Maricann Group Inc (CSE: MARI) has been a fan favourite in the pot stocks industry for quite some time. Although it has had some issues in the past, such as an electrical fire at one of their facilities, or a wind storm causing damage to another, investors appear to have looked past this. The company has always been honest and up front about this information, which has been made clear by investors that they appreciate.

The love of this company has flowed through to that of our email inbox, where we have received multiple requests for articles on the company. Investors want more Maricann, and were happy to oblige with that. Although based on current poll results we’ll be doing a full Deep Dive on the company this weekend, we wanted to give viewers a taste of what this company has to offer. And with that, lets dive in to the current share structure of Maricann Group.

A Dip Into the Share Structure of Maricann Group

Maricann’s Share Structure

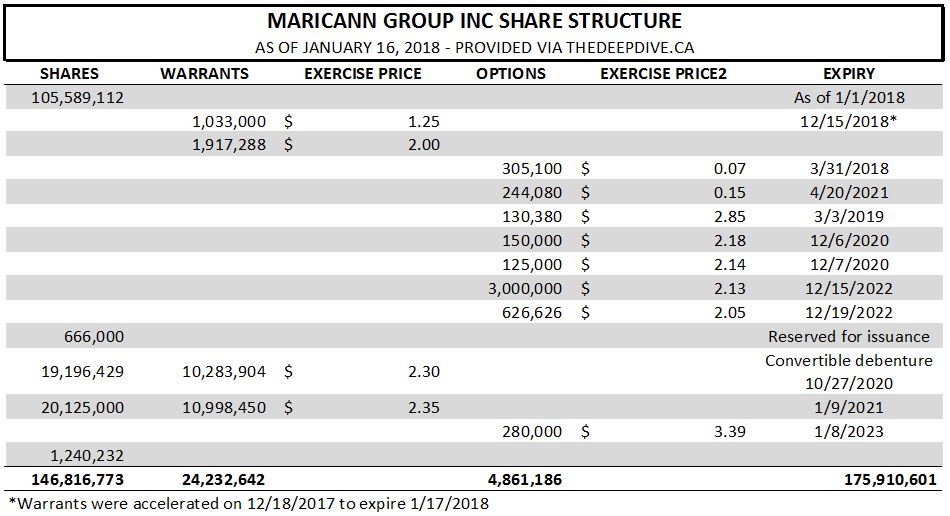

To put it simply, Maricann Group is extremely tight on details when it comes to their current share structure. Interim financials are presented in a very dystopian manner in relation to share structure, providing investors with way too much information to be able to process the data effectively. They also do not lay out the data in a detailed table like the vast majority of listed companies do on the Canadian junior exchanges. They did however provide a general table in their investor presentation from which we could reference.

Further to what was stated above, we didn’t notice any news from the company noting that several of the listed options had been issued. We managed to collect this information via the filings required under CSE listing rules.

The current share count has increased steadily as of late. As of September 30, the company had roughly 73 million shares outstanding. As it currently stands, it is estimated that there is 146,816,773 shares of Maricann currently issued when the conversion of debentures is factored in. Based on this figure and the closing price of $3.08 on January 16, Maricann has an approximate market valuation of $452.2 million. On a fully diluted basis, this expands to $541.8 million.

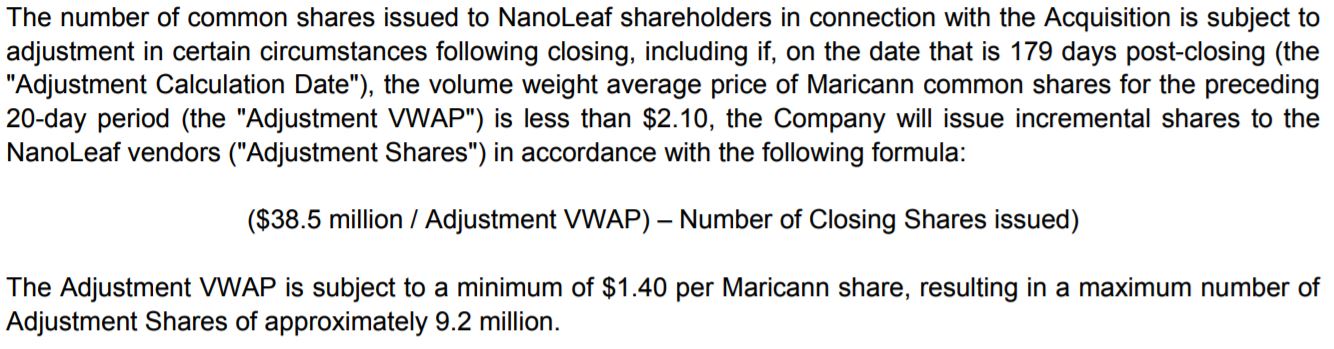

It should also be noted that the share count may change as a result of a clause built in to the purchase of NanoLeaf. The deal, which closed on October 27, 2017, has the potential for revised share issuance up to 179 days from the date of closing based on the average price of Maricann. See below for the skinny on it.

As it stands, the company has allocated “approximately” 18.3 million shares for the acquisition of NanoLeaf. This is subject to change based on the calculation seen above. However, based on the current trading price of the company it is not anticipated that further shares will be required for issuance.

Insider Positions at Maricann

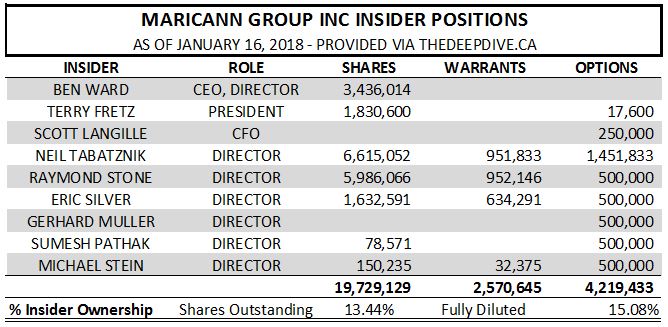

To touch briefly on the insider positions at Maricann, we compiled the data available from SEDI with regards to what insiders currently control. For the figures below, all special warrants, rights, and convertible debentures were calculated into their conversion equivalents.

Currently, insiders own approximately 13.44% of all shares outstanding, again with the calculated conversion of debentures. On a fully diluted basis, this figure increases to 15.08%. These figures are relatively inline with industry standards based on the previous data we have compiled on the companies competitors.

It should also be noted that insiders have bought in to every raise to date for the company. This is especially notable in the case of Eric Silver, a director whom has participated in each raise to date himself. This has been executed through several holding and investment companies in which he is in control of.

Closing Remarks

Overall, the share structure of MariCann Group is quite tight, which is further strengthened by a sizable portion being held by insiders. This indicates strength in the company. This strength is then further reinforced through the act of insiders participating in each raise that has been available since the company went public. The management clearly believes in the company, which is an excellent indicator for current and future investors.

With regards to the rest of the company, it looks like we’ll be performing our full analysis on it this weekend. Again, this is based on poll results that can be found on the sidebar of the website. Be sure to participate in this, as it helps us deliver the content that you want. If you’d like to see a future full analysis on a particular company, reach out to us either via our Twitter handle, or through the “Contact Us” link at the top of the page. We’re always open to suggestions, and several articles have been brought about through viewer requests. Be sure to catch our full analysis every Sunday morning!

Look for strength in numbers. Insider positions will reveal plenty on a stock. Dive Deep.

Information for this analysis was found via Sedar, The CSE, SEDI, and MariCann Group Inc. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.