Within the public cannabis sector, there’s a notion among investors and management teams alike that bigger is always better. This can be exemplified by Aurora Cannabis’ (TSX: ACB) (NYSE: ACB) claims to 625,000 kilograms of cannabis per annum in funded capacity for 2020, or by Canopy Growth Corps (TSX: WEED) (NYSE: CGC) five million square feet of licensed capacity. But few have paused to ask critical questions, key of which is something simple: do they produce a product that consumers desire?

As a result of this ongoing notion, few have taken the time to consider the little guy in the equation – the craft producers, if you will. Part of this issue, is that few are available to place retail investment dollars into. This is where the Wildfire Collective comes in. Although not public per se, the firm, which is focused on quality outdoor grown cannabis, is currently open for outside investment through a crowd sourcing of sorts.

Founded by industry veteran Mark Spear, the Wildfire Collective aims to focus on a quality organic craft product versus that of large scale growing. It does so through the use of a collective, true to its name. Spear has assembled a team of small-scale farmers to establish the collective, all of whom have prior growing experience.

The concept is simple – empower small scale organic outdoor farmers to be able to produce a high quality grade of product, process and package it, and sell it through Wildfire’s established distribution lines. Wildfire then keeps 30% of the revenues, with 70% going back to the farmer.

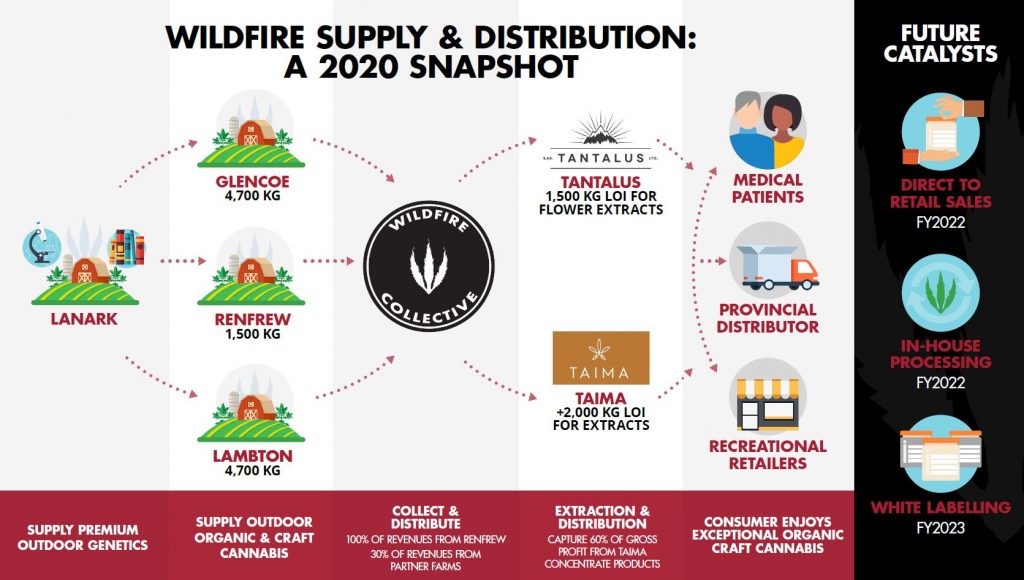

Wildfire currently has three farms set for the 2020 season, which will be the firms first operational season. The farms, known as Glencoe, Renfrew, and Lambton, will each produce cannabis at their separate locations across Ontario which collectively consist of 21 acres. With anticipated capacity of 11,000 kilograms of cannabis for 2020, the product will then be collected by Wildfire and pushed to its pipeline. Wildfire has partnered with both Tantalus Labs as well as Taima, who will extract a portion of the overall harvest. The final product will then be distributed through provincial distributors, medical patients, and recreational retailers.

While the first year of the operation will consist of a total of 21 acres and three farms, Wildfire Collective intends to scale it’s small scale growing operation over the next several years. The firm anticipates to expand to seven farms for 2021, and thirteen farms for 2020. The final result of which will be an anticipated capacity of 60,300 kilograms of cannabis across 95 acres. The difference, relative to public peers, is that it will all be craft, organic product – something that just can’t be done in a million square foot facility.

Wildfire Collective is currently looking to raise $500,000 in total to fund its operation. To do so, Wildfire is selling common shares at a price of $0.20 per security, with the minimum purchase being $1,000. To date, the firm has raised a confirmed $68,000, with another $56,600 currently being processed and 21 days remaining for the raise. We should be clear here however in that the common shares are not publicly traded – although the firm has signaled that investors will see a return on investment via share buyback at a later date (at a higher multiple), or through a potential go public transaction.

If you wish to learn more about the Wildfire Collective and their current fund raising effort, you can find them on FrontFundr by going here.

Information for this analysis was found via FrontFundr and Wildfire Collective. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.