In keeping with the reporting pattern established over the company’s short, action-packed life, Acreage Holdings (CSE:ACRG.U) quietly filed their quarterly earnings statements this past Friday after market. A full ten days prior, Acreage issued a press release about these same earnings, along with a slide deck meant to help investors follow along through a conference call the next day, in which Acreage’s brass explained the earnings the way they’re meant to be appreciated; without a bunch of IFRS-mandated mumbo-jumbo cluttering it up. Like subatomic particles, the nature of Acreage’s reporting is known to change based on the manner in which it is observed. Only in a controlled vacuum can Acreage’s earnings be viewed in the proper context.

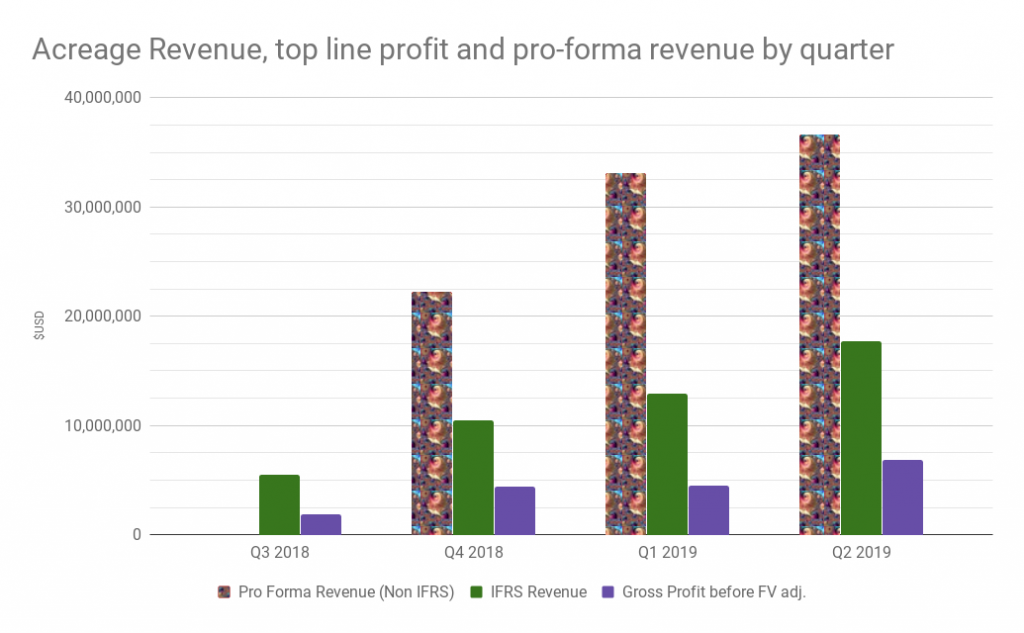

Acreage’s $17 million in Q2 revenue, $6.8 million in top-line gross and $33.9 million net loss calculated by IFRS standards aren’t something the company is trying to bury, exactly, because there’s no denying our corporeal existence. But Acreage suggests we look beyond the traditional metrics to find meta-figures of $36.6 million in pro-forma revenue, and $17 million in adjusted net loss. They also help observers out by tracking the growth in both the financial and meta-financial metrics over the similar period from last year, instead of quarter-over-quarter, as one might expect for a company in a rapidly changing growth industry caught in the prison of linear time.

Time as a dimension.

The innovation in Acreage’s reporting is the backward-looking pro-forma. A traditional forward-looking pro-forma can always be checked against the actual when it comes around because, whether time is an illusion or not, this realm is bound to it. But Acreage’s pro-formas don’t project the performance of cannabis assets they own forward in time, so much as they project the scope of the period they’re reporting for sideways onto businesses that Acreage acquired later on, or has a plan to acquire.

The instability of the US Cannabis legal environment is such that certain states prevent for-profit enterprises from owning cannabis operations. Acreage uses option agreements and promissory notes to secure the purchase of operations in jurisdictions that don’t allow for commercial exploitation of cannabis, gaining a toe-hold ahead of a potential future law change. The company earns “management services revenue” from these operations in an aggregate amount that it classifies as “not material”. The $18.9 million in revenue from these enterprises that Acreage added to their $17.7 million in regular Q2 revenue to arrive at $33.6 million in Q2 pro-forma revenue is the gross sales produced by those dispensaries, this period, in the realm in which they can be observed. Acreage does not provide pro-forma cost of sales or gross margin, and does not publish unit sales for either universe.

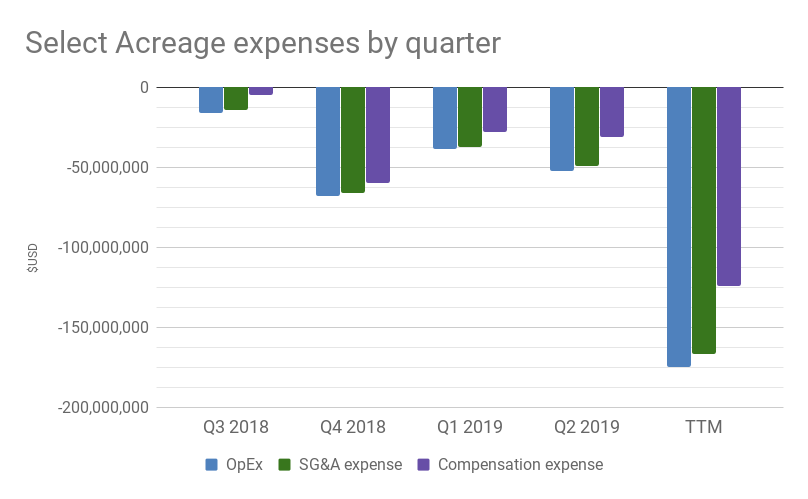

Acreage’s expenses accumulate steadily. The largest expenses outside of operations were SG&A and compensation, and for that the company makes no apologies. The company expects to, “continue to invest considerably in this area to support [their] aggressive expansion plans, and to support the increasing complexity of the cannabis business,” and there’s no denying its complexity.

Acreage’s expenses are growing a lot faster than its revenue, and a lot faster than its margin, but that doesn’t seem to bother them. Because Acreage isn’t interested in the profitable operation and standardization of these businesses in the near term. The strategy here is to acquire territory, and wait for it to pay off with a law change.

Fractalized existential determinism

Functionally speaking, from the perspective of retail shareholders in the habit of buying liquid positions on the open market, Acreage’s operation details, risk-board strategy, etc. don’t really matter. This balance sheet is the effective property of Canopy Growth Corp by virtue of the same sort of arranged marriage under which Acreage claims future title to various medical dispensaries that they’re presently prevented from owning by statute. Once the laws allow for it, those dispensaries will be the property of Acreage, and Acreage will be the property of Canopy. A fractal of dominoes held together by contractual end-runs around legal prohibitions.

Acreage shareholders received an advance dowry from Canopy in the form of a proportional share of a $300 million cash payment this past April. As soon as the bride is legal, shareholders will all receive 0.5818 shares of Canopy Growth Corp. The post-Linton Canopy hasn’t given any indication that they’d pull the plug on their option to buy Acreage, but they haven’t made a priority out of defending the price of the stock they’ve agreed to buy Acreage with, either. Acreage shareholders get 0.5818 shares of Canopy for their stock no matter what the price of Canopy is when the triggering event happens, so expect these companies to run together.

Both the Canopy-Acreage deal and Acreage itself are designed to take advantage of a federal legalization of cannabis in the United States. Until that happens, investors can expect Acreage to burn cash as they acquire new territory and keep the territory they’ve got afloat. Fortunately, CEO Kevin Murphy has never had trouble raising money. A 154,000 share at-market buy made by the executive July 12th, with ACRG trading for $12.85, didn’t help stop the slide.

Information for this briefing was found via Acreage Holdings. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.