t any good, but eventually, once it got settled and developed a pro staff, it became Late Stage Deadspin, which was really good.

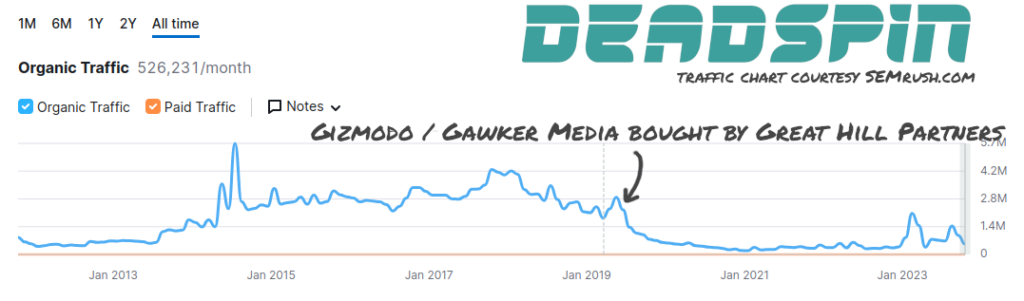

Deadspin was bought with the rest of Gawker Media in 2019 by private equity firm Great Hill Partners, who promptly drove out any writer who could get a better job anywhere else, then fired the rest of them, and effectively ruined the property.

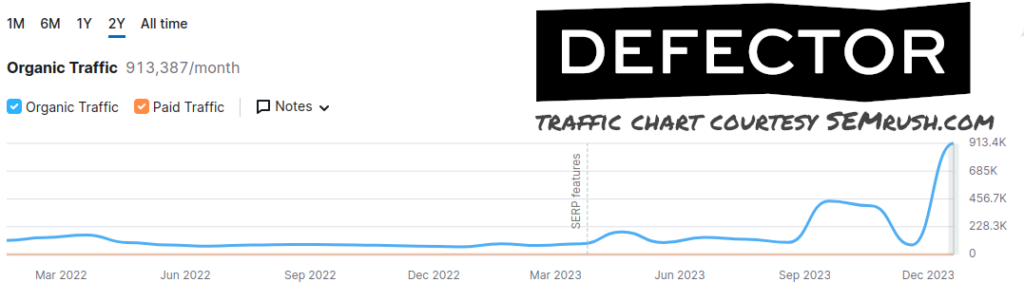

Much of the former Deadspin staff went on to form Defector, one of the better and funnier sports news sites, which operates as a creator-owned enterprise, and answers only to its subscribers. The content is excellent, the staff are happy, and the traffic is headed in the right direction.

After only a couple of years, Defector has eclipsed Deadspin in organic traffic, and are about a third of the way to the 2.8 million monthly readers that Deadspin drew when it was using this team to create its content. The writers and editors, who now work for each other, got there by producing materially the same product that they were producing when they were called Deadspin, and leaving Deadspin‘s new owners to figure out on their own that you can’t just shovel any sports content into the tubes and expect people to come back for more.

No word on if the AI equivalent of Jim Cramer beat real Jim Cramer at picking stocks.

Sports Illustrated has about ten times as many readers as Deadspin did before the suits ruined it which, if you believe in the content being the core of the value, is a potentially-rich silver lining for the Sports Illustrated content team, who deserve better than to have their jobs become collateral damage in a sword-fight between two board rooms over the name and logo.

Information for this story was found via the sources and companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.