Shortly after Sam Bankman-Fried’s arrest and subsequent release from custody, captivated onlookers were bewildered that there was someone out there that would co-sign the fraudster’s $250 million bail aside from his loving parents.

According to freshly-released unredacted documents thanks to Judge Lewis A. Kaplan’s ruling in favour of news organizations’ request to make the information public, the two guarantors behind SBF’s bond are none other than Stanford research scientist Andreas Paepcke and former Stanford Law School dean Larry Kramer. For the record of drawing obvious connections, both SBF’s parents are professors at Stanford…

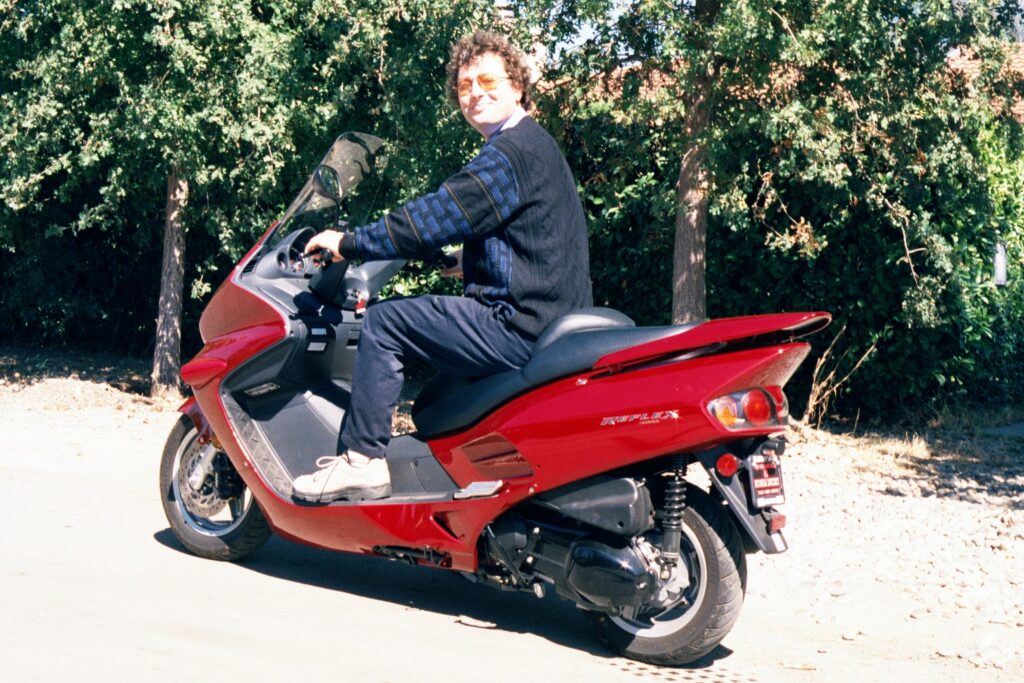

Paepcke is a senior research scientist and Harvard University alumni focused on data analytics, whose hobbies include piano playing, sub-par poem-writing, and riding his red Honda scooter to overcome a midlife crisis.

Kramer, meanwhile, served as the Stanford Law School dean from 2004 to 2012, and sits on a number of boards for nonprofit organizations including the National Constitution Center, Independent Sector, and the ClimateWorks Foundation. He was described as a close family friend who sympathized with the Bankman-Frieds, and was quoted by the New York Times as saying he didn’t see “how this doesn’t bankrupt them,” referring to the costly legal process that’s about to envelop SBF.

As per the terms of the bond, the guarantors had to have substantial income or be “of considerable means,” and couldn’t be related to SBF. Although the fraudster’s bail was to the tune of $250 million— one of the heftiest in US history— Paepcke and Kramer only agreed to surety $200,000 and $500,000 respectively.

Information for this briefing was found via the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.