Earlier this week, Equinox Gold Corp. (TSX: EQX) reported its first quarter financial results for 2022. The company reported revenues of $223.16 million, down roughly 3% year over year, while gross profits dropped 35.6% to $28.5 million.

As a result, the company reported negative income before taxes of $16.12 million and a net loss of $19.8 million, as compared to the $50.3 million in positive net income it reported for the same period last year. The company reported an adjusted EBITDA of $43.4 million, down from $60.9 million for the same period last year.

Production-wise, the company produced 117,452 ounces of gold this quarter, compared to 210,432 last quarter and 129,233 for the same period last year. The company sold 119,324 ounces of gold this quarter at an average realized gold price of $1,862, which is higher than the last two quarters.

The company saw an uptick in both cash costs and the all-in sustaining costs to produce an ounce of gold. Firstly, the cash costs increased to $1,238 from $1,039 a quarter ago, while the all-in sustaining costs increased to $1,578 from $1,265 a quarter ago.

Lastly, the company ended the quarter with $151.2 million in unrestricted cash, down from $305.5 million a quarter ago. While the company saw it’s net debt rise by about the same amount.

Equinox Gold currently has 12 analysts covering the stock with an average 12-month price target of C$13.61, or an upside of 73% to the current stock price. Out of the 12 analysts, 1 has a strong buy rating, 6 analysts have buy ratings and 5 have hold ratings. The street high price target sits at C$18.53, which is a 135% upside to the current stock price.

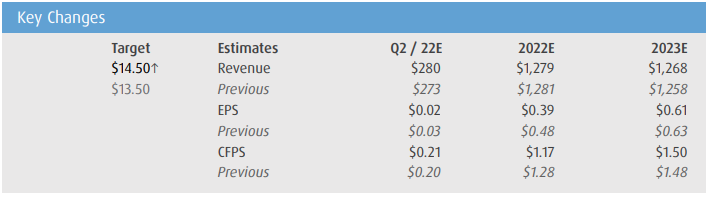

In BMO Capital Markets’ note on the results, they reiterate their outperform rating on the stock while raising their 12-month price target from C$13.50 to C$14.50, saying that the results showed that the company is off to a slow start but production will increase later into the year.

On the results, BMO said that the adjusted EPS of ($0.08) was below their estimate of ($0.01), which was driven primarily through lower-than-expected production. While operating income also came in way below their $36 million estimates. Though BMO notes that the company did state that most of the company’s operating cash flow would come in the second half of the year.

On the production results, they say that the first quarter gold production of 117,000 ounces was 16% lower than their 139,000-ounce estimate. While they note that the all-in sustaining costs were elevated this quarter, primarily due to the lower production. Though they believe that the company will in fact see higher production results in the back half of this year.

BMO notes that a number of mines missed their production estimates. Mesquite production was estimated at 22.4k ounces versus 17.1k ounces, RDM had a 12.1k ounce estimate versus the 7.2k ounce result, Aurizona 27.1k ounce estimate versus 22.9k ounce results and Mercedes which was a 15.1k ounce estimate and a 11.3k ounce result.

BMO also notes that as Equinox spent $40 million on the Greenstone construction, they expect to see Santa Luz ramp up production into the second half of the year.

Below you can see BMO’s updated estimates on the sector.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.