Last week, BMO Capital Markets reinstated their coverage on Air Canada (TSX: AC) after discontinuing their coverage since mid-2019. They now have a C$33 price target, down from their previous C$50 target but have kept their outperform rating on the company.

Air Canada currently has 17 analysts covering the company with a weighted 12-month price target of C$26.81. The highest price target comes from Veritas Investment with a C$35 price target, while the lowest comes from Cormark Securities with a C$24 price target. Five analysts have strong buys while nine have buy ratings. Three analysts have hold ratings on the company.

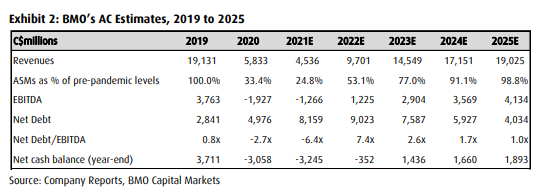

Fadi Chamoun, BMO Capital Markets analyst, believes that the worst is behind us. He writes, “We expect demand will recover over the coming several quarters/years as health concerns ease with increased immunization and increased safety protocols.” BMO’s base case has Air Canada flying at 25% 2019 capacity and ramping to about 30% by the fourth quarter of this year. Then will hit low 50% in 2022 and around 75% in 2023, with >90% of 2019 capacity being hit by 2024.

Chamoun points out that the pandemic has provided airlines with the opportunity to reconfigure how they operate. He writes Air Canada has provided the opportunity to redesign “how the network is set up; increase automation levels; re-engineer the loyalty program; implement a brand new reservation system where meaningful yield enhancement opportunities are possible going forward; and renegotiate suppliers’ contracts and commitments.” He believes that if Air Canada can retain their C$850 million cost reductions, it would lower their unit cost by about 5%.

The last thing Chamoun points out is that Air Canada has been built to outlast the pandemic. In 2019, the company reported C$2.1 billion in free cash flow with a net-debt-to-EBITDA ratio of 0.75 times. The company has either cut or deferred roughly C$3 billion in capital spending till 2024. He writes, “We believe that a financial aid package being finalized by the Canadian government could potentially provide the company with a lower cost of financing and potentially forgivable loans.”

Below you can see BMO’s Air Canada estimates till 2025.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.