3 Sixty Risk Solutions (CSE: SAFE) announced this morning that it has been successful with its efforts to reduce operating expenses. To date, the firm has reduced its total operational expenses by an annualized $2.4 million, and continues on its path to realize up to $4 million in annualized cost savings.

While the firm identified that it is focused on getting closer to a path of “sustainable profitability,” the firm notably did not indicate that it has of yet achieved profitable operations. The consultant, whom is predominantly focused on providing security and consulting services within the cannabis sector, notably has operated a money losing venture for which The Deep Dive has been vocally critical of.

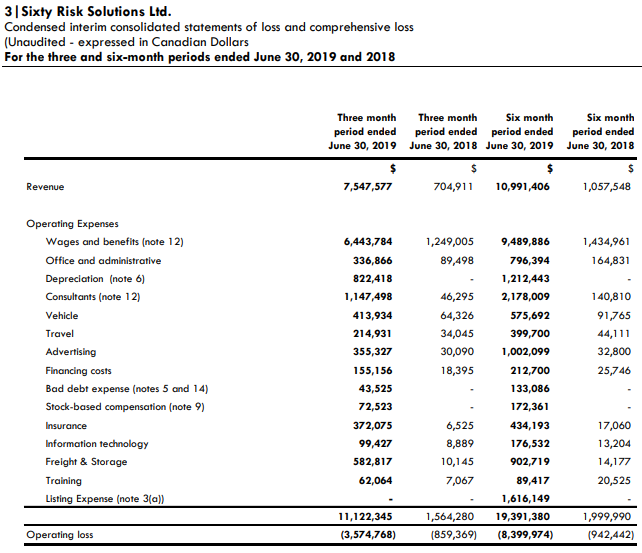

Despite the doubling of revenues, there appears to be no path to profitability for the firm. While the firm doesn’t recognize cost of goods sold, total operating expense came in at $11.12 million for the quarter, resulting in a net loss of $3.57 million.

While the figures would be acceptable if the firm was largely mired by non-cash items, the most significant portion of the operating expense was wages at $6.44 million, and consultants at $1.14 million, which puts the firm behind the profitability line before non-cash items are even considered. To require these expenses routinely signifies that 3 Sixty is quite literally selling its services below the cost of being able to provide them.

3 Sixty meanwhile also reiterated its prior guidance of $8.5 million in revenues for the third quarter of 2019, which signifies slowing growth for the firm. It also doesn’t appear to be enough to get the operation to a level of profitability. On an annualized basis, the firm has reduced expenditures by $2.4 million – which boils down to $600k on a quarterly basis. All other figures remaining the same, this still results in a quarterly deficit of approximately $2 million.

Even if we pull out the non-cash items, which amounts to $5.02 million, the net cash used in operating activities still comes in at ($6.14 million), indicating the 3 Sixty needs to significantly reduce its costs to do business. The current framework is simply not sustainable, and its goal of annualized cost reductions of $4 million is not enough to right the ship.

Simply, their service is being sold below the cost to do business

3 Sixty Risk Solutions closed yesterdays session at $0.10 on the Canadian Securities Exchange.

Information for this briefing was found via Sedar and 3 Sixty Risk Solutions. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.