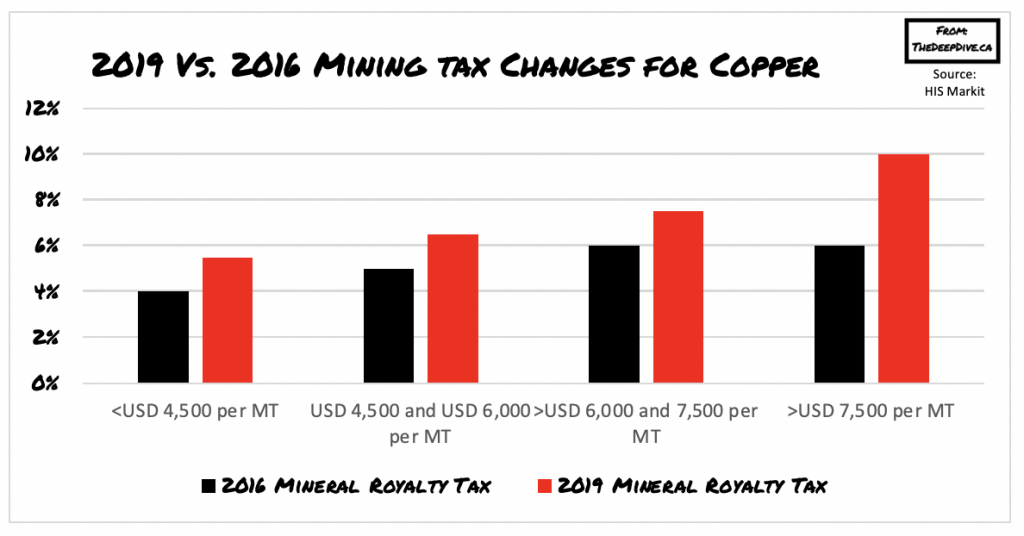

Last year, the Zambian government decided to revamp its economic policy, and increase the mineral royalty tax on copper. The sudden move is aimed at foreign mining operators, which have allegedly been “cheating” the country. As a result, mineral royalties will now range from 5.5% to 10%, compared to the previous 4% to 6%.

Although mining accounts for approximately 12% of Zambia’s GDP and 70% of its exports, the country has been suffering from mounting external debt and a reduction in aid. It is anticipated that the increase in mining royalties will go towards the country’s financially deprived sectors.

As a result, Zambia’s new tax royalty regime has resulted in several disagreements with foreign copper miners. In fact, First Quantum Minerals Ltd (TSX: FM), a Canadian-based copper mining company, has decided to halt a $1 billion investment into its Kansanshi operation, citing reduced viability in Zambian projects. According to Zambia Chamber of Mines chief executive Sokwani Chilembo, the newly-imposed royalty schemes are making it increasingly difficult for miners to continue their operations due to rising costs stemming from Zambia’s continuously changing tax regime.

The company just weeks ago had upgraded its mineral resource estimate for the property, increasing project reserves by 40% to 939.6 million tonnes of mineral reserves, while announcing the significant investments it planned to make at the operation. The enhancements to be made were slated to increase processing capabilities from 28 million tonnes per annum to 52 million tonnes per annum of ore, nearly doubling capacity. Last year, the mine produced 232,243 tonnes of copper and 145,386 ounces of gold.

First Quantum, as well as several other foreign mining companies, have expressed their grievances with the Zambian government’s royalty tax increases. The Canadian-based company has stated it will not proceed with extending the life of its Kansanshi operation until the copper royalty is treated as a deductible from other corporate taxes.

Chilembo noted that many mining projects in Zambia have become less attractive given the rising cost of capital and double taxation of producers. He notes that in order for many of these projects to continue, the royalties will need to be treated as a deduction from profit tax.

Cumulatively, the changes in the royalty structure have resulted in an estimated $2 billion in copper projects being put on hold within the country. The result, is that more mineral will stay in the ground, providing pressure for rising copper prices.

Information for this briefing was found via IHS Markit and Bloomberg News. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.