Wesdome Gold Mines (TSX: WDO) has unveiled its financial results for the fourth quarter and the year ending December 31, 2023 as it plans for higher production and free cash flow in 2024 and 2025.

“We closed 2023 with a stronger balance sheet and performed well relative to our 2023 operating targets. With the release of our multi-year guidance earlier this year, we are now focused on delivering significantly higher production and free cash flow in 2024 and 2025,” said CEO Anthea Bath.

Wesdome Gold Mines Ltd. announced Q4 and full year 2023 financial results, exceeding production targets with increased cash margins. Plans for higher production and free cash flow in 2024 and 2025, with significant mineral reserve and resource additions. $WDO.TO

— MiningNews (@MiningNewsApp) March 12, 2024

In Q4 2023, the company reported gold production totaling 36,216 ounces, achieving cash costs of C$1,451 per ounce and all-in sustaining costs (AISC) of C$2,082 per ounce. This compares to Q4 2022’s production of 35,116 ounces.

For the full year 2023, gold production reached 123,336 ounces at cash costs of C$1,579 per ounce and AISC of C$2,231 per ounce. These figures surpass the company’s guidance ranges for the year.

The cash margins for Q4 2023 and the full year 2023 amounted to $47.6 million and $132.9 million, respectively. This represents an increase of 80% and 39% compared to the corresponding periods in 2022, primarily attributed to a higher Canadian dollar realized gold price and an increase in ounces sold.

Net income and adjusted net income for Q4 2023 reached $2.4 million (or $0.02 per share), despite a non-cash deferred tax impact of $8.6 million. This is a jump from last year’s net loss of $3.5 million.

Operating cash flow for the quarter and full year 2023 stood at $37.2 million (or $0.25 per share) and $101.4 million (or $0.69 per share), respectively, marking substantial increases of 262% and 55% over the corresponding periods in 2022.

Furthermore, free cash flow for Q4 2023 and the full year 2023 amounted to $7.8 million and an outflow of $6.4 million, respectively. These are improvements from last year’s outflows of $31.6 million and $90.2 million.

The company boasts an available liquidity of $152.6 million, including $41.4 million in cash and $111.0 million of undrawn availability under its revolving credit facility.

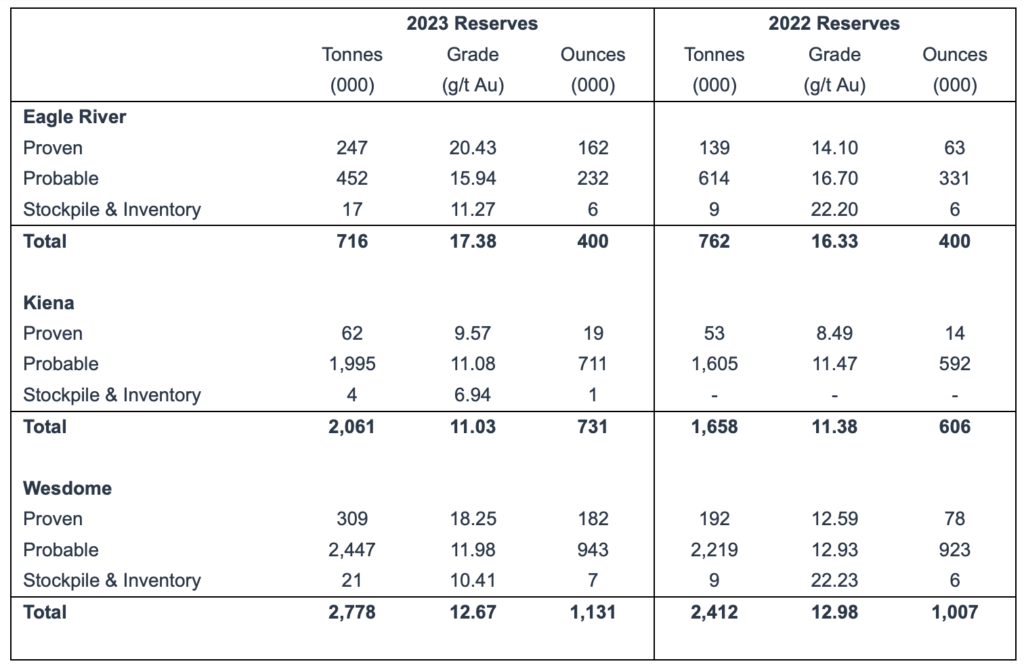

Alongside the financial results, Wesdome announced its mineral reserves and resources for the year ended 2023, revealing a 12% increase in total gold mineral reserves compared to year-end 2022. Notable additions include the initial mineral reserve at Presqu’île Zone and expansions at Kiena Deep and Zone 6 Central at Eagle River.

Bath emphasized an ambitious exploration program for 2024, anticipating high-quality resource additions and new discoveries, exemplified by the rapid growth of the Falcon 311 Zone at Eagle River.

In 2024, Wesdome anticipates Eagle River to produce 80,000 to 90,000 ounces of gold at cash costs ranging from C$1,275 to C$1,425 per ounce, with AISC expected to be between C$2,050 and C$2,250 per ounce. While production levels remain consistent with the prior year, there will be a shift in the contribution of tonnes and ounces away from the 720F Falcon Zone towards the higher-grade 300 Zone at depth.

Similarly, Kiena is projected to yield 80,000 to 90,000 ounces of gold with cash costs ranging from C$875 to C$975 per ounce, and AISC of C$1,475 to C$1,625 per ounce. The increase in annual production reflects a decrease in production contribution from the Martin Zone, offset by higher-grade ore from the Kiena Deep 129L horizon.

Wesdome Gold Mines Ltd. last traded at $9.77 on the TSX.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.