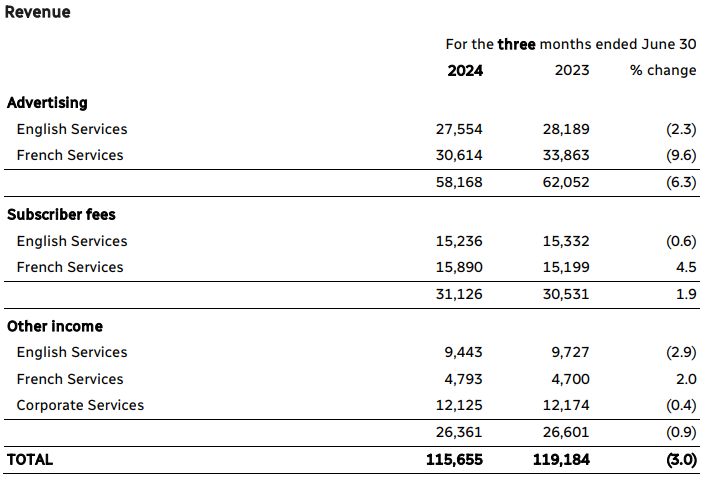

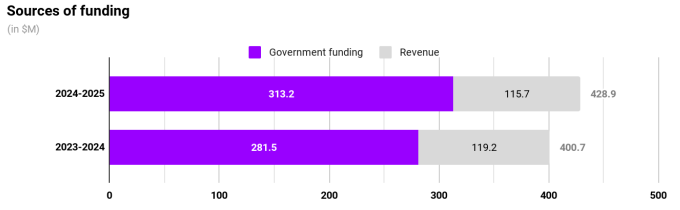

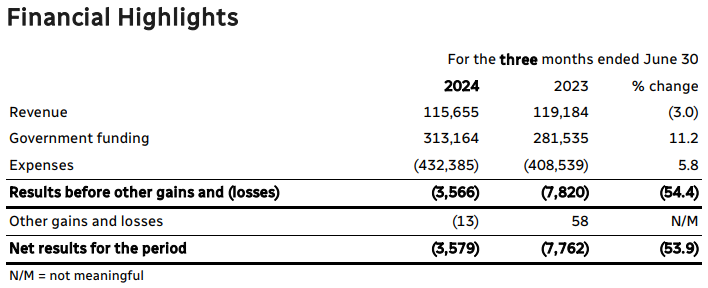

The first quarter of the 2024-2025 fiscal year has presented CBC/Radio-Canada with a mixed bag of financial results, posting revenue of $115.7 million, which is a 3.0% decline from the same period in the previous year, when revenue stood at $119.2 million.

This downturn is primarily attributed to a decline in television advertising, which fell by 10.7%, resulting in a $3.9 million drop. The softer market conditions for television advertising have been driven by reduced demand, a situation consistent with broader industry trends as audiences continue to shift from traditional television to digital platforms.

However, digital advertising has seen growth of 4.7%. This shift aligns with industry transformations, where media consumption habits are increasingly geared towards on-demand services and free ad-supported TV channels.

Subscriber fees, a key revenue stream for CBC/Radio-Canada, experienced modest growth of 1.9%, generating $31.1 million in the first quarter. This uptick was driven by an increase in digital platform subscriptions, particularly ICI TOU.TV EXTRA and CBC Gem, which saw a 30.1% increase in revenue.

However, this growth was somewhat offset by declines in traditional discretionary TV platforms, which dropped by 5.4% due to ongoing cord-cutting and cord-shaving trends that continue to impact the cable television industry.

The broadcaster’s total expenses for the quarter rose by 5.8% to $432.4 million, driven by increases in television, radio, and digital service costs. Specifically, English services saw a 16.6% increase, largely due to higher programming costs and the timing of broadcasting schedules, which influenced overall spending. In contrast, French services expenses decreased by 4.8%, demonstrating some efficiency in the management of resources.

The rise in costs was partially mitigated by a lower pension expense, which fell in line with expectations. The increase in programming costs is likely tied to new content launches and the need to maintain competitive programming in an increasingly crowded digital media landscape.

Government funding

Despite a soft advertising market, government funding provided a crucial boost, helping to stabilize operations and continue broadcasting across various platforms. For the first quarter, government appropriations amounted to $313.2 million, a 11.2% increase compared to the same period last year. This significant boost in funding was attributed to seasonal factors, reflecting the broadcaster’s need for operating funds during the quarter.

Government funding, which makes up the majority of the broadcaster’s revenue, includes both operating and capital expenditures. While advertising revenues are subject to market fluctuations, government appropriations provide a steady and predictable source of income, helping the broadcaster navigate periods of financial uncertainty.

CBC/Radio-Canada recorded a net loss of $3.6 million for the quarter, a significant improvement from the $7.8 million loss reported in the same period last year. This reduction in losses reflects the higher government funding and increased efficiency in managing expenses, despite the challenges posed by a weaker advertising market.

The improvement in the broadcaster’s bottom line can also be attributed to gains from remeasurements of defined benefit plans, which resulted in a $69.4 million gain. This was largely driven by changes in actuarial assumptions, specifically a 10 basis-point increase in the discount rate used to calculate pension obligations.

At the end of the first quarter, CBC/Radio-Canada had $211.3 million in cash and cash equivalents, down from $232.6 million at the beginning of the period. This reduction in cash was primarily due to operating activities, which used $11.2 million in cash, a marked decrease from $37.7 million used in the same period last year. The broadcaster also saw reduced cash inflows from investing activities, which brought in $18.7 million, compared to $57.4 million in the previous year.

Information for this story was found via the sources and companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.