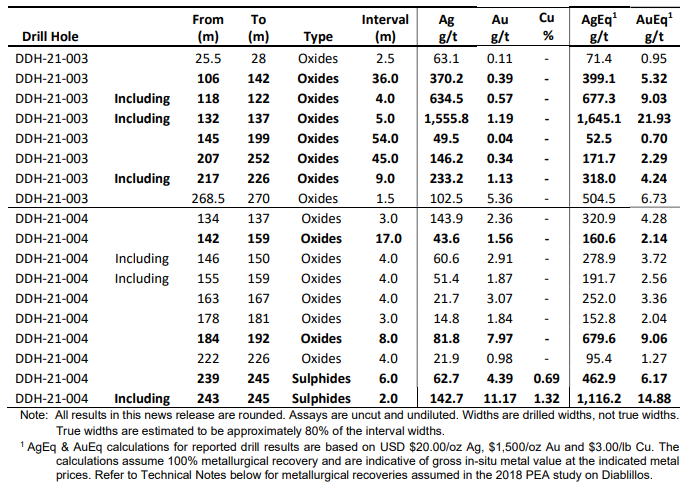

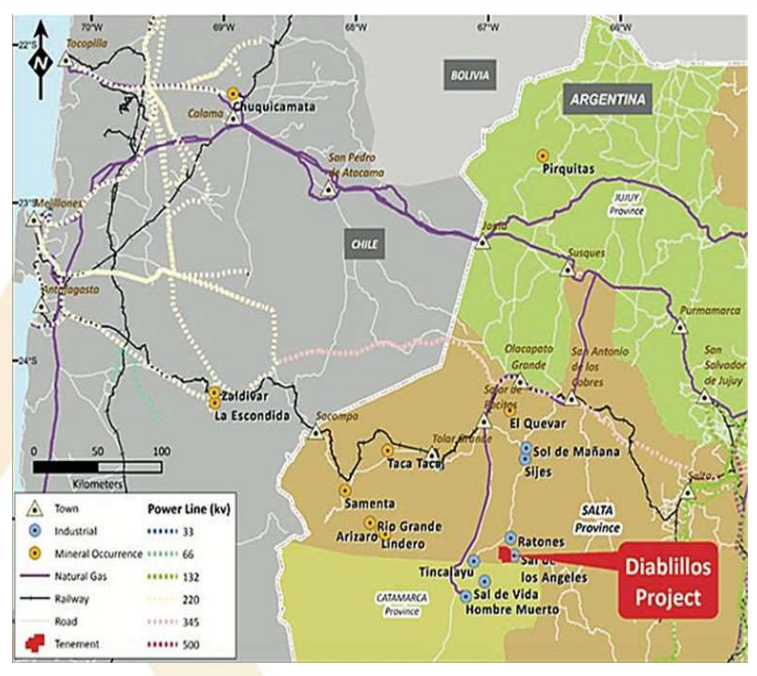

On April 6, AbraSilver Resource Corp. (TSXV: ABRA) reported constructive, high-grade assay results from two diamond drill holes at the Oculto deposit on its 100%-owned Diablillos property in the Salta Province of Argentina. The Oculto deposit is a high-sulfidation, epithermal gold deposit.

Specifically, one of the holes intersected a 36-meter segment with a silver-equivalent (AgEq) content of 399 grams per tonne (g/t) of resource, including 5 metres with a concentration of 1,645 g/t AgEq. Another segment of the same hole reached a 45 metre length with a 172 g/t AqEq grade. The new drill results seem to signal that the current Whittle pit drilling area could be expanded in a northeast direction where prior drill holes have revealed high-grade gold zones.

The Diablillos project, AbraSilver’s key asset, has indicated resources of 81 million ounces of silver and 732,000 ounces of gold. AbraSilver acquired Diablillos from SSR Mining Inc. (TSX: SSRM) in 2016. AbraSilver is required to make one final payment of US$7 million to SSR Mining in 2025.

A preliminary economic assessment (PEA) completed in 2018 estimated that an open pit mine at the project would produce nearly 10 million ounces of AgEq annually and have a US$212 million net present value, along with a 30.2% internal rate of return, based on what are today very conservative assumptions – US$1,300 per ounce gold and US$20 per ounce silver prices, and a 7.5% discount rate. In mid-2021, AbraSilver hopes to release an updated PEA for Diablillos.

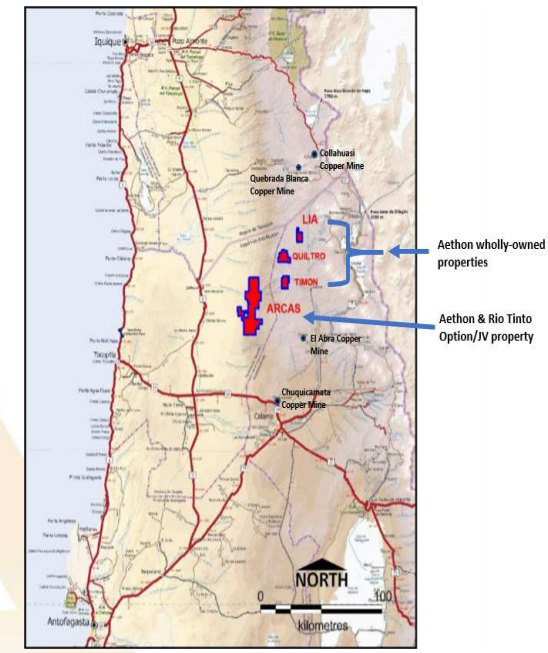

Arcas Copper/Gold Project

Through its December 2019 merger with Aethon Minerals, AbraSilver also owns the Arcas project in Chile. Arcas is located in one of the world’s most prolific copper producing regions.

In September 2019, Aethon signed an earn-in with option to joint venture agreement with the mining giant Rio Tinto Group (NYSE: RIO). Rio Tinto can acquire up to a 75% stake in the project by incurring capital expenditures of up to US$25 million over an eight-year period.

The arrangement outlines US$4 million of capex plus cash payments totaling US$0.3 million over the first three years allows Rio Tinto to gain a 51% stake; Rio Tinto’s incurring an additional US$5 million of capex over the next two years allows it to bring its stake to 65%; and a further US$16 million of spending over the subsequent three years gives Rio Tinto the right to increase its interest to 75%. Rio Tinto plans to commence a drilling program at Arcas in the first half of 2021.

Debt-Free Balance Sheet

Per its April 2021 investor presentation, AbraSilver has about $18 million of cash (down from around $24 million on September 30, 2020) and negligible debt. For a pre-revenue company, AbraSilver has controlled its costs well. Its operating cash flow deficit averaged only around $1.5 million per quarter for the first three reported quarters of 2020.

| (in thousands of Canadian dollars, except for shares outstanding) | 3Q 2020 | 2Q 2020 | 1Q 2020 | 4Q 2019 | 3Q 2019 |

| Operating Income | ($1,871) | ($908) | ($1,154) | ($828) | ($212) |

| Operating Cash Flow | ($2,303) | ($820) | ($1,276) | ($838) | ($5) |

| Cash | $24,467 | $1,812 | $743 | $1,812 | $58 |

| Debt – Period End | $5 | $10 | $17 | $34 | $0 |

| Shares Outstanding (Millions) | 400.0 | 274.8 | 249.8 | 249.8 | 96.7 |

If future assay results at Diablillos were to prove less constructive or if the expected mid-year 2021 revised PEA on the project were to be disappointing, AbraSilver shares could suffer. Also, a weakening of precious prices metals prices could also impact the stock.

AbraSilver is a well-capitalized junior miner with an attractive set of properties. Most notably, assay results at its Diablillos property in Argentina have been quite promising and the project’s PEA could be revised in a positive manner in a few months. Also, its agreement with Rio Tinto on the Arcas project in Chile could in time prove to be quite accretive.

AbraSilver Resource Corp. trades at $0.56 on the TSX Venture Exchange.

Information for this briefing was found via Sedar and AbraSilver Resource Corp. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.