Since the onset of the coronavirus pandemic back in March, the US government has been spending tax-payers into oblivion in order to prop up whats left of the crumbing US economy. However, with no end in sight to the ever-increasing infection rates, the toll of the government’s never-ending spending is becoming more evident.

The Congressional Budget Office (CBO) has just released the latest data concerning the state of the US budget, and the numbers are certainly not pretty. The 2020 fiscal year is projected to see the budget deficit skyrocket to a staggering $3.3 trillion in response to the rampant government spending aimed at curtailing the resulting economic damage from the coronavirus pandemic. The grim deficit will amount to approximately 16% of GDP, which is significantly greater than the 4.6% in 2019, and the biggest since the Second World War.

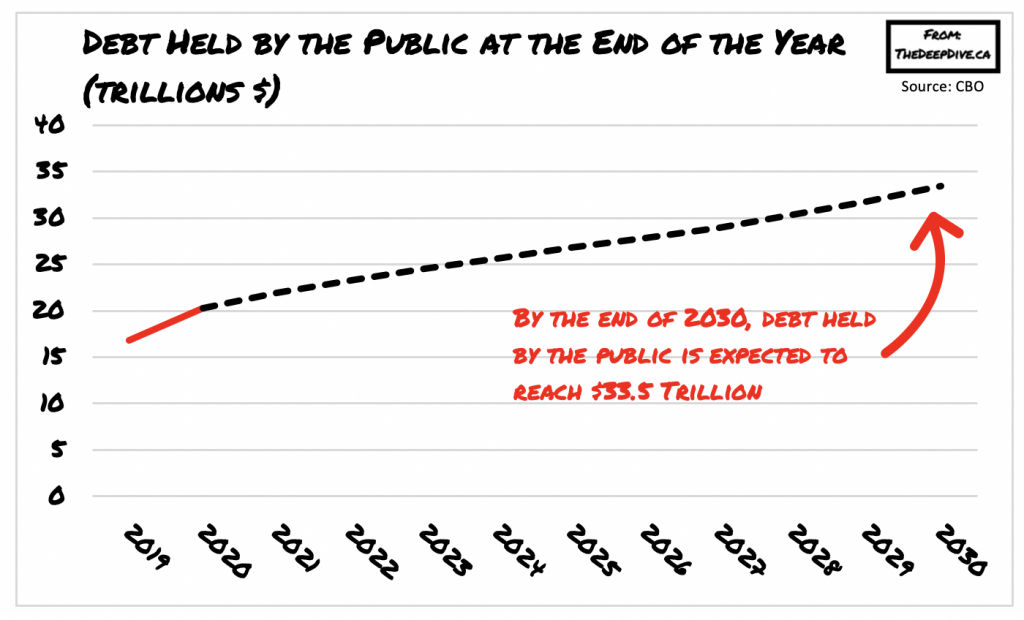

In the meantime, government outlays are expected to surge to $6.6 trillion this year, while revenue is forecast to fall to $3.3 trillion. The ever-increasing budget deficit means that the government will continue to borrow even more; as a result, the CBO is anticipating that public debt will rise to $33.5 trillion by 2030, which equates to more than 109% of the country’s GDP.

However, despite the bottomless spending by the US government, the economy remains at a standstill. As coronavirus cases continue to increase, many states have been reinstating restrictions, with New York City’s mayor even banning indoor dining until a successful vaccine is available. In the meantime, it appears that the US job market has entered a standstill, as staffing company Homebase reported that the hourly time worked by employees at small and medium businesses is still 20% lower than before the pandemic. This suggests that road to recovery for America’s economy is not even visible in the clearing.

Nonetheless, enough about the depressing state of the US economy. How about that S&P500 lately? Several weeks ago the index reached a record-high, obliterating any previous losses stemming from the coronavirus pandemic, causing large corporations and some of America’s wealthiest to gleam with delight. But as the US economy continues to crumble beneath the weight of its ever-increasing debt, the S&P500 hit yet another milestone today: the index’s forward price to earnings multiple also reached an all-time high of 27.02x, thus outperforming dotcom bubble of the 1990s.

Given that the S&P is now trading at its highest price alongside a record-breaking forward P/E multiple, analysts are scrambling to keep up with their ever-changing price targets. The current average Wall Street target is sitting at 3,198, which is a significant disconnection from the skyrocketing trading price. This means that there is either asymmetric information somewhere and the S&P will come crashing down shortly, or a cascade of revised price targets will soon ensue. Nonetheless, whatever the momentum is that’s pushing the US stock market to perform exceptionally well, should be trickled down to the US economy – because it needs all the help it can get.

Information for this briefing was found via the CBO and Homebase. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.