In March, the US government put in the place the CARES Act – a relief package aimed at supporting both the working class as well as businesses through the economic hardships brought on by the pandemic. Also within the Act, is a mortgage forbearance program which allows individuals to delay their mortgage payments for up to six months at a time, penalty-free.

Now however, Fannie Mae and Freddie Mac, along with the US government are faced with a grim situation: over 3.4 million mortgage holders have entered into forbearance – a much higher number than what was initially anticipated when the program was rolled out back in March.

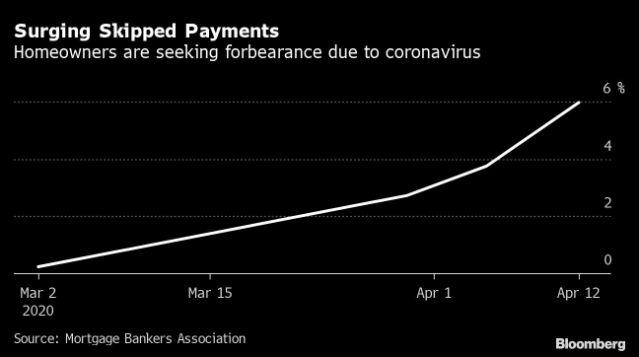

The 3.4 million mortgage borrowers in forbearance account for approximately 6.4% of all outstanding mortgages. Black Knight, which is the firm focused on keeping weekly tallies of mortgage data, has reported the number of new mortgages in the forbearance program has jumped by 9% in just one week, which accounts for an increase of 477,000 loans. All of the mortgages in the forbearance program thus far account for approximately $754 billion in outstanding principal, with 5.6% of those loans backed by Freddie Mac and Fannie Mae, while 8.9% of them are FHA/VA loans.

Even though mortgage borrowers are not making payments, mortgage servicers are still required to make $2.8 billion worth of principal payments on government-backed loans to bondholders. Meanwhile, another $207 billion worth of unpaid principal is not government-backed, and are either held in private-label securities or on bank balance sheets.

Since the economic shutdown in the US, borrowers have only been obligated to make one mortgage payment. Even though Fannie Mae requires servicers to make payments for at least a year, servicers are given a small break and are now only required to make payments for the next 4 months. Loans backed by the Federal Housing Administration have been provided with a liquidity fund to help offset some of the payments that servicers are required to make.

Information for this briefing was found via Bloomberg, CNBC, Black Knight, and Mortgage Bankers Association. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.