WeCommerce (TSXV: WE) reported its fourth quarter and full-year financial results on March 29th, with the company posting quarterly revenues of $12.25 million, up from $6.15 million last year. This was primarily driven by their recurring subscription revenue which grew 229% year over year to $7.35 million for the quarter. Though the company reported an operating loss of $753.9 thousand, while having an EBITDA margin of 67% or $8.24 million this quarter.

For the year the company saw its revenues grow 81% to $38.58 million, once again driven by its recurring subscription revenues, which grew 247% to $22.38 million. The company reported an operating loss of $1.9 million with an EBITDA margin of 33% or $12.59 million. They ended the quarter will a cash balance of $26.12 million.

In Canaccord’s note, they reiterate their buy rating but lower their 12-month price target from C$12 to C$10 while saying “WeCommerce’s valuation does not appear out-of-reach on a rule-of-40 basis.”

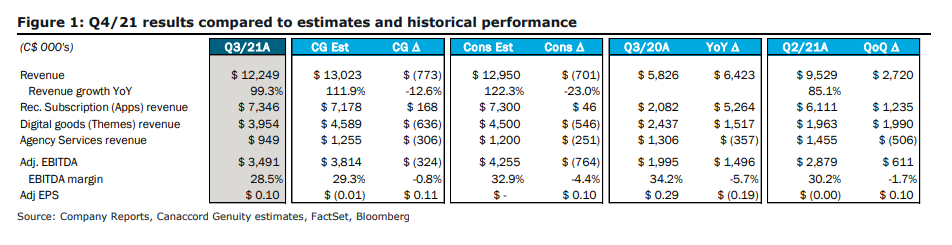

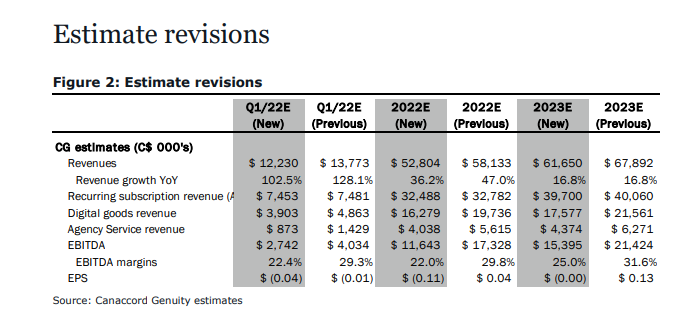

For the fourth quarter results, Canaccord says that the company missed all estimates, primarily due to weakness in its Themes and Agency services. Though going by line item, their Apps revenue grew 240% to $7.3 million, which beat their estimate. They say this beat was due to better than expected results from the Stamped acquisition. Below you can see Canaccord’s breakdown of their estimates going into the quarter.

Next, Canaccord expects to see WeCommerce ramp up its investments, saying that they believe the company will continue its scaling of their most recent acquisition KnoCommerce while continuing the hiring at Stamped. They write, “We believe Archetype’s 50%+ EBITDA margin will support these investments.” Though, they have lowered their EBITDA margin in the near term, cutting their 2022 and 2023 estimates by about 8% each.

Lastly, they note that the company’s M&A pipeline remains robust as the management highlighted that their pipeline has grown to over $100 million in potential additional revenue with talks ongoing, and a slight focus on the Apps side. Canaccord says that they are pleased to hear that multiples have started to look more reasonable and writes, “we expect WeCommerce to remain active on M&A in 2022. WeCommerce management has typically taken a longer-term view with acquisitions.” Though they admit that the company will not likely see another Stamped-like acquisition unless the company taps the capital markets for additional debt.

Below you can see Canaccord’s updated estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.