Zenabis Global (TSX: ZENA) continued to punish long term shareholders last night, announcing that it would be conducting a best efforts overnight marketed offering of units of the company. Zenabis intends to collect gross proceeds of $6.0 million via the financing, which will be utilized for the partial repayment of unsecured convertible debentures due next month, among other items.

The $6.0 million financing will see units offered at a price of $0.085. Each unit includes one common share and common share purchase warrant, resulting in an additional 70.6 million common shares hitting the firms already bloated share structure along with an equal number of common share purchase warrants that have an expiry of five years and a conversion price of $0.10.

The significant issuance of warrants is a potential cap to the upward momentum of the equity, given that any price movement beyond a dime will potentially be met with the exercise and sale of warrants, which would be a source of downward pressure on the equity. The financing is also subject to an over-allotment option, valid for a period of 30 days following the close of the financing for an additional 15% in units.

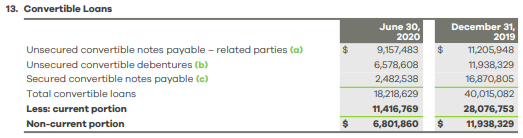

Proceeds from the financing are stated to be used for general working capital and corporate purposes, along with the “partial repayment of the Company’s unsecured convertible debentures.” It’s unclear just how much exactly in principal is remaining on Zenabis’ balance sheet from its unsecured convertible debentures as a result of the accounting methods used, however a carrying value of $9.2 million has been assigned to debentures which are largely due in October. Additional unsecured debentures remain on the books, however the maturity date for these are further in the future and not a near term issue for the company.

Given that Zenabis reported a cash position of just $6.7 million as of June 30, and the conversion of the near term convertible debentures is at $1.91 per share, the company was essentially required to raise funds to deal with the matter. The debt originates from shareholder loans that were converted to debentures in October 2018 from related parties, which were scheduled to mature in October 2019. Given that its now a year out since that date, those shareholders are now likely demanding that the debt be repaid rather than renegotiated yet again, for a third time.

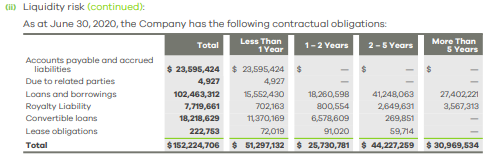

Compounding the problem is the fact that the company is facing a liquidity crisis while having many millions in near term obligations to cover – such as the $23.6 million in outstanding accounts payable, and the $7 million short term debt that is due December 31, 2020. This also does not include its quarterly interest expenses, which last quarter amounted to $8.0 million – more than what the company had in its coffers by the end of the period.

In total, the company boasts contractual obligations to the tune of $51.3 million over the course of the next 12 months.

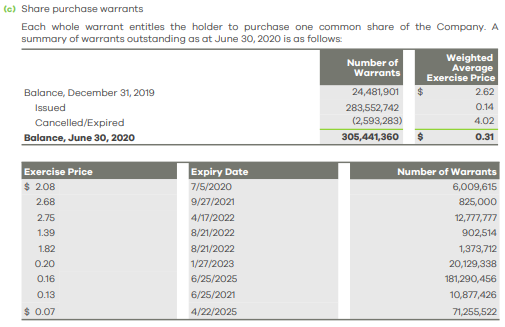

Zenabis Global had 619,511,526 common shares outstanding as of June 30, 2020, in addition to 305,441,360 common share purchase warrants with an overall average exercise price of $0.31. 283.6 million of those warrants however have been issued since January 1, 2020 with an average exercise price of $0.14.

An additional 11,637,450 options with an average exercise price of $0.55 are also outstanding, along with 3,475,000 restricted share units at a price of $0.15. Further, an additional 23.5 million restricted share units were subsequently issued by the company to employees and board members.

The latest financing, if fully subscribed, will as a result push the firms share structure to over one billion shares outstanding on a fully diluted basis.

Zenabis Global last traded at $0.095 on the TSX.

Information for this briefing was found via Sedar and Zenabis Global Inc. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.