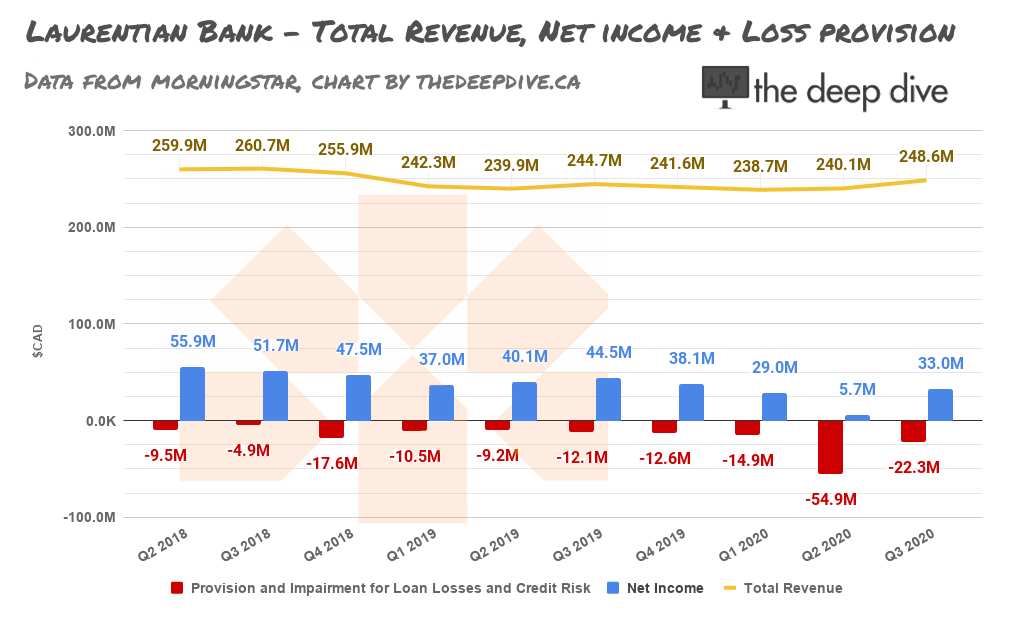

Montreal-based Laurentian Bank (TSX: LB) is a Canadian Schedule 1 lender whose equity took a beating in the pandemic economy, and still hasn’t quite recovered. The bank’s bottom line was hurt in recent quarters by some charges it had to take for allowances for delinquent loans in the shifting economy, which optimists might consider an indication that the potential defaults have already been priced in.

But recently former CEO Francois Desjardins and the Laurentian board of directors aren’t really glass-half-full types, so the CEO left suddenly in June in a decision that the parties described as “mutual.”

Naturally, the economy can always get worse, further grinding Laurentian’s net by way of its balance sheet, but this country has an un-matched social safety net for the corporate components of its banking system. Canadian mortgages are backed by the CMHC, personal debtors who are out of work can still draw income through CERB, and depositors have the full backing of the Canadian Deposit Insurance Corporation.

The allowance charges that pounded Laurentian’s net contributed to the equivalent pounding of its stock, but not as much as a cut in the company’s regular $0.60 quarterly dividend to $0.40 in June, where it stayed in September. At the reduced payout, LB produces an annualized yield of 5.92%, which might be enough to attract yield chasers who are buoyed by the basic, sideways, boring, flat aesthetic being carved out by its revenue, and the hope that the allowance charges end up being just prudence.

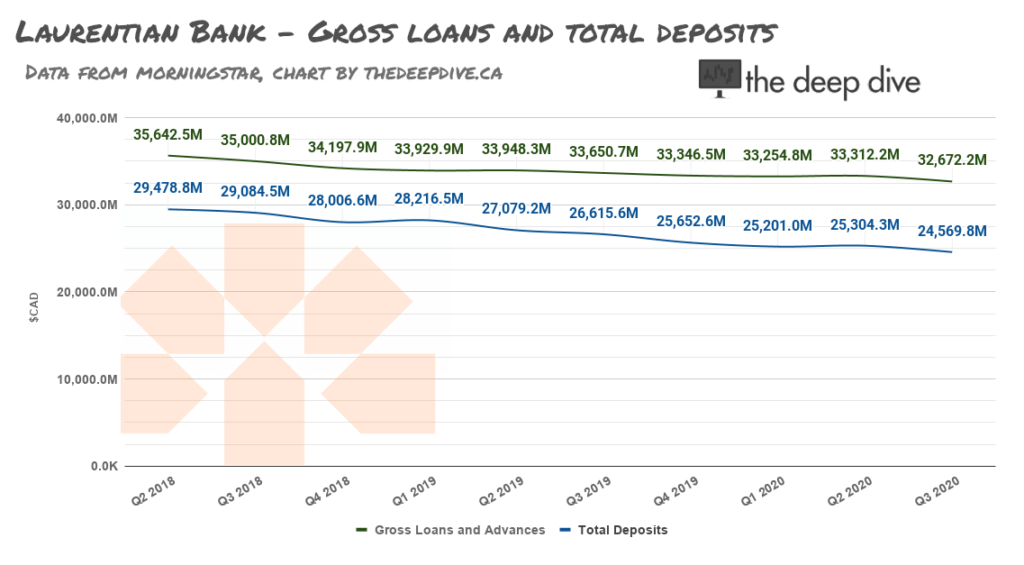

At its current $1.1 billion market cap, the bank is trading at less than half of its $2.5 billion net asset value. The company has a small securities business, and all of the regular lending channels one expects from a Schedule 1 bank, and they’re all basically flat. As a business, these numbers draw a picture of a hundred year old institution that hasn’t figured out how to compete in a more crowded Canadian banking landscape, just plodding along on the inertia that is afforded to necessary institutions like banks, waiting for something to happen. But help may be on the way.

The Globe and Mail‘s James Bradshaw reports that LB has hired one Rania Llewellyn as its next CEO, and that the 44 year old will become the first woman to lead a major Canadian bank beginning October 30th. The executive got her start as a part-time teller at Scotia Bank after immigrating from the Middle East, rising to the c-suite after 26 years with the organization. The Globe makes Llewellyn for the first non-francophone to head the bank since the Second World War, and notes that she is a rare outside hire for the tight-knit Quebec bank.

Desjardin split on year two of a seven-year turnaround plan, clearly out of ideas. New blood from outside might bring both fresh perspective and the sort of disrespect for tradition that is often required to bring about true change. It’s tough not to pull for her, and we’re inclined to see the beat up equity as a head start towards growth, instead of a handicap.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.