Consolidation continues within the junior markets, with Adventus Mining (TSXV: ADZN) and Luminex Resources (TSXV: LR) last night announcing a merger to create a copper-gold company focused on growth in Ecuador.

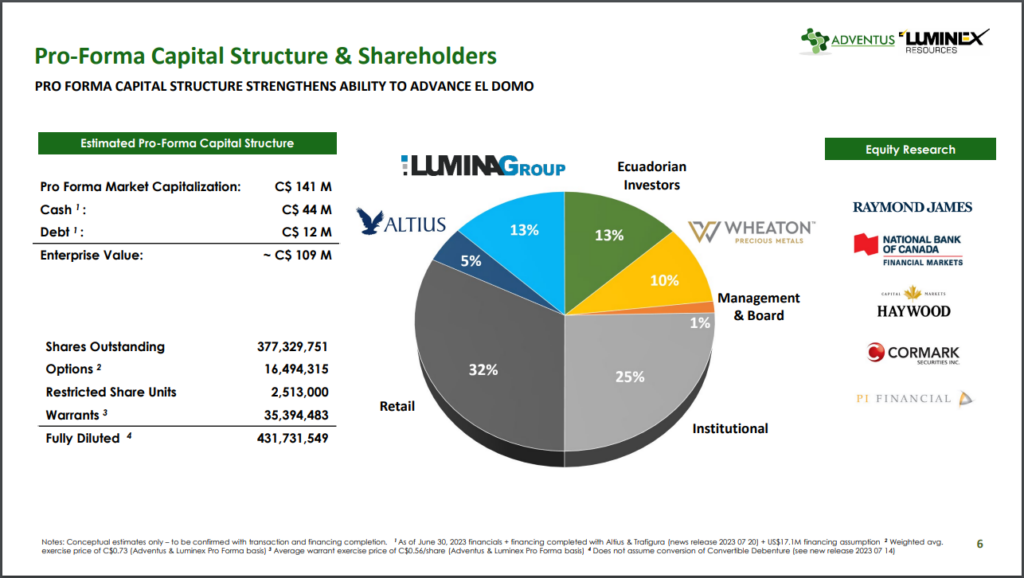

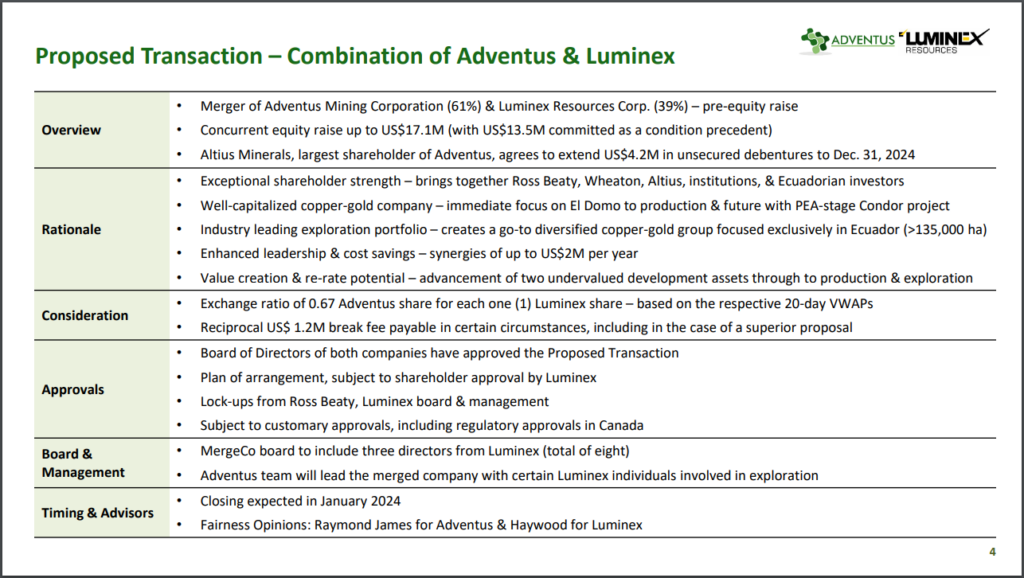

The transaction will see Adventus succeed as the resulting issuer, with Luminex shareholders to receive 0.67 Adventus shares for each share of Luminex held. Adventus shareholders are expected to own 61% of the resulting issuer, following a concurrent private placement that will see US$17.1 million raised.

The acquisition of Luminex will add Ross Beaty’s Lumina group to Adventus’ shareholder base, while establishing an entity that is only 32% owned by retail investors. Ross Beaty is expected to be a substantial shareholder of the resulting issuer with a 13% stake on an undiluted basis.

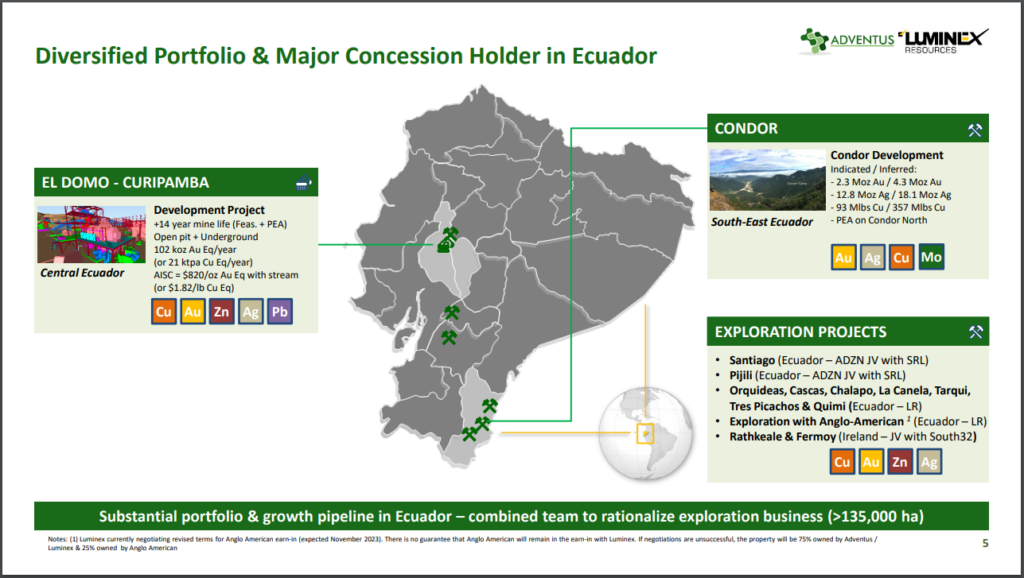

Strategic rationale for the transaction is the consolidation of a large and prospective gold-copper development and exploration portfolio within Ecuador, with land claims set to total over 135,000 hectares across 13 projects, as well as its shareholder strength. The company also anticipates operational synergies, resulting in savings of $2.0 million per year from the transaction.

Going forward, the focal point of Adventus will remain the El Domo-Curipamba copper-gold project, which is on track for a construction decision in the first half of 2024, with a current feasibility study outlining a 14 year mine life based on production of 102,000 ounces of gold equivalent per year.

The transaction will also add the Condor project to Adventus’ portfolio, which has a resource of 2.3 million ounces of gold, 12.8 million ounces of silver and 93 million pounds of copper on an indicated basis, while a 2021 PEA outlines an NPV(5%) of US$562.0 million.

“This transaction is an exciting opportunity to unite complementary assets, teams, and investors to create value for all Adventus and Luminex shareholders. Adventus is pleased to welcome Mr. Ross Beaty, members of the Lumina Group, and new investors as we continue the advancement of the El Domo Project towards future cash flowing operations. For Adventus shareholders, the new capital and acquisition of Luminex’s Condor Project and other properties allows the creation of a stronger and more diversified company with one of the largest copper-gold exploration portfolios in Ecuador,” commented Christian Kargl-Simard, CEO of Adventus.

Kargl-Simard is expected to remain as the CEO of the resulting issuer, while the board will be made up of eight members, three of which are to be nominated by Luminex. The current proposed board is to be led by Mark Wellings, and will include Karina Rogers, Leif Nilsson, David Darquea Schettini, David Farrell, and Ron Halas, all of whom are to be independent. Non-independent directors meanwhile will include Kargl-Simard and Marshall Koval.

The transaction remains subject to regulatory approval, approval by Luminex shareholders, a minimum of $13.5 million raised under the concurrent financing, and other standard closing conditions. A termination fee of US$1.2 million is also in play.

The transaction is currently slated to close in January 2024.

Adventus Mining last traded at $0.37 on the TSX Venture.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.