Wealthsimple Technologies, a digital financial services provider, is reportedly expanding its services into the private credit sector through a collaboration with alternative fund manager Sagard, allowing retail investors to gain exposure to a market that is typically limited to major financial institutions and Canada’s high-net-worth individuals (HNWIs).

The firm has announced the official launch of Wealthsimple Private Credit, which is characterized as an investment vehicle managed by Sagard’s private credit subsidiary. Adam Vigna, the former Global Head of Principal Credit Investments at the Canada Pension Plan, is leading the charge.

Private Credit is here! Our new private credit fund lets you earn money like an institutional investor: by making loans and collecting interest. For info on the current targeted yield (9%!) and investment requirements (some!), check out the story below.https://t.co/mKNXCx4WqT

— Wealthsimple (@Wealthsimple) March 22, 2023

This is the second private asset fund to its lineup in the last year, following the launch of a venture capital and growth equity fund in April.

Private credit is a method for businesses to raise cash that refers to loans provided directly to businesses by investors.

The firm touts a targeted 9% yield for the private credit product, accounting for the higher risk the investor is going to take, said the executives.

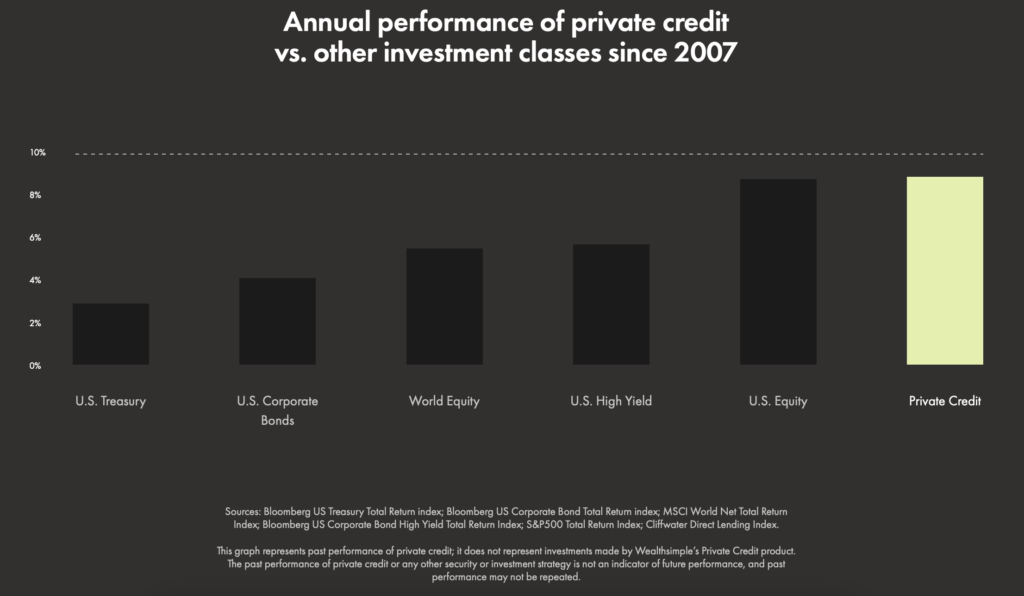

Wealthsimple’s entry into the sector comes after a year of volatile markets and rising interest rates. Some private credit funds experienced significant growth over the last decade, with billions of dollars flowing into firms such as Bridging Finance Inc., Ninepoint Partners LP, and Romspen Investment Corp., whose funds typically paid out attractive 8% yields at a time when interest rates on government bonds and guaranteed investment certificates were near zero.

Yet, once interest rates began to increase rapidly, several managers found themselves in a bind due to a flood of investor redemptions.

However, Vigna, who is also the managing partner and chief investment officer of Montreal-based Sagard, said Sagard was not among the managers that had difficulty and continues to see strong institutional interest in private credit.

According to Wealthsimple’s chief investment officer Ben Reeves, part of the difference when it comes to risk is that Sagard’s private credit portfolio targets companies that they believe can “withstand the current economic environment.”

That means Sagard makes certain that it lends to companies that do not have a lot of debt and that loans are secured against assets that can be used to repay the fund if it defaults.

“We think the fund can perform well at different times than Treasury bonds and equities, which is what constitutes most of Weathsimple’s portfolios,” Reeves said in an interview.

The transition of @Wealthsimple from a robo-adviser touting the virtues of low fees and long term index investing, to crypto clown car, gamified stonk trading, and now humping high fee mediocre VC and private debt to retail in investors, is downright pathetic. @ronmortgageguy https://t.co/trY1P2Ioyb

— Keubiko🇺🇦 (@Keubiko) March 23, 2023

To gain access to the fund, clients must have a minimum of $100,000 in Wealthsimple deposits and make a minimum investment of $10,000 in the fund. Wealthsimple likewise limits private credit investments to 20% of an investor’s portfolio due to the risk involved.

“This investment won’t be for everyone,” says Michael Katchen, chief executive officer of Wealthsimple. “If you can’t take any risk then you may be better suited to a GIC or savings account.”

Vigna said that the opportunity for private credit investors is now higher than it has ever been.

“When we look at what’s going on with like the banks today … what the government will likely do is to continue to increase regulation and that means the banks will naturally have to be more conservative with their lending,” he explained. “And if they’re more conservative with their lending, they’re going to continue to pull back from the market from a lending perspective. So that will result with even more opportunities for private investors like ourselves.”

Information for this briefing was found via The Globe And Mail and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.